Perlindungan Takaful Kereta Dengan Ansuran Mudah

Selamat & Bayaran Fleksibel

Bayar takaful kereta secara ansuran patuh Syariah, dengan tempoh 3–12 bulan ikut bajet anda.

Lulus Cepat & Proses Mudah

Permohonan ansuran lulus secepat 15 minit tanpa slip gaji. Sesuai untuk renew segera tanpa kerumitan.

Nikmati Perlindungan Di Seluruh Malaysia

Bekerjasama dengan 300 agensi takaful seluruh Malaysia.

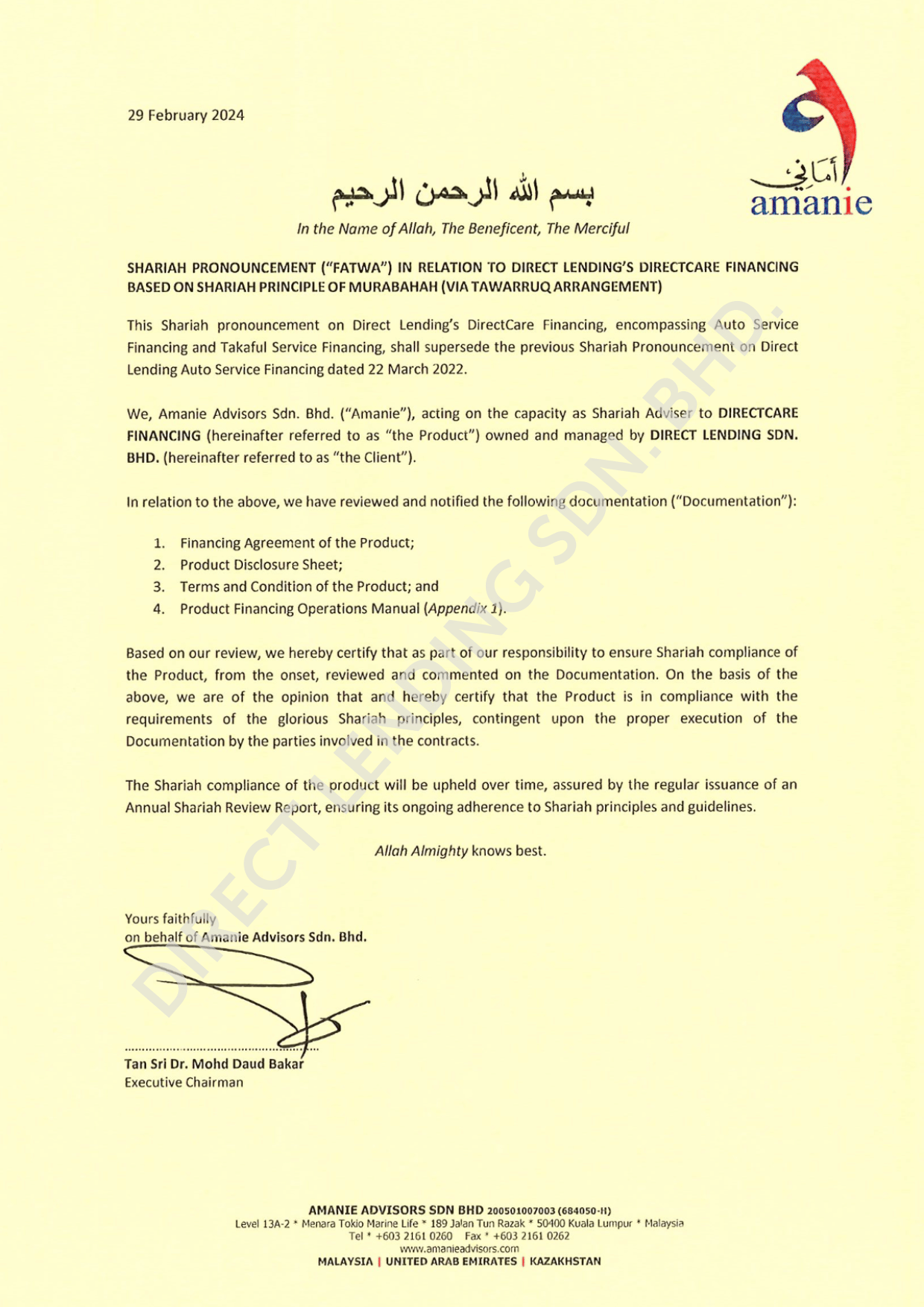

Pembiayaan Patuh Syariah

Kalkulator Bayaran

Ansuran Takaful Kereta

Kira bayaran bulanan takaful kereta anda dengan mudah menggunakan pelan ansuran Direct Lending. Sesuaikan tempoh ansuran 3–12 bulan mengikut bajet anda.

3 Langkah Mudah untuk Mohon Pelan Ansuran Takaful Kereta

Mohon Ansuran

Hantar permohonan secara online dengan mudah, hanya perlukan kad pengenalan dan penyata bank. Slip gaji tidak diperlukan.

Daftar Keluar

Sahkan pelan pembayaran bulanan dan tandatangani kontrak pembiayaan.

![]()

Bayar Bulanan

Lulus secepat 15 minit (waktu bekerja), dapat quotation dan bayar secara ansuran. Nikmati pelan bayaran fleksibel 3–12 bulan.

Apa Kata Pelanggan Kami yang Gembira

Anda boleh jadi yang seterusnya

Panel Takaful Kereta

Kelebihan Takaful Berbanding Insurans

Perlindungan Patuh Syariah

Takaful beroperasi tanpa riba, gharar atau unsur tidak patuh Syariah. Semua sumbangan peserta digunakan secara beretika dan telus.

Lebihan Dikongsi Bersama

Jika ada lebihan tabarru’, ia boleh diagihkan semula kepada peserta. Sistem lebih adil berbanding insurans biasa yang berasaskan keuntungan syarikat.

![]()

Lebih Fleksibel & Mesra Bajet

Takaful menawarkan pilihan bayaran ansuran yang lebih ringan, membantu anda kekalkan perlindungan tanpa perlu bayar lump sum setiap tahun.

Perbandingan Bayar Insurans & Roadtax Kereta: Bayar Penuh vs Ansuran Takaful

Jika anda ingin tahu perbezaan antara bayar insurans kereta secara penuh dan bayar roadtax/insurans secara ansuran, jadual di bawah membantu anda membuat perbandingan. Dengan pelan ansuran takaful kereta Direct Lending, anda boleh kekal dilindungi walaupun bajet bulanan ketat, menguruskan aliran tunai dengan lebih mudah, dan mengelakkan gangguan perlindungan.

| Situasi / Isu | Bayar Penuh | Bayar Secara Ansuran (Takaful Kereta) |

|---|---|---|

| Gaji cukup-cukup / bulan sempit | Susah nak keluarkan RM1,000–RM2,000 sekali gus | Boleh renew walaupun bajet ketat sebab bayar RM70–RM700/bulan (berdasarkan profil & kelayakan) |

| Banyak komitmen lain (sewa, bil, anak sekolah) | Roadtax/insurans selalu tertangguh | Bayar sikit setiap bulan → lebih stabil |

| Insuran perlu renew segera (untuk kerja, hantar anak, e-hailing/penghantaran) | Tak dapat renew jika duit tak cukup | Boleh renew cepat → hanya bayar deposit rendah |

| Tabung kecemasan terhad | Habis terus bila bayar penuh | Tak kacau simpanan sebab ansuran ringan |

Soalan Lazim Pelan Ansuran Takaful Kereta

Pelan Ansuran Takaful Kereta Direct Lending (Renew Sekarang, Pay Later) ialah kemudahan pembiayaan tanpa cagaran yang mematuhi prinsip Syariah. Pembiayaan ini adalah untuk tujuan membaharui takaful kereta di mana amaun pembiayaan yang telah diluluskan akan dibayar kepada pembekal takaful kereta terpilih (pembekal yang anda membaharui takaful kereta), dengan syarat pembekal takaful tersebut adalah sebahagian daripada rakan platform pembekal takaful kereta dengan Direct Lending. Kemudahan pembiayaan ini dikira berdasarkan kadar keuntungan tetap di mana bayaran ansuran bulanan adalah tetap sepanjang tempoh pembiayaan. Sekarang anda boleh bayar ansuran untuk membaharui takaful kereta dan lanjutkan bayaran bulanan sehingga 12 kali.

Produk pembiayaan ini berasaskan konsep Syariah daripada komoditi Murabahah melalui Tawarruq. Kontrak jual beli ini adalah antara anda dan Direct Lending, dengan komoditi patuh Syariah tertentu yang dikenal pasti dan digunakan sebagai aset pendasar untuk transaksi jual beli antara pelanggan dan Direct Lending untuk tujuan pengagihan dana di bawah Kemudahan tersebut.

Selain daripada butiran peribadi, kami hanya memerlukan dua dokumen ini:

- Gambar IC (depan dan belakang)

- Penyata Bank 3 bulan terkini (akaun utama yang menerima pendapatan seperti gaji) – Cara untuk muat turun penyata bank boleh rujuk di sini

Pembiayaan ini terbuka untuk warganegara Malaysia berumur 18 – 65 tahun yang mempunyai akaun bank. Kad kredit TIDAK diperlukan.

Keputusan pra-kelayakan akan dimaklumkan segera selepas mengisi maklumat peribadi berdasarkan profil kredit anda. Kelulusan permohonan dan jumlah pembiayaan yang layak akan dimaklumkan secepat 15 minit (selepas waktu bekerja) selepas anda melengkapkan pemohonan.

Anda boleh membaharui takaful kereta dalam masa 2 minggu selepas permohonan diluluskan.

Selepas anda ketahui jumlah bayaran ansuran untuk membaharui takaful kereta; anda boleh mula merancang dan dapatkan sebut harga dengan mana-mana pembekal takaful kereta yang menawarkan pembiayaan ini.

Jika anda baru mendapati anda memerlukan dana yang lebih semasa di pembekal takaful kereta, anda juga boleh terus membuat permohonan di pembekal takaful tersebut dan keputusan pra-kelulusan hanya mengambil masa 15 minit (semasa waktu kerja).

Kadar keuntungan adalah 1.5% sebulan.Tiada apa-apa caj pemprosesan yang akan dikenakan untuk pembiayaan ini.

Amaun pembiayaan adalah dari RM300 (minimum) sehingga RM5,000 (maksimum). Pembiayaan ini adalah bertempoh dari 3 kali bayaran bulanan sehingga 12 kali bayaran bulanan.

Tidak –kontrak pembiayaan akan ditandatangani secara digital melalui telefon bimbit anda selepas servis kereta anda telah selesai dan sekiranya anda bersetuju untuk mengunakan pembiayaan tersebut.

Kemudahan pembiayaan ini tidak memerlukan penjamin atau guarantor.

Direct Lending akan mengkreditkan amaun pembiayaan terus ke pembekal takaful kereta dalam 3 hari selepas menandatangani kontrak pembiayaan untuk membaharui takaful kereta. Sekiranya jumlah pembiayaan tidak mencukupi untuk membayar keseluruhan bil membaharui takaful kereta, anda dikehendaki membayar baki bil kepada pembekal takaful kereta terus sebelum mendapatkan polisi takaful kereta.

Sebelum menandatangani perjanjian pembiayaan di platform Direct Lending, anda perlu sediakan eMandate untuk membenarkan proses auto debit melalui akaun bank anda, daripada institusi kewangan berlesen di Malaysia. Bayaran bulanan akan ditolak daripada akaun ini pada tarikh bayaran seperti yang dinyatakan dalam kontrak pembiayaan.

Anda akan dikenakan caj lewat bayar sebanyak 8% setahun yang terdiri daripada; Ta’widh (pampasan) 1% setahun dan Gharamah (penalti) 7% setahun pada ansuran tertunggak. Caj Gharamah (penalti) ini akan disalurkan kepada badan kebajikan. Caj lewat bayar ini tidak akan dikompaun.

Anda boleh membuat penyelesaian awal sebelum tamat tempoh ansuran, dengan memberikan notis bertulis 1 minggu terlebih dahulu kepada Direct Lending. Rebat boleh diberikan kepada anda berdasarkan baki keuntungan tertunda.

Anda boleh daftar di sini dan pihak Direct Lending akan hubungi anda dalam masa 1 hari bekerja..

Pembiayaan ini akan ditawarkan oleh Direct Lending Sdn. Bhd., sebuah platform pembiayaan peribadi yang menyediakan pembiayaan yang selamat dan berpatutan untuk pelanggan yang bekerja keras di Malaysia. Direct Lending adalah Syarikat Kredit Komuniti yang dikawal oleh Kementerian Pembangunan Kerajaan Tempatan (KPKT).

Direct Lending menerima anugerah Top Rising Star of 2023 daripada Fintech Frontiers Awards Malaysia. Direct Lending juga penerima geran daripada Cradle Fund Sdn. Bhd., dan antara syarikat startup daripada Global Accelerator Programme pada tahun 2017 anjuran Malaysian Global Innovation & Creativity Centre (MaGIC).

Takaful kemalangan peribadi berkumpulan (Takaful PA DirectCare+) yang melindungi anda daripada kemalangan diri dan termasuk ciri perlindungan pembiayaan untuk pemohon yang berjaya menyelesaikan proses checkout Pelan Ansuran Takaful Kereta Direct Lending.

Klik sini untuk info lanjut.

Klik sini untuk Terma dan Syarat Pembiayaan DirectCare

Klik sini untuk Lembaran Penerangan Produk DirectCare

Klik sini untuk Soalan Lazim Takaful PA DirectCare+

*Tertakluk kepada terma dan syarat. Amaun pembiayaan adalah dari RM300 (minimum) sehingga RM5,000 (maksimum). Kadar keuntungan adalah 1.5% sebulan berdasarkan profil kredit pelanggan. Tempoh pembiayaan adalah 3 sehingga 12 bulan. Sebagai ilustrasi, untuk pembiayaan RM500 dengan tempoh pembiayaan 6 bulan, kadar keuntungan 1.5% sebulan, bayaran bulanan adalah RM89.5 sebulan.