By Sera

Marketing

8 Free Budgeting Apps to Help Plan Your Spending

Keeping track of your income and spending on a monthly basis is really crucial, as it affects how much savings you have at the end of the month. According to research by World Bank, 40% of Millennials in Malaysia admitted that they spend more than they can afford. And most of the spending is contributed towards food and utilities.

With careful planning of your expenditures will not only help you understand your own spending habits but also improve your spending so that you do not overspend on unnecessary items. We have gathered a humble list of free budgeting apps to help you get financially organised.

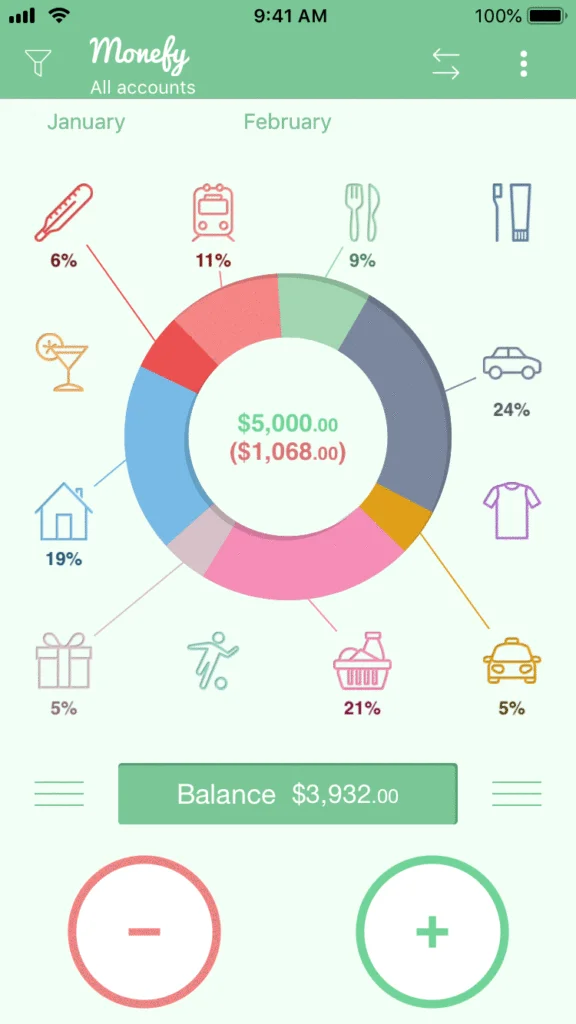

1. Monefy (Android and iOS)

This app is a simple way to track your everyday expenses by adding them to the app’s interface. It is simple, easy to use and you can see your spending patterns in a pie chart for a certain amount of time that you can specify. It has a built-in calculator which could be quite handy for some of us.

Monefy allows you to use the app on multiple devices or even with your family or partner. You can even synchronise your data with Google Drive or Dropbox account.

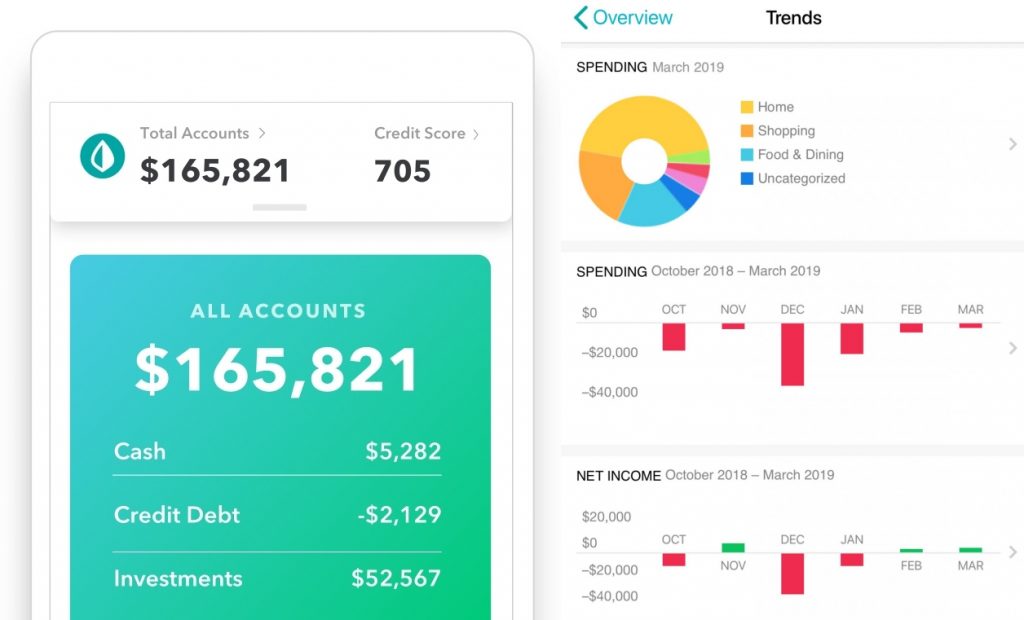

2. Mint (Android and iOS)

Mint is an all-in-one financial planning tool. Mint is web-based but it is accessible through apps too. It helps you to manage and organise your finances such as bills, credit score, credit debt, investment, and more.

Mint also alerts you when you are being charged for fees, exceeding your budget, suspicious transaction, etc. It also provides you with a weekly summary.

You can also get access to ‘Mintsights’ whereby the app provides you with insights on how to save more, spend smarter and pay the debt. The only downside is that only those with access to financial institutions in US are able to link it to the app.

Otherwise, you can always create a dummy bank URL and account number for record purposes. Overall, it is a pretty straightforward app to use.

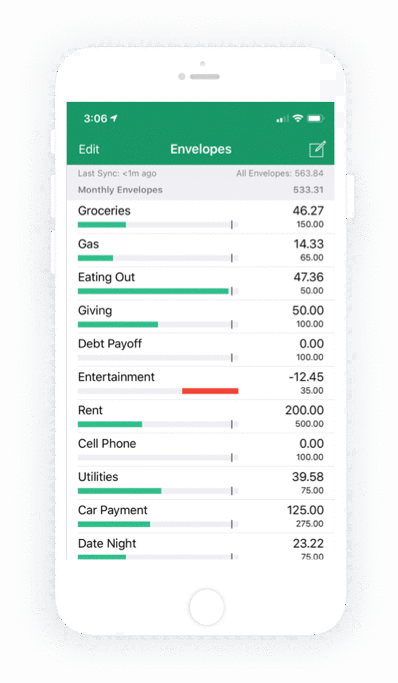

3. Goodbudget (Android and iOS)

Goodbudget is web-based but it is accessible through apps too. This financial app works based on an ‘envelope budgeting method’, only that it is done virtually. Sort your finances and stick to your budget limits without having the hassle of keeping actual cash in physical envelopes.

The app also allows you to sync your data with your loved ones. It syncs your financial records across different devices. You can also schedule transactions, separate transactions, and check your overall finance report.

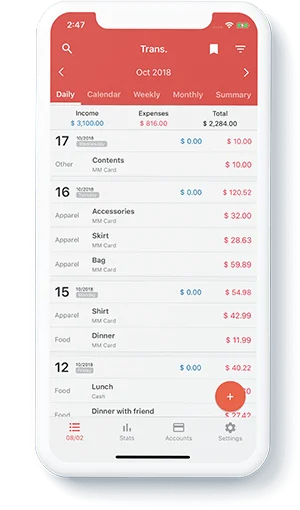

4. Money Manager (Android and iOS)

Money Manager allows you to plan money withdrawals, track expenses, check your financial standing and build a budget. You can group your income and expenses into categories. Users can create up to 12 expense categories and 5 income categories, which is great for people who have more than one source of income, like those who run multiple businesses at once. You can also capture photos of your receipts or memories with that app.

The app also allows you to synchronise your accounts like home loans, credit cards, student loans, etc. You can also easily transfer and receive money to and from individuals within your network. This makes it easier to transfer money to your parents, for instance.

5. Spendee (Android and iOS)

Spendee has a minimalist interface that makes it easy to navigate and has a quick outlook of your expenses. The main feature displays your overall weekly expenditures that are sorted by category or by recentness. There is also a feature to display overall monthly, yearly, or specific time period’s financial standing.

This app allows you to link online banking, e-wallets, and crypto-wallets. You can also set up different wallets for different purposes.

6. Monny (Android & iOS)

Known to have cute features, Monny gives its users fun mini challenges to bring some fun into money management. For instance, the first challenge is to record expenses for seven days straight. This is helpful to gets users used to tracking expenses using this app.

It automatically creates daily and monthly reports of all your transactions and shows you where your money has been spent on. Besides being very user-friendly, it also separates account books based on different categories, has a data backup feature, gives daily notifications, and comes with a password for safety.

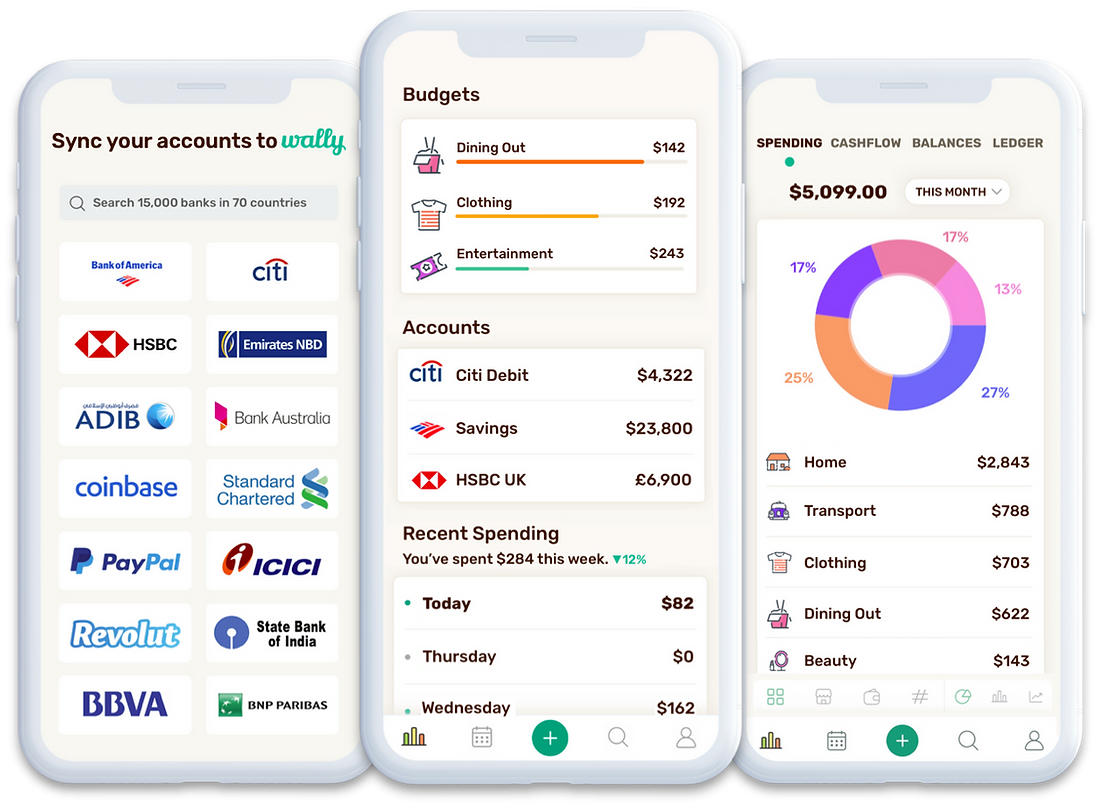

7. Wally (Android & iOS)

Reach your goals faster with Wally – it centralises all of your accounts so that you can study, manage and improve your financial management. This app has been recommended as the best financial management app more than 150 times. Financial advisors, bloggers, and even big names like Forbes, Economic Times, BBC, etc, recommend Wally for you to get ahold of your finances.

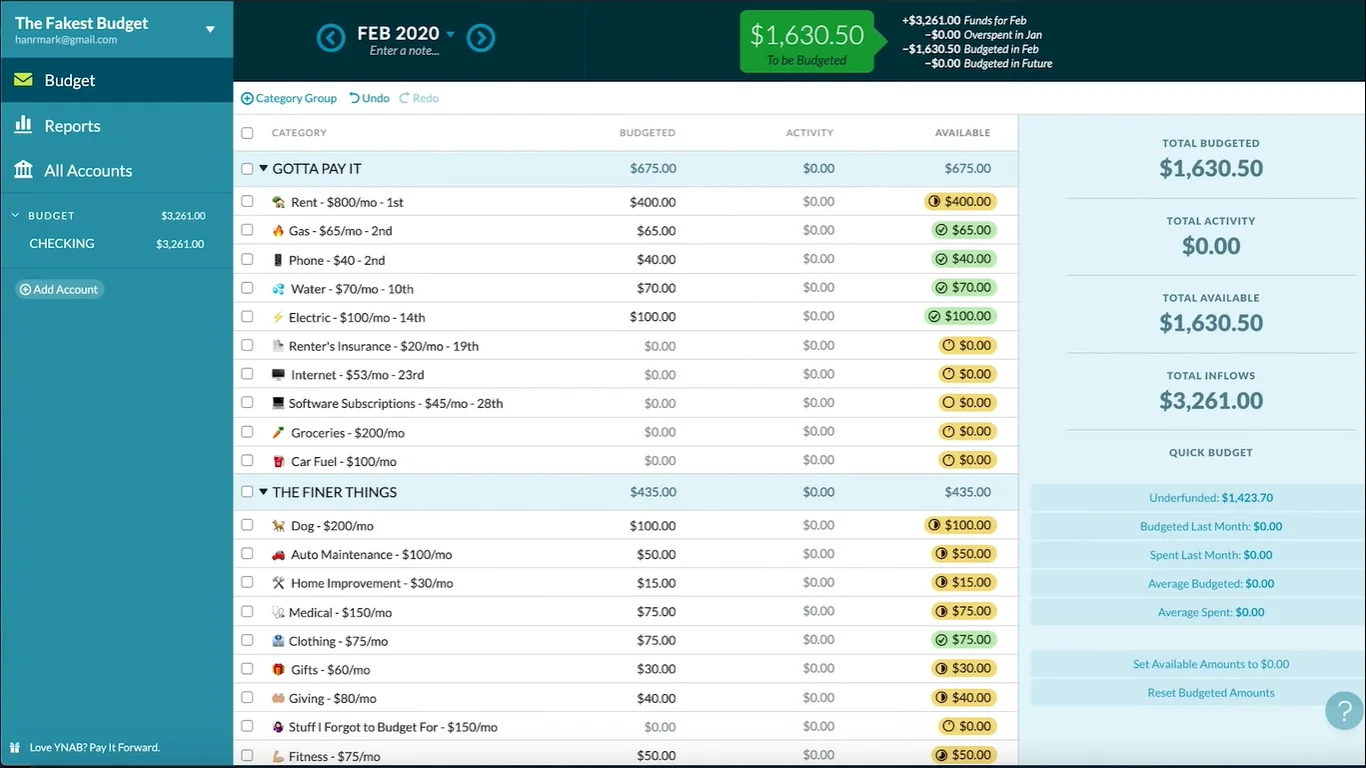

8. You Need a Budget (YNAB)

This app teaches you to manage your finances and also to remain financially healthy.

YNAB helps you to proactively manage your finances by making you allocate some of your income towards savings and the rest towards the upcoming month’s expected expenditures. It reports on 3 categories: expenses, net value, and income to expenses ratio.

This helps you create a timeline for your finances, but this app may take some time to get used to.

Conclusion

In general, any of these apps would be a great way to help you keep track of your loans and debts by breaking things down to a more manageable level. It is important to plan your spending, not just track it. Weighing up your finances before spending is important in avoiding account deficits and debt problems within a family and society as a whole.

This article is brought to you by Direct Lending, a personal lending platform that offers bank and koperasi loans with interest as low as 2.95% and processing time as fast as 2 working days! Check your eligibility with us for free today.

(This article was originally published on the 21st of February 2018 and updated on the 2nd of February 2022).

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.