By Yik Seong

Director

CCRIS Report: 8 Simple Ways To Improve It

We have received many inquiries from our customers on how to improve their CCRIS report (Central Credit Reference Information System) records. Many people refer negative CCRIS record as a ‘blacklist’ record.

Do you know that CCRIS or CTOS itself can’t ‘blacklist’ you? Both of these institutions just provide your credit record to financial institutions to assess your creditworthiness. However, this negative record can prevent an individual from getting his or her loan approved, such as a personal loan. Commonly, a negative CCRIS record includes having:

- Existing loans overdue for 3 months and above

- A ‘Special Attention Account’ (SAA) in CCRIS (for debt that has been written off by banks)

- Legal action taken by banks (declared bankrupt) on the individual due to non-payment of loans

In our previous article, we shared what is CCRIS and CTOS. Here, we would like to share 8 simple ways to improve your CTOS and CCRIS score.

Table of contents

- 1. Consolidate your debt & automate your monthly loan installment

- 2. Prioritise overdue loan amounts

- 3. Earn extra income to help with overdue loan

- 4. Refinance current credit card debt with a low interest rate personal loan

- 5. Apply for a koperasi loan to settle overdue loans

- 6. Choose a fast but safe online personal loan

- 7. Discuss an alternative schedule for your loan repayment

- 8. Be financially disciplined all the time

- Video: How To Clear Your CCRIS Score

- When is CCRIS Update Date and How Often CCRIS is Updated?

- How Long Does It Take To Clear Negative CCRIS Report

1. Consolidate your debt & automate your monthly loan installment

First, check and consolidate your debt. Debt consolidation means combining all of your existing loan commitments such as personal loan, credit card, car loan into one new personal loan. This makes it easier for you to monitor your loan repayments as you can focus on paying one installment. When you are always late on paying up monthly loan installments, this will negatively affect your CCRIS score. If you are a forgetful person, set up an auto-debit or standing instruction and schedule the repayment date just after your monthly salary date. That way, you will not miss the scheduled payment date.

2. Prioritise overdue loan amounts

Instead of spending your income on eating out, buying new clothes or gadgets, use the money to settle any overdue loans you have. Even if you have a relatively large overdue amount, practicing this ‘frugal’ attitude over a period of time will allow you to settle the outstanding in due course. When you receive any bonus or special incentive from your employer, use that to pay your overdue amounts or reduce your debt commitment before spending on something else.

3. Earn extra income to help with overdue loan

With technology and the internet, you can easily earn some side income while having a day job. For example, you can utilise your skills as a photographer, writer, bookkeeper, or design whiz to earn extra income as a part-time freelancer on websites like Fiverr or Upwork. There are plenty of contract jobs available and are quoted in US dollars.

If extra hours at the desk does not appeal to you, make full use of your car and be a Grab driver over the weekend or after work.

If you have stuff you no longer want that are still usable in your home, for example baby or kid’s stuff, clothes, books or even furniture, just snap a picture of these items and post them on Carousell, Lelong or Mudah. This allows you to get some extra cash while also freeing up your living space.

4. Refinance current credit card debt with a low interest rate personal loan

A common debt that many Malaysians are unable to catch up on payment is credit card debt. If you have a credit card debt, you are most likely paying an interest of 15-18% per annum. For a RM10,000 credit card debt, you would be paying about RM500 a month. One option to help lower your monthly debt commitment is to opt for a low interest personal loan to settle credit card debt first. For example, the Co-op Bank Pertama Personal Loan has an interest rate of 2.95%, with up to a 10-year tenure (rates are correct at the point of writing). This will help you to reduce your monthly commitment to about RM100 per month. In return, this allows you to channel extra cash to settle your overdue loans.

5. Apply for a koperasi loan to settle overdue loans

In case you have a relatively large overdue loan amount, you can apply for a koperasi loan to ‘overlap’ or settle the overdue debt. This would enable you to remove the ‘blacklist’ debt from your CCRIS record. In some cases, the interest rate for koperasi loan is also lower than an unsecured personal loan from commercial banks.

Koperasi loan has a more lenient approval process compared to a commercial bank as repayments are made through salary deductions. Currently, a koperasi loan is available only to civil servants in Malaysia. But remember, your commitments are still there. Therefore, ensure that you do not miss out on your repayments.

6. Choose a fast but safe online personal loan

If you work in the private sector and have an overdue loan in the CCRIS report, you can also apply for a cash loan with a small amount and a short loan period. Situations like this are ideal if you have a small amount of debt and need immediate cash loan. Remember, even if the amount of unpaid dues is small but it is still the cause of your loan application being rejected by the bank.

7. Discuss an alternative schedule for your loan repayment

If your current salary is unable to sustain your monthly loan repayments, then discuss with your bank(s) to reschedule your loan repayment. But be sure you can stick to the plan. The bank may not agree, but there is nothing to lose by discussing, especially if you can show your commitment and ability to pay according to the rescheduled terms. It is also in the bank’s interest to be able to collect the full amount due without needing to take lengthy legal action.

8. Be financially disciplined all the time

Only borrow what you can actually afford and require. Consistently pay on time. Also, don’t forget to check your CCRIS report from time to time. To retrieve your CCRIS report, the cost is free. You may visit the portal eCCRIS or use the kiosk in BNMLINK Kuala Lumpur, BNM Offices, and AKPK branches.

This will allow you to check for any loan status that is not up to date in CCRIS. If so, then approach the respective banks and get them to update it. Maintaining a good CCRIS score is a long term commitment. It is important that you do so as it will allow you to enjoy the financial flexibility and pursue your dream of buying a family home, expanding your business, pursuing your studies and many more.

Watch our video on how to clean up bad CCRIS records:

Video: How To Clear Your CCRIS Score

When is CCRIS Update Date and How Often CCRIS is Updated?

As you may know, a good CCRIS report is important to ensure fast loan approval. But what about those who don’t have a good existing CCRIS? Fortunately, CCRIS will constantly update your report based on your recent cash flow and spending habits. That’s why it is crucial for you to practise a good spending habit as your credit report is never stagnant.

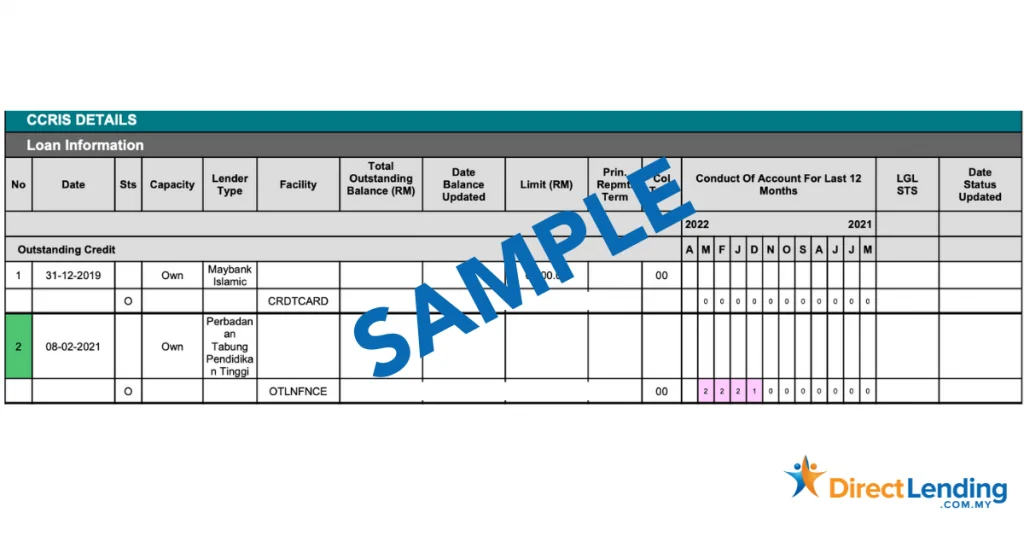

If you have successfully settled your loan overdues, Bank Negara Malaysia (BNM) will update your CCRIS information on the 10th of each month. For example, if you paid off your dues on June 26th and check the CCRIS report on the 11th of the following month, you will see that the payment record for June has been updated to “0,” indicating that there is no due outstanding balance. The CCRIS report lists all of your outstanding loans, including the type of credit facility, payment record, instalment amount, credit limit, and credit applications that have been approved or are being calculated over the last 12 months.

How Long Does It Take To Clear Negative CCRIS Report

On the other hand, CCRIS report update is different for bankruptcy cases. If you were to file for bankruptcy, a record of the filing will appear on your report. That record could take up to a month to appear in your report. Once discharged, the bankruptcy information will be updated. It will take longer for you to improve your CCRIS report as a bankruptcy record is only removed after 2 years from the date of full settlement (a settlement / release letter is required). The same goes for other legal cases, which will appear for a maximum of 2 years in your credit report.

This article is prepared by Direct Lending, an online personal lending platform with the mission to provide simple, safe and affordable financing to all hardworking adults. We help borrowers to find, apply and receive financing that most suit them. Receive financing as fast as 2 working days. Our service as always is 100% free.

(This article was originally published on the 8th December 2017 and updated on the 22nd January 2024).

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.