By Sera

Marketing

Need Emergency Money? 11 Ways to Get Instant Cash in Malaysia

When you urgently need instant cash in Malaysia, not everyone has savings or an emergency fund to rely on. That’s why many people search for fast, legal, and safe emergency cash options. In this article, we share 11 real ways to get instant cash and emergency loans in Malaysia, helping you handle urgent expenses without falling for scams or illegal lenders.

One of the fastest options is an emergency loan from licensed moneylenders, with approval as quick as 24 hours and no guarantor required. Some even offer instant loans without documents in Malaysia, needing only basic IC and income details. For those who don’t qualify, we also cover safe alternatives to emergency loans so you still have legal ways to get instant cash.

Table of contents

- 1. Emergency cash loan from bank

- 2. Emergency Cash Loan from Bank & Koperasi

- 3. Licensed Moneylending For Instant Loan

- 4. Apply Home Refinance for Emergency Cash

- 5. Cash Advance (Upfront Cash Credit Card)

- 6. Cash Instalment Plan (Cash Insurance Plan)

- 7. Use "Buy Now, Pay Later" Payment Plan

- 8. Borrow Emergency Cash With Your Family or Close Friends

- 9. Pawn Gold at Ar-Rahnu

- 10. Sell Your Unnecessary Items

- 11. Take Out Money from 2 EPF Account

- How to Get Instant Fast Approval Loan

- Never Make a Loan with Ah Long

- Infographic: Difference of Ah Long VS Licensed Moneylenders

- 5 Quick Ways to Get Fast Approval Loan

1. Emergency cash loan from bank

You might think that getting a loan from bank will take a long time to process the loan. But you can actually try getting a loan from local banks that offers instant cash loan as fast as 24 hours. Some banks even offer instant cash loan in 1 hour. However, the approval criteria for emergency loan via bank is stricter compared to other financial institution. Most of the banks will not accept does not accept applicant with bad CCRIS and CTOS, which surely make the approval rate smaller.

How to apply: Go to the local banks websites for various kind of financing that suits your need.

2. Emergency Cash Loan from Bank & Koperasi

If you apply for an emergency loan or instant cash loan from a bank, the approval rate is usually lower because banks have stricter criteria. Applicants with a bad credit score, CCRIS/CTOS issues or high commitment will find it difficult to get approved. That is why many borrowers choose koperasi loans as an alternative way to get instant cash.

Koperasi loan is a popular option amongst public sector workers because of the leniency and flexibility in approaching the loan applied compared to commercial banks. This is because the repayment method scheme that is use by koperasi bank is through salary deduction by ANGKASA (Angkatan Koperasi Kebangsaan Malaysia Berhad). Koperasi bank’s personal loan also accept application from individual that have arrear and bad CCRIS or CTOS record or listed under Special Attention Account (SAA) as well as AKPK.

Like loan from commercial bank, koperasi loan offers big loan and fast approval loan. Loan plan from koperasi is secure like loan plan from commercial bank as it is registered with Malaysia Co-operative Societies Commission (SKM), under the Koperasi Act 1993 (Act 502)

However, koperasi loans are only available to specific groups such as civil servants, employees of selected GLCs or statutory bodies. If you fall under any of these categories, you are eligible to apply. Most koperasi now allow online applications — making it easier to get instant cash approval without visiting a branch.

Eligibility Criteria For Koperasi Loan:

- Malaysian Citizen aged from 20 – 59 years old

- Public sector, statutory body and selected Government Linked company (GLC)

- Permanent position and minimum of 3 months service

- Fixed monthly salary minimum of RM1,500 including fixed allowance

- High outside commitment, blacklisted or CCRIS/CTOS are eligible to apply (for chosen koperasi loan)

- Tenure from 1 – 10 years

Basic Document Required:

- Copy Of MyKad

- Latest 3 Months Of Salary Statement

- Job Confirmation Letter

- Copy Of Bank Statement

- Copy Of Utility Bill

Reason For Applying For Loan

- To settle old/current debt (debt consolidation)

- To expand business

- House renovation

- Car or motorcycle purchase

- Paying off education fee

- Marriage

- Travelling

- Other emergency situation

How to apply for koperasi personal loan via online at Direct Lending:

- Eligibility check at personal loan bank and koperasi webpage

- Compare and select product that best suited you

- Send your document and our friendly Loan consultant will contact you for the loan process

Apply for Koperasi Loan - Approved As Fast As 2 Days

3. Licensed Moneylending For Instant Loan

Not everyone who needs emergency cash works in the public sector. So what are the options for private sector employees or self-employed individuals who need instant cash immediately? Don’t worry — aside from bank and koperasi loans, there is a third alternative that is open to everyone: licensed moneylenders (Credit Community).

A Credit Community loan — also known as a licensed moneylender loan — is a popular solution for those who do not qualify for bank loans or koperasi loans. These lenders offer instant cash with more flexible requirements. Many of them accept applicants with low credit scores, CCRIS/CTOS issues, or those under AKPK’s Debt Management Programme (PPK). Some even provide instant loan without documents in Malaysia, only requiring NRIC and basic income proof.

However, there are a few drawbacks. Licensed moneylender emergency loans usually come with higher interest rates compared to banks and koperasi. The loan amount is smaller and the tenure is shorter, making it more suitable for short-term emergency cash rather than long-term financing. However, the good news is that all licensed moneylenders in Malaysia are regulated by KPKT, and the maximum interest rate allowed is capped at 18% per annum, which helps protect borrowers from being overcharged like in illegal loan scams or Ah Long.

Still, if you urgently need instant cash in Malaysia and do not qualify for traditional financing, a licensed moneylender emergency loan can be a safe and legal option — as long as you choose a lender registered under the KPKT (Kementerian Perumahan dan Kerajaan Tempatan).

Eligibility Criteria For Licensed Moneylender’s Personal Loan

- Malaysian citizen aged from 20 – 60 years old

- Permanent job and minimum of 3 months of service

- Fixed monthly salary (net salary and fixed allowance) minimum of RM1,500 for Peninsular Malaysia or RM1,200 for Sabah and Sarawak

- Own a bank account

- No credit history or low credit score are eligible

- Not declared Bankrupt

Traits of Licensed Moneylender:

- 1.5% monthly interest rate or 18% annually

- Loaned amount from RM1,000 to RM20,000

- Flexible tenure from 1 year to 4 years

- Does not take your ATM card, no upfront payment

- Approval as fast as 1 working day

Basic Document Required:

- MyKad

- Latest payslip

- EPF statement (if needed) or utility bill – electric, water or others

How to apply for loan with licensed moneylender via online at Direct Lending:

- Eligibility check at personal loan licensed moneylender webpage

- Compare and select product that best suited you

- Our friendly loan consultant or loan provider representative will contact you for the loan process

4. Apply Home Refinance for Emergency Cash

Did you know you can make money from your current home loan? Your house isn’t just a place to live — it can also be a source of instant cash if you understand how housing loan refinancing works.

Refinancing is swapping your present mortgage with a new loan under a different terms and conditions be it from the same bank or different. Many house owner take the alternative to earn some cash or to get a lower interest rate. However, this loan will take a longer approval period compared to others mentioned. This financing is suitable for those who needs a huge fund and be patient with the application process that is similar to the process of purchasing a house again.

5. Cash Advance (Upfront Cash Credit Card)

Upfront cash credit card or better known as “Credit Card Cash Advance” is an instant cash loan service that is prepared by the bank. Cash advance allows the card holder to cash out money as fast as 24 hours from any ATM around the world, or over the counter of the respective bank according to the limit set.

It is suitable to be used of an reason for loan like emergency, purchase and more because of its easy and instant cash out. All you need is a credit card and PIN number and it does not require any document or compensation.

How to cash out emergency money with Cash Advance at ATM:

Step 1: Bring your credit card and go to any ATM

Step 2: Insert PIN number

Step 3: Select ‘cash advance’

Step 4: Insert cash amount

Step 5: Take the cash and receipt (if needed)

Cash advance usually does not include a large amount, it is one of the best option to overcome an individual financial need on short notice. However, there are some bad sided to Cash Advance:

Unreasonable Interest Rate

We are already aware that the interest rate for credit card is high but the interest rate of Cash Advance is higher. Most bank usually charge at least 18% of interest.

Daily Interest Rate

Compared to the interest rate of credit card user that is only charged once, the interest rate for Cash Advance are calculated daily. Hence it will leave a compounding effect which is the interest rate will be charged on the interest that have not been settled.

If you cash out RM1,000 using credit card, bank will charge 10% interest annually but counted daily (Daily interest rate 20%/365 = 0.054% per day). You might possibly think that the interest pay is RM200 but because it is counted daily, the actual amount that you have to pay is RM221.34 after a year because of the compounding effect.

Fees

Every cash out transaction at the ATM will be charged fee of 5% from the amount or minimum of RM 15-25 depending on the bank. This mean that, if you cash out RM1,000 through Cash Advance, you will be charged RM 50 right at the moment. This does not yet include with the daily interest rate that will be charged later on.

Henceforth, use Cash Advance only if you are confident that you can payback the amount in a near future (a week or a month)

6. Cash Instalment Plan (Cash Insurance Plan)

A Cash Instalment Plan (CIP) is an alternative for credit card users who need instant cash but want to avoid the high interest and fees of a Cash Advance. With a CIP, you can convert part of your credit card limit into emergency cash, and repay it through fixed monthly instalments.

Unlike personal loans or cash advances, most Cash Instalment Plans offer:

- 0% interest (no annual interest rate)

- No upfront handling fee

- Fast approval and instant cash disbursement into your savings or current account

This makes it a more practical and affordable option for credit card holders, especially those who need a large amount of instant or emergency cash.

How to apply for Cash Instalment Plan: Most banks do not charge 5% fee for cash personal loan compared to cash advance but you need to apply for CIP online or contact them via phone call or e-mail and wait for your loan to be approved.

There are banks that accept application at their counter. After getting your financing approved, the fund will be transferred to your saving account or current account. Depending on the bank, it can be as fast as 24 hours to 2 weeks. Before applying, make sure that you know the interest rate that is charged to your credit card as each bank charge a different amount and interest rate.

Is Cash Instalment Plan the Best Option for Instant Cash?

7. Use "Buy Now, Pay Later" Payment Plan

“Buy Now, Pay Later” plan is a type of short term payment that is gaining popularity in the online shopper community. BNPL offers instalment payment plan that is more flexible, normally 3 or 6 times payment. Compared to credit card, this payment plan is more favoured by the users because some company does not require credit card.

You can shop online and pay via instalment every month according to the schedules payment that is prepared and usually, there is no interest rate (0% interest) This method is suitable for those who need emergency funding for purchasing something but does not have credit card or is not eligible to apply for bank loan and koperasi. However, make sure that you can follow the repayment schedule and pay it on time as the late repayment charge for BNPL is too high.

This method is suitable for those who need immediate financing for the purchase of specific items but do not have a credit card or are not eligible to apply for a cash loan from banks and cooperatives. Services like the Auto Service Financing provided by Direct Lending also allow you to obtain financing to pay for car servicing costs in installments. This Sharia-compliant financing has a repayment period of 3 to 12 monthly installments, up to RM5,000.

8. Borrow Emergency Cash With Your Family or Close Friends

If the 7 emergency cash methods in Malaysia mentioned earlier still don’t work for you, there is another option you can consider. You can borrow money from family or friends, which is one of the fastest ways to get instant cash without documents or strict eligibility checks.

This method is popular because:

No need for payslips, bank statements, or supporting documents

No CCRIS, CTOS, or credit score checks

No interest, no hidden fees

Instant cash if they agree to help

If your family or friend is financially capable and you’re confident you can pay them back, this can be a more flexible solution than applying for an emergency loan from a bank or koperasi.

Your relationship with your family or friends might be affected negatively if failed to payback the money that you borrowed in the period that you have agreed on. This loan is completely different if you were to borrow from financial institution as the bank agency will only ask for payback in the agreed period as written and signed in loan agreement.

9. Pawn Gold at Ar-Rahnu

Another alternative to get emergency cash immediately is by pawning your gold accessories or gold bar. There is islamic pawn system that is Syariah compliance like Ar-Rahnu. This system is introduced by Yayasan Pembangunan Islam Malaysia (YPEIM) and Bank Negara Malaysia (BNM) is different with the conventional pawn system ‘as it offers loan without interest charge and only charge an affordable keeping charge.

10. Sell Your Unnecessary Items

When you're in desperate need of money, applying for an emergency loan is not your only option. One practical way to get instant cash is by selling valuable items that you no longer need. It may be difficult to part with personal belongings, but turning unused items into quick cash is a smart alternative—especially if you want to avoid taking on new debt or going through the approval process of an instant loan without documents in Malaysia. This method can help you access emergency funds immediately without commitments to banks, koperasi or licensed moneylenders.

Desperate time calls for a desperate measure. Some examples of valuable items that you can sell are electronic gadget, smartphone, game controller, furniture, bag and branded accessories. You can sell these items to your family members or friends first. If you needed, you can advertise your product as well on social media and selling apps and website like Carousell and Mudah to get interesting and worthy price for your product.

11. Take Out Money from 2 EPF Account

The last way that you can try when you are in need of emergency cash immediately for emergency situations like paying off medical cost and treatment. Other than that, EPF 2 account saving can be withdraw based on:

- Education

- House purchase

- House renovation

- Reduce/settle mortgage loan balance

- Monthly house loan instalment

- Hajj

- PR1MA housing

- Flexible housing

- savings exceeded 1 million

Application can be make at the EPF counter or via online. Go to this website for more details.

How to Get Instant Fast Approval Loan

Never Make a Loan with Ah Long

No matter how desperate you are, never ever take a loan with Ah Long. There are a lot of bad experiences and memories shared on social media by victims of Ah Long. Many has fall victim to the sweet and irresistible ‘too good to be true’ offer that is made by Ah Long only to be paying back ridiculous amount every month.

Hence why, do not be too fast on your feet when making decision without thinking of the long term effect that it will bring to your life. Even though the loan process is fast and easy, but the road of escaping it is a long and a rough one. Some of the negative occurrence from borrowing for instant cash loan with Ah Long are:

- Never ending interest rate

- Hidden cost and terms

- Important personal documents (for example; ATM card) taken away as a ‘security deposit’

- No option for full settlement

- Pressure to take up loan from other Ah Long

- Mental and physical harassment

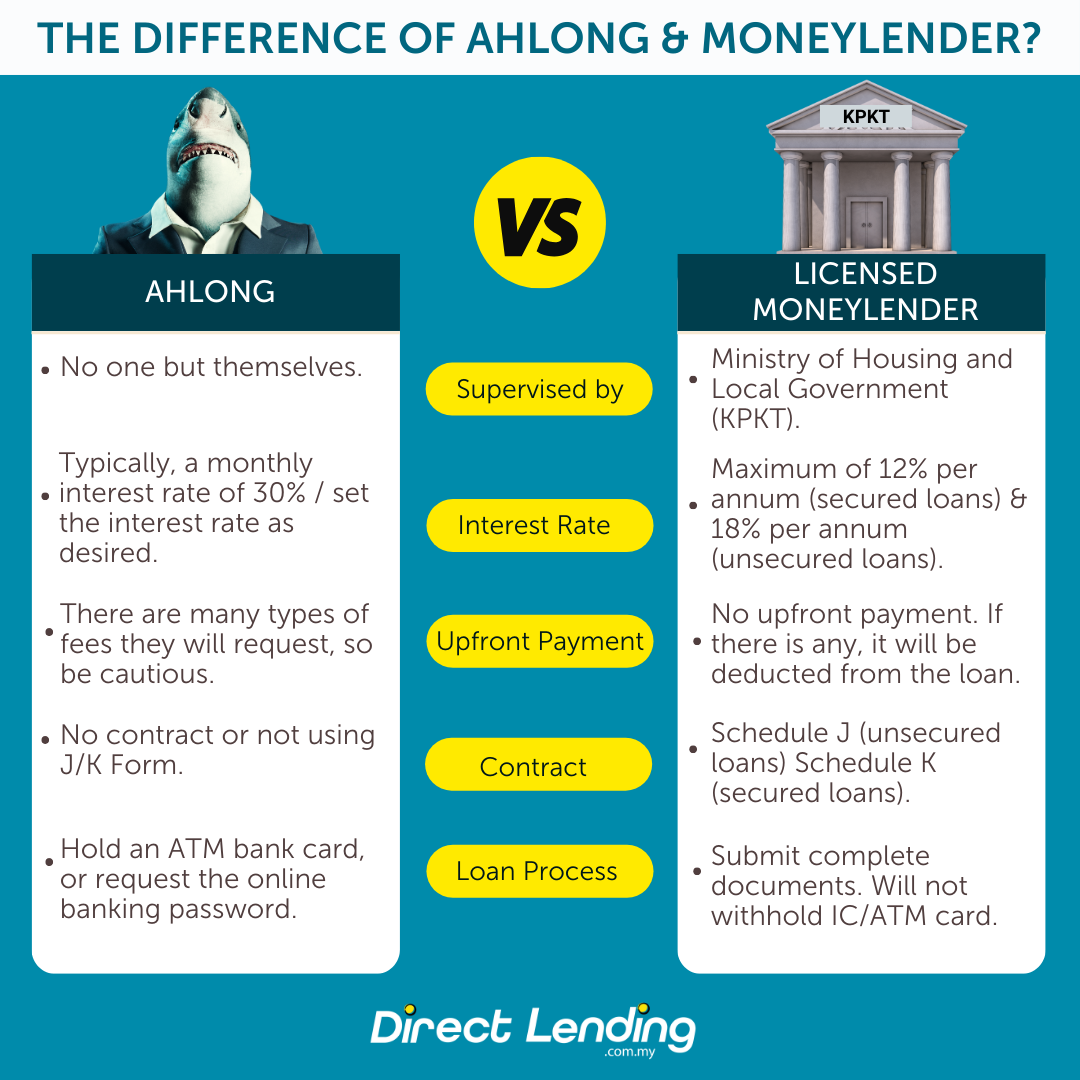

Infographic: Difference of Ah Long VS Licensed Moneylenders

Other than paying extra attention to not get involved with Ah Long, you should also watch out for personal loan syndicate. Personal loan scammer is a bit different from Ah Long as you will not even receive a single cent from them but you will also lose money because they will ask you to make an upfront payment that does not even exist.

Many personal loan scammer claim that they are a licensed moneylender registered under KPKT and many has fallen victim to this lie. You need to be cautious and avoid from making this kind of loan. Licensed credit community loan and bank and koperasi loan will never ask for upfront payment and hold on to your ATM card.

5 Quick Ways to Get Fast Approval Loan

Check the eligibility of your personal loan online through the Direct Lending platform, and our loan consultants will help you choose the best financing that suits your needs!

(This article was originally published on 26th January, 2023, and updated on 22nd October, 2025).

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.