By Yik Seong

Director

10 Best Ways to Pay Off Bad Debt Quickly

Living a life without the burden of debt is the dream of many people in the world. However, the question is how to settle these debts on time, and it becomes more concerning when they turn into bad debts.

Bad debts are overdue debts that become monthly commitments in the long term. They are also categorized as debts that do not add financial value to your life and may involve additional costs for the long term. In this article, we share ways to settle bad debts, techniques such as the snowball method, overlapping personal loans, and more. But before that, understand what constitutes good debt and bad debt.

Table of contents

- What are Good and Bad Debts?

- Video: Differences Between Good Debt VS Bad Debt

- 1. Allocate a budget

- 2. Check your outstanding balance and interest rates

- 3. Set Targets and Choose Techniques to Clear Bad Debts

- 4. Make use of credit card benefits

- 5. Cut down on unnecessary spending

- 6. Use bonus incomes to pay off debt

- 7. Get a second job for side income

- 8. Resell the unwanted items in your home

- 9. Reward yourself at the end of the journey!

- 10. Do not put off repaying debts

- Video: The Best Way to Settle Your Debt Early

- Summary

What are Good and Bad Debts?

Good Debt

Good debt is debt that yields returns in the long term, such as housing loans, business loans, and education loans.

A housing loan allows you to own your own home, while a business loan opens up opportunities to expand your business and generate higher income. Education loans offer various benefits as they represent an investment in the future through the acquisition of knowledge. For example, PTPTN loans provide students with the means to finance all or part of their tuition fees and living expenses throughout their period of study. The repayment rates for PTPTN are also affordable for all borrowers.

Good debt is debt that brings high returns and motivation to make repayments at all times. Making a loan to own a car is reasonable because it serves a good purpose, facilitating daily movement. However, taking a loan to own a luxury vehicle beyond your means is considered bad debt as it can strain your finances.

Furthermore, a good loan is a personal loan with a low-interest rate. It can fulfill the previously stated purposes, ensuring that you choose a lender with the lowest rates, such as banks and koperasi, as long as this personal loan is used for the same purposes.

Bad Debt

Bad debt is the complete opposite of good debt, is a debt that does not bring returns and makes your life miserable.

The increased use of electronic goods, smartphones, gadgets, branded clothing, cosmetics, and various other items contributes to impractical spending. Additionally, indulging in activities like spas, beauty clinics, cosmetic surgeries, and other beauty products is a major reason why individuals resort to personal loans or apply for credit cards.

It should be noted that you should not use your credit card until it reaches its maximum limit for the above purposes because it leads to very high repayment rates. Therefore, if you only need emergency financial assistance, you can look for community credit loans or licensed money lender loans with a loan period of less than 2 years. If you are diligent in repayment, you can enjoy affordable rates without late fees. Make sure you seek a legitimate and secure community credit loan.

Ensure you make wise decisions by distinguishing between wants and needs. This will save you from making extravagant expenditures that can lead you into the realm of high bad debts. When you find yourself unable to pay off debts, it means you have bad debts. Worse still, if your debts are overdue for up to 6 months, you may be declared bankrupt without realizing it.

Video: Differences Between Good Debt VS Bad Debt

How to Settle Bad Debt

1. Allocate a budget

The first step to clear bad debts is by preparing a simple-to-follow budget. You can use Excel or financial applications to help track your expenses and savings every month. Be honest with yourself about your income and expenses. This way, you can categorize your spending and see where you can spend more or less. But most importantly, you must be disciplined and committed to following the budget!

2. Check your outstanding balance and interest rates

1. Website/Mobile Application/Hotline

You can browse the official sites or applications of the financial institutions that you are dealing with to get complete information on your loans, such as outstanding balances and interest rates.

2. Professional assistance

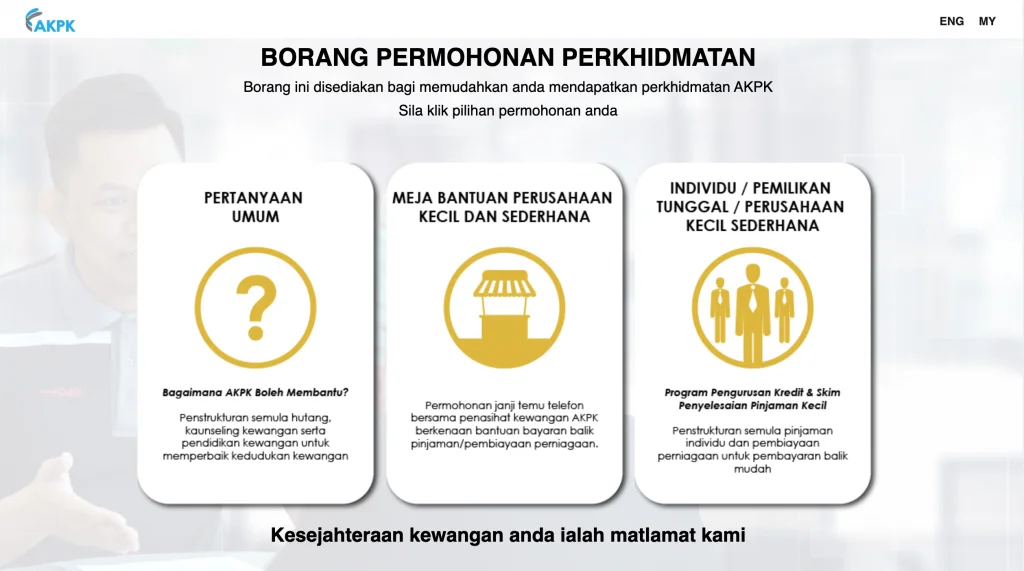

Bantuan profesional seperti Agensi Kaunseling dan Pengurusan Kredit (AKPK) yang tersedia di seluruh negara.

This Bank Negara Malaysia (BNM)-certified agency offers free advice and consultation for debtors, debt management programs as well as general financial literacy education, especially for those that are in need of some intervention with their financial management.

3. Make comparisons

Before taking up any loan, compare beforehand which bank can offer you the most reasonable interest rates.

4. Consult your bank

Most banks are open to renegotiating their clients’ loan terms. The best way forward is by communicating your issues and come to a mutual agreement with your lenders on a new repayment plan.

3. Set Targets and Choose Techniques to Clear Bad Debts

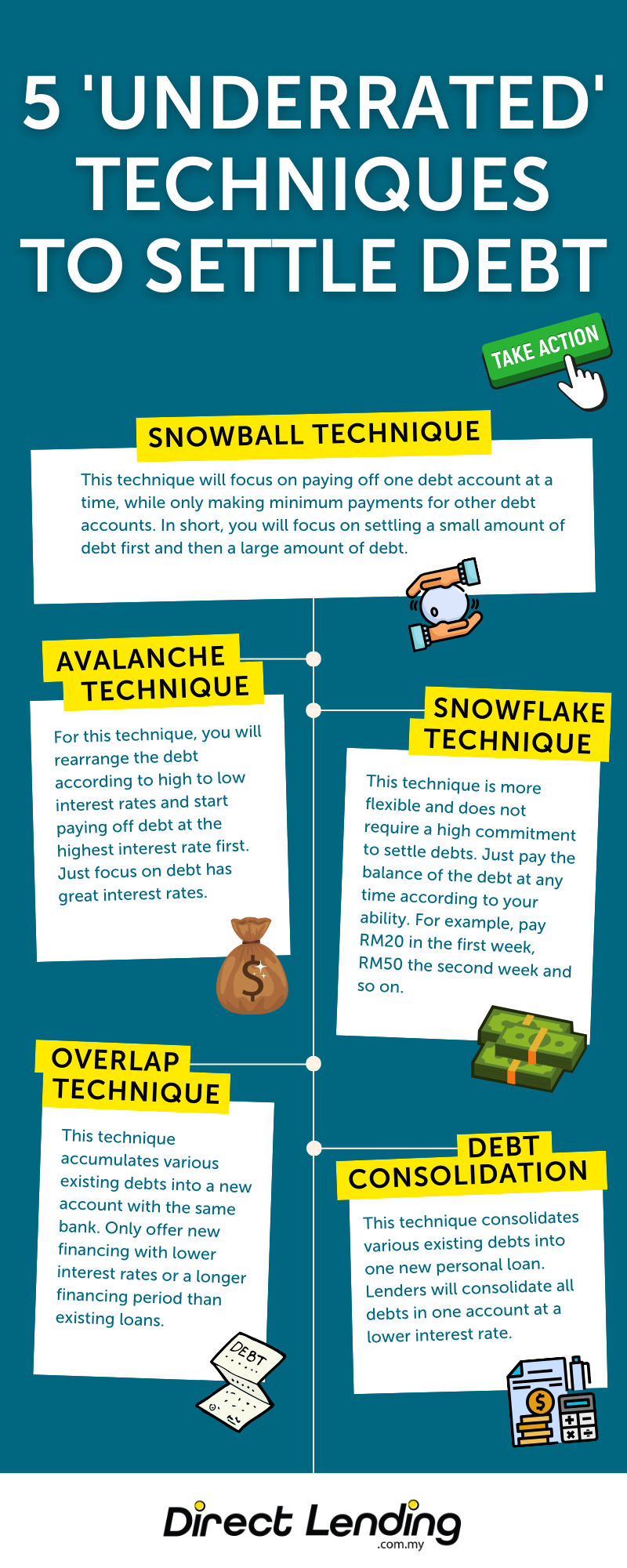

When in debt, it is crucial for you to set targets to settle all payments or loans. For example, set a goal to clear PTPTN debt within a year. Having a target serves as motivation to eliminate bad debts. There are several techniques to clear debts, especially those that have become problematic.

Technique 1: Snowball

This technique focuses on paying off one debt account at a time, while making only minimum payments for other outstanding debts. In essence, you prioritize settling smaller debts first before addressing larger ones.

Steps to settle you bad debts with Snowball technique.

- List down all your debts in an ascending order, from the smallest to the largest amount.

- Next, list down each of their corresponding interest rates and monthly instalments. You can check for accurate information by contacting your banks or financial institutions.

- Each of the debt also has a payment deadline every month. To ensure that you do not get penalised for late monthly payments, write down all of the payment deadlines for your debts to avoid late payment interest charges as this indirectly contributes to your debt increasing.

- Following this list, select the debt with the lowest value when both the monthly instalments and interests are taken into account. For example, your lowest-valued debt might be the one with the lowest monthly instalment. You should now focus on completely paying off this one. Say if your lowest-valued debt is a credit card debt amounting to RM100 monthly instalments, try to mark it up a little to RM150 so that it can be settled quicker.

- At the same time, you still need to pay at least the minimum instalments of your other commitments.

- After you have successfully settled the smallest debt (in this case a credit card), choose the second debt on your list. As an example, take a personal loan with a monthly instalment of RM300.

- Continue to set aside RM150 as you previously did for your credit card debt, except now it is added to the RM300 instalment of the personal loan. Therefore, each month you will now be paying a total of RM450 (RM300 + RM150) to settle the personal loan.

- Repeat this strategy for all of the debts on your list.

Advantages & disadvantages of using the Snowball technique

This technique can provide motivation for you to continue paying off all debts. You will also become wiser in managing bad debts and avoid excessive use of credit cards.

However, this technique will add the total amount of time taken to settle all of your debts. This is because the minimum repayment that is made for the other commitments will cause an accumulation of interest on them and will lengthen their repayment time.

Technique 2: Avalanche

This technique is similar to the Snowball technique, except this one requires you to first sort your debts in a descending order, particularly from the one with the highest interest charged to the least, or from the most important commitment to the least. Paying off the commitment with the highest interest first can help you save on overall interest payments in the long run.

The most important aspect of this is for you to sort your commitments in order of priority, from rent or mortgage repayment, vehicle loans, utilities, personal loans, daily necessities, and then other cash expenses. This way, you can then set aside other expenses that you have more flexibility in choosing, such as gym memberships, pet food, and online streaming subscriptions, to name a few.

Simply put, as opposed to the Snowball technique that is focused on the smallest balance, Avalanche is focused on the debt with the highest interest rate first.

Steps to settle bad debts with Avalanche technique

- List down all your existing debt in a descending order, starting from the one with the highest interest rate.

To illustrate, say you have these debts:

| Credit Card | Personal Loan *estimated 2 years | Car Loan *estimated 7 years | PTPTN *estimated 6 years | |

| Outstanding Balance | RM3,000 | RM5,000 | RM45,000 | RM30,000 |

| Interest Rate (yearly) | 18% | 8% | 3.51% | 1.5% |

| Monthly Installment | RM150 (1st month) | RM241 | RM667 | RM435.96 |

2. The debt with the highest interest rate following this example is credit card debt, with an 18% interest rate. According to this Avalanche technique, you should pay off this debt first.

3. The schedule above shows an overall debt totalling to RM1,493.96. To pay off the credit card debt quicker, you should use all the remaining balance to pay off the debt.

4. The same calculation method as the Snowball technique is adopted. E.g., you usually allocate RM1,600 per month for all your debt commitments. The balance from this allocation is RM106.04 (RM1,600 – RM1,493.96) and it is used to supplement the repayment of the debt with the highest interest (in this case the credit card). At the same time, you should make minimum repayments for the other debt accounts.

5. After you completely pay that off, you should move on to the commitment with the second highest interest, specifically the personal loan. The repayment amount should now be RM256.04 (RM150.00 carried forward from the previous credit card debt + RM106.04). Repeat the same method for all the subsequent debts.

Advantages & Disadvantages of the Avalanche Technique

The advantage of this Avalanche technique is that you can save money by avoiding multiple interest payments because you settle bad debts with the highest interest rate first.

In some cases, there are debts that are of the highest amount among all your debts and is also charged the highest interest. It will take you about 2-3 years to pay that off. This is where a psychological battle may take place. Ask yourself, will you be able to stick to the Avalanche technique for that long? In a nutshell, this technique requires a high self-discipline and commitment.

Technique 3: Snowflake

Advantages & Disadvantages of the Snowflake Technique

You will not be burdened with a high financial commitment, as you only need to pay a little at a time with a small sum of money.

You can settle this debt without realising if you finance it by getting a side job or by doing freelance work.

This technique, however, can take up a long time and the timeline of when the debt can be settled might appear a little vague. Therefore, it takes careful planning if you choose to pay off debt with this technique.

You must update the bad debt balance to avoid hidden charges or accumulated interest. This is also to ensure that you can predict the timeframe needed to settle all these debts.

The 3 techniques outlined above all carry their own pros and cons, but they all point out to the same outcome: PAYING OFF DEBTS

To add to them, these are 2 additional techniques to pay off debt quicker and simultaneously cut down on your monthly commitments with lower monthly instalments.

Technique 4: Debt Consolidation

Debt consolidation is a way to consolidate various debts you have into a new personal loan. Lenders will combine all your debts into one account (new personal loan) with an interest rate that must be lower than the average rate of the loans you have. For example, if you are burdened with car loan debts, this technique is one way to quickly settle car loan debts.

To simplify, you will be using the money from the new personal loan to settle your existing debts. Debt consolidation can be done at any financial institution that offers the service.

Step-by-step guide to pay off debt with Debt Consolidation

- Take due diligence on yourself (list down all your debts)

- Find a better interest rate

- Identify processing costs, fees & hidden charges

Advantages of Debt Consolidation

- Focus on paying one instalment only

- Help to lessen your monthly commitment

Disadvantages of Debt Consolidation

- Longer repayment period with lower interest rate

- Chances of application being rejected

- Will not eliminate debt

Technique 5: Debt Overlap

Overlap consolidates various existing debts into a new account (personal loan) with the same financial institution. Overlapping personal loans offer new financing with lower interest rates or longer financing periods than existing loans. Use our overlap personal loan calculator to estimate monthly installment savings if you overlap.

Overlap is only offered by the same financial institution. As an example, you have a personal loan and credit card (active loan) at Bank X. You can apply for Overlapping Facilities only in the same bank.

Step-by-step guide to pay off debt with the Overlap technique

1. Overlap with a lower interest personal loan

2. Overlap with a longer loan term

3. Overlap with salary deduction exceeding 60% (for civil servants)

Advantages & Disadvantages of Debt Overlap

You can reduce monthly commitments and receive 'cash in hand' without increasing the amount of existing debt. However, the debt burden is not reduced. Overlapping personal loans are one technique to reduce commitments, but the debt still exists and may increase if borrowers are not disciplined in repaying the debt.

Which is the best technique for you?

Know yourself better, it's yourself. So choose a technique that suits your nature and abilities. Each of the five techniques above has its own advantages and disadvantages. There are techniques that can settle bad debts quickly but require high discipline and commitment, and some are very flexible. Each individual has different financial commitments. Therefore, you need to reflect, ask your preferences, and choose an effective technique for you.

4. Make use of credit card benefits

If you have one or more than one of this ‘plastic money’, you can actually do more with it than buying things on credit. Depending on the type of credit card that you own, some cards will allow you to do a ‘balance transfer’, which is to transfer your funds at an interest rate of 0%. Make use of this feature as it can help you save some money.

For instance, say you have a credit card balance of RM15,000 at an annual interest rate of 18%. Within a year you can save up to RM2,700 through balance transfer. If you have an amount of debt that you are certain can be settled within a few months, check with your bank to do a balance transfer with a low fee (if not for free) to speed up your dept repayment process.

5. Cut down on unnecessary spending

Source: Freepik (@Odua)

Source: Freepik (@Odua)

The best way to stop adding to your bad debts is to stop shopping! Certainly, not to stop shopping completely. Start by reducing small and non-essential expenses. For example, besides using paid streaming music apps, how about trying the free version.

When buying something, ask yourself if it is better to buy now, or buy later in say, 6 months from now. It is best for you to think every time before spending to be on top of your finances.

6. Use bonus incomes to pay off debt

The first thing that may spring to mind when receiving a bonus is probably rewarding yourself. Before you jump to getting a decadent treat for yourself, think first if the ‘treat’ is truly a necessity, or if it is simply a desire. You can opt to simpler rewards, such as a budget holiday trip or having a fancy family dinner. It is more practical to use the extra cash on paying off debt first, as it is very important in securing your financial position now to prevent trouble at a later, unpredictable time.

7. Get a second job for side income

Getting a second job is one quick way to pay off your debt. Use your time outside of your regular working hours wisely. Instead of lying on the couch watching your favorite series, use this time to do freelance work that matches your skills, such as writing or graphic design, which you can do from home. So, start building your portfolio by looking for opportunities on Upwork, Fiverr, Freelancer, and others. Additionally, you can turn your hobbies into a second income. If you enjoy baking, for example, try selling cakes online. The opportunities out there are endless!

8. Resell the unwanted items in your home

Look around your home for any items you no longer need. If you have old gifts, decorations, or furniture that is no longer needed but still in good condition, clean them up and sell them online to get immediate cash. Post ads on marketplace platforms like Carousell, Mudah.my, or Lelong at reasonable prices so they can be sold quickly! The profits from selling these items can be used as an addition to the amount you have to pay off your debt.

9. Reward yourself at the end of the journey!

Paying off debt will be a long journey if you see it as a punishment for your lifestyle. Set achievements or goals and reward yourself if you can reach those goals. This is to motivate yourself. We don't mean for you to go on a shopping spree. For example, you can camp in a nearby area without having to travel abroad on weekends.

10. Do not put off repaying debts

As humans, we cannot escape forgetfulness. This includes forgetting to pay off debts on time. Therefore, we provide 5 tips to make it easier for you to pay off debts on time and not miss important payments, including bad debts.

1. E-mail reminders

Websites like Boomerang for Gmail or FollowUpThen.com can provide you with monthly e-mail reminders that can be set a few days before those debts are due.

2. Phone reminders

Use this simple feature to set monthly instalment repayment reminders on your phone, just be sure to set the correct dates.

3. Mobile applications

Some of the applications we suggest for using as your reminders are Remember The Milk (Android & iOS) and Google Allo (Android).

4. Pay first thing

This might be the easiest way to be reminded. As soon as you earn your monthly pay, set aside an amount equating to your debt instalments. Pay off the crucial ones first, and then set aside some savings and the rest can be used for daily expenses and self rewards.

5. Sticky notes

Do this analogue method by writing down your instalment due dates and their respective amounts, and then stick them up on places where you frequently go to. This can be your fridge, work desk or computer.

Seeing those notes every day will certainly reduce your chances of forgetting those due dates.

Video: The Best Way to Settle Your Debt Early

Watch this video for more explanation on ways to pay off bad debts.Summary

Your debt will not pay itself off. As expressed by Dave Ramsey, "There is no shortcut when getting out of debt." At the early stages, it will be very challenging, however, if you don't start making changes, nothing will change. No matter how difficult it is, don't take the easy way out, such as getting a loan from illegal lenders or loan sharks.

You will surely regret the decisions you make. However, if you have tried ten ways as mentioned earlier and are still struggling with debt problems, try getting advice from AKPK. The organization offers free counseling and can help you through their debt management program.

This article is provided by Direct Lending. A digital platform that helps you find, compare, and apply for the cheapest and most suitable personal loans for you. Our smart eligibility check system can recommend safe and Sharia-compliant personal loans from the best banks and cooperatives for you.

(This article was originally published on 9th August 2017, and updated in 23 January 2024.)

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.