By Q

Looking at today’s economic pattern, many people are voicing out their concern and disappointment regarding their economic health; be it being underpaid, high living cost, high monthly commitments which all have the same underlying message: Not Enough Money! Hence the new norm of doing a side income in Malaysia to earn some extra money. There are many side income malaysia edition that you can try!

According to the Malaysian Bureau of Labour Statistics, there are more than 26 million people with a side income in October 2022. Usually, side jobs can take up to 30 mins to 36 hours a week based on the work that you choose to take up.

Side jobs are not only popular with employed individuals but also popular among university students, even parents and retirees, because of its flexibility in terms of working hours and variety of jobs. There are many types of side income jobs that you can find in Malaysia if you are interested in joining.

In this article, we will share some side income ideas that you can do online and offline.

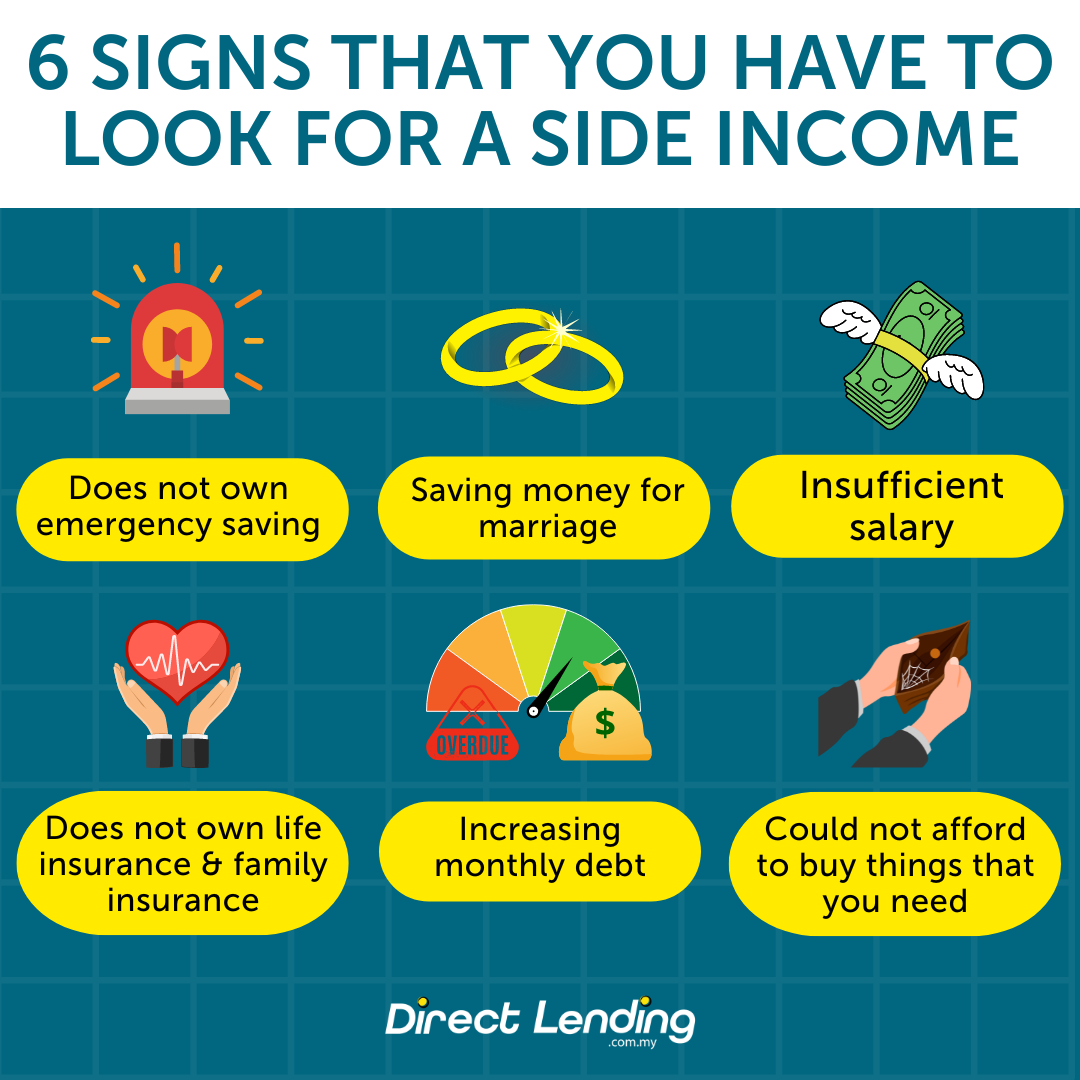

Signs That You Need To Look For Side Income

Online Side Income Malaysia Edition

Online jobs are the most popular way to earn a side income with little to no initial cost needed.. This means that you can usually do these jobs anytime and anywhere.

1. Talent / Skills

You can use your talent or assets to earn some extra income. For example, if you have the ability to teach, you can try online tutoring. For people who like to communicate and stand in the spotlight, becoming a TikToker, vlogger and Youtuber will best suit you. You can also try freelancing jobs on local freelancing websites like Fiverr, Workana and Upwork. If your make up skills are top notch, you can also try becoming a makeup artist. Ghost writing is also a popular side income idea as it requires you to write and finish written tasks anonymously on behalf of your client.

2. Affiliate Marketing

Affiliate marketing is becoming a popular side income job in 2022. There are many kinds of affiliate work that you can do based on your product of interest. Make sure to pick a niche that you like as it will motivate you to do great videos and marketing for the products. TikTok is one of the more popular platforms for affiliate marketing as compared to Facebook and Instagram.

The advantage is that you do not need to hold onto the product yourself, but you only need to promote on the right platforms to reach your audience. It is a simple yet rewarding process as the more your customers buy through your affiliate link, the more commission you will receive from the company that you work with.

That way, with the extra money earned you can start to budget your salary and allocate a portion towards your emergency fund.

3. Data entry or customer representative

If you would like a job that is more towards the professional setting, you can try a side income job like data entry or become a customer representative. Data entry is a type of clerical work where you have to key in raw data into computer systems or databases. As a customer representative, you will be representing the company that you work with to talk and answer inquiries from customers regarding the products and services that they offer.

You can easily find these jobs on GoGet. GoGet is a community platform for reliable and skilled manpower. There are various kinds of work available on GoGet which is handy as you can access it whenever and wherever. The wide range of jobs available are administrative, logistics, operations, sales/marketing, home and life and more.

Offline Side Income Malaysia Edition

If you like to be out and about rather than doing a side job online, you can try these offline side income ideas. Even though online jobs are more popular, some offline side income jobs are very interesting and high in demand too.

1. Become a gig worker on GoGet

One of the easiest and fastest ways to find an offline side income job is by becoming a gig worker on GoGet, who are also known as GoGetters. You choose to do delivery or dispatch jobs where you will be delivering various kinds of items like cakes, flowers, food and more. Alternatively, you can try working as a warehouse helper or better known as picker and packers, to earn some side income. Warehouse pickers and packers often work at retail or manufacturing warehouses.

During festive or sale season, these warehouses can become overwhelmed with the overflowing demand and orders from customers. Companies often require extra manpower to fulfill their orders; that is where you come in. You will be assisting them with packaging and shipping out orders from the warehouse to the customer.

2. Car boot sale

Participate in car boot sales. Due to the current trending theme of sustainability in our fashion industry, and also lifestyle, joining events for car boot sales is a smart move. All it takes is your items that you do not want to use anymore and your car boot and Tadahh, you are all set!

To open a car boot sale does not require you to sell a specific type of item, it can be anything from kitchen appliances to clothes as well as furniture. Not only are car boot sales easy to start, you will also be helping to improve our environment by encouraging recycling and sustainable living. Car Boot Sale Lembah Keramat, Car Boot Sale Puncak Jalil and Car Boot Sale Taman Melawati are some of the famous car boot sale places that you can join.

3. Side business

Last but not least, if you are business minded, you can try doing side businesses in your free time to earn some side income. One of the businesses that will surely bring you some cash is the home food delivery business. If you are confident with your cooking skills, give it a try. Some people who are tired of eating fast food or restaurant food but are too lazy or too busy to cook will surely order home food delivery.

Other than that, you can also try selling your preloved items like preloved clothes and toys on platforms like TikTok Shop, Shopee, Lazada and Carousell or becoming a reseller and work as a dropship agent for bigger companies. You can look for trending items or popular companies to sign up as dropship agents.

Best Side Hustle in Malaysia

Think about ways to earn extra money that suit your skills and schedule. You need to try to increase your income, for example through freelancing, dropshipping, baking, selling second hand goods, be a food rider and so on. These different ways can help you add to your main income and make your finances more stable.

Also, consider passive income sources like investing in unit trusts, real estate, or gold. By spreading out how you make money, you can build a stronger financial foundation. Just be careful of scams and make sure your side hustle doesn't interfere with your main job.

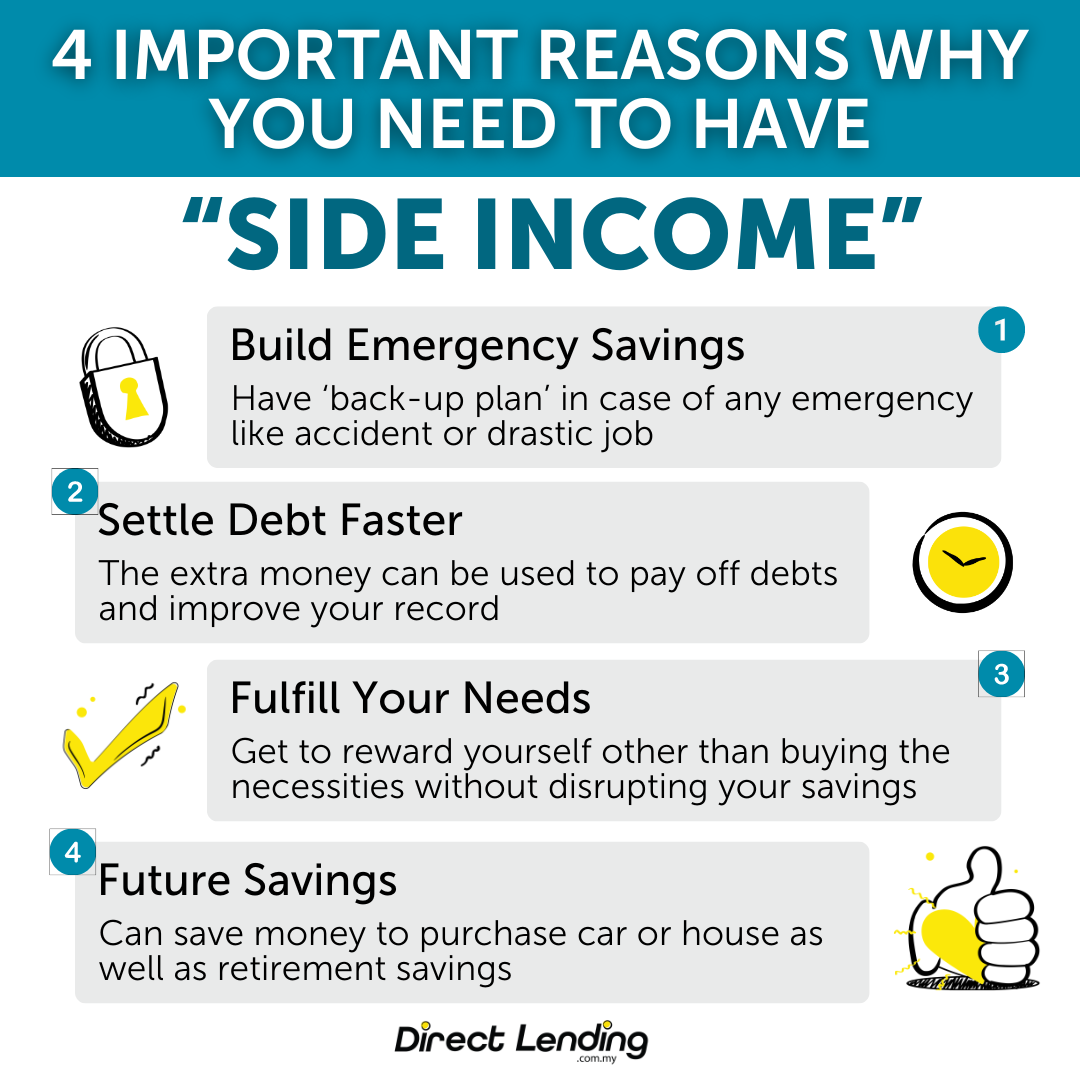

4 Important Reasons Why You Need To Have Side Income

This article is written in partnership with GoGet – A community platform for reliable and skilled part time help. If you are looking to try some work from home jobs, sign up via the GoGet work app today!