By Mandy

Marketing

3 Best Ways to Buy a Car: Cash, Hire Purchase & Personal Loan

“Used cars are more affordable and economical”, “New cars function well and can last longer”. Weighing on all the pros and cons, sometimes it is hard for us to decide between choosing a new or used (secondhand) car in terms of cost and functionality. Before you decide on the method for you to finance your new or used car purchase, read this article as your comprehensive guide.

The intention of this article is not to debate which option is better but rather to advise on the best way to purchase either a new car or a used car. Whether it is by cash, personal loan, or hire purchase loan; we will drill down the differences for you.

Table of contents

Weigh Up Your Finances Before Buying a Car

Generally, you should know that financing and owning a car requires significant expenses. If you buy a car beyond your means, you will certainly be tied to a liability for a considerable amount of time, at least 5 years, and it will inevitably become a heavy commitment in the future.

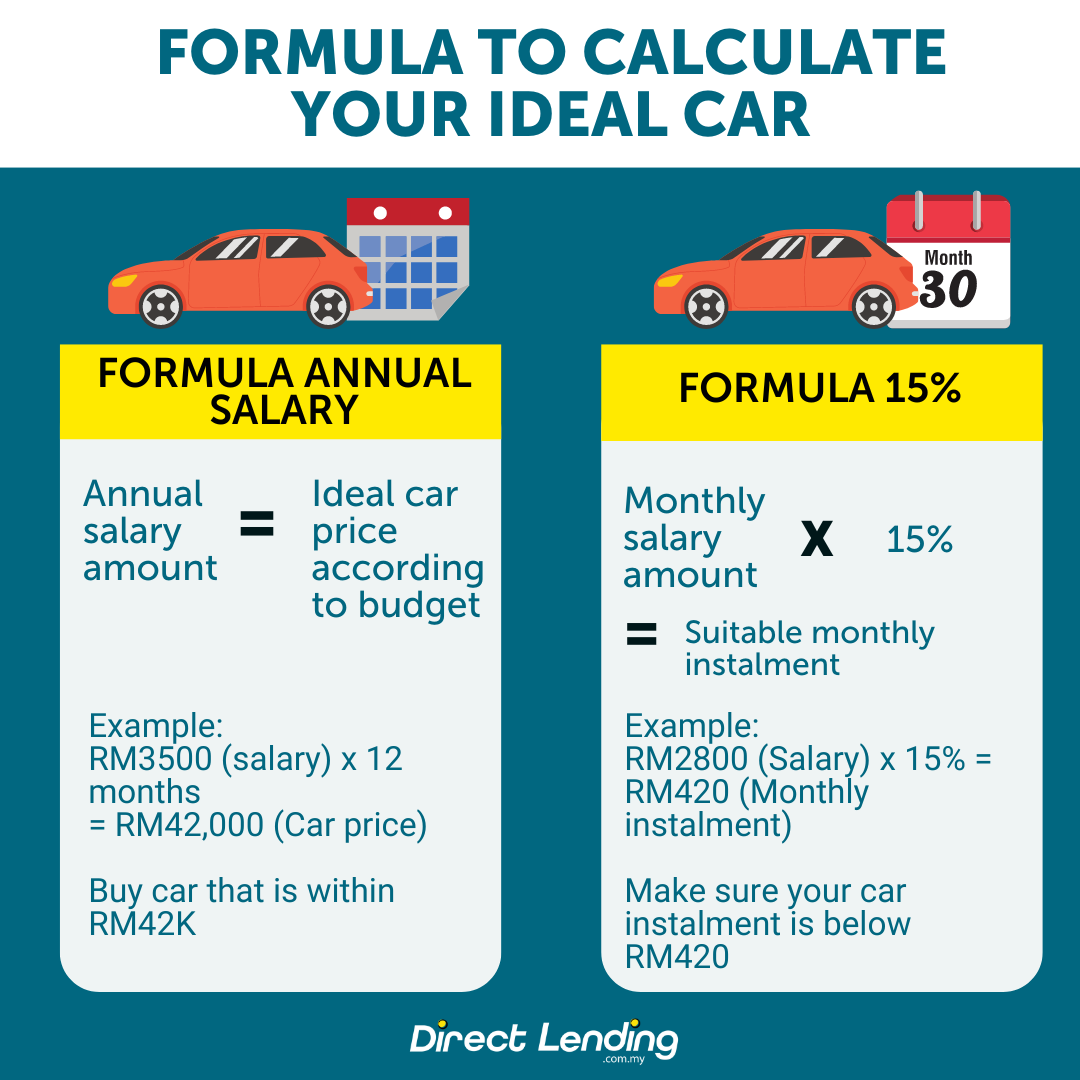

So, what is the appropriate salary to buy a car? RM1,200? RM1,500? RM2,000 and above? Here are 2 formulas to check your car loan eligibility.

Rule of thumb #1:

Monthly income x 12 months = the car model price you can afford

| Monthly Income | Yearly Income | Car |

| RM1,500 | RM18,000 | Any secondhand cars below RM18K |

| RM2,000 | RM24,000 | Perodua Axia 1.0 E / Secondhand Car |

| RM2,500 | RM30,000 | Perodua Axia 1.0 E / Secondhand Car |

| RM3,000 | RM36,000 | Proton Saga 1.3 Standard AT |

| RM3,500 | RM42,000 | Proton Iriz 1.3 Standard CVT |

| RM4,000 | RM48,000 | Perodua Bezza 1.3 Advance (AT) |

| RM4,500 | RM54,000 | Perodua MYVI 1.5 X |

| RM5,000 | RM60,000 | Perodua Alza 1.5 SE (AT) |

| RM5,500 | RM66,000 | Proton Persona 1.6 Premium CVT |

| RM6,000 | RM72,000 | Perodua Alza 1.5 X |

Based on the above schedule, if your monthly income is aroun RM4,5000, you can afford a RM54,000 priced car model like a MYVI 1.5 X AV and Bezza 1.3 Advance (AT).

Example of monthly instalment calculation for MYVI 1.5 X with 10% deposit:

Monthly instalment = RM660 to the bank/financial institution at 3% interest over loan tenure of 7 years

Fuel cost estimation = RM500/month

Toll = RM100/month

Maintenance = RM250 every 6 months

Insurance & road tax = RM3000/year (No claim discount – NCD)

Disclaimer: These are purely estimations intended as guidance. It is best to check with respective parties to know the actual costs involved.

Rule of thumb #2:

The monthly instalments should not be more than 15% of your monthly income, with a loan tenure of not more than 5 years

For those earning RM4,500 per month, 15% means RM675 per month.

This means that the individual is entitled to a car model priced RM60,000 maximum. Based on the schedule given above, the individual is entitled to get a MYVI 1.5 X.

The upside to this is that the maintenance cost becomes lower. If the individual chooses a loan tenure of 9 years, the amount to be paid monthly is only RM539, which is less than 15% of their net monthly income.

This is a more conservative calculation method. It is worth noting that both these methods are still lacking in the sense that they do not take into account the minimum income one should be earning to justify buying a car, and it also ignores the other expenditures that the car buyer will also be subjected to when owning a car.

Infographic: How to Calculate Your Ideal Car

New Car and Used Car Buying Process

Before we discuss more on the financing part, let us go through the process required in order for you to purchase a new car or used car.

Buying a new car

To buy a new car in Malaysia, you will need to go through the following steps:

- Pay a booking fee

- Look for financing options (Cash/Personal loan/Hire purchase loan)

- Prepare the necessary documentation

- Apply for road tax

- Register your car with the Road Transport Department (JPJ)

- Apply for car insurance

Usually, the car dealer or seller will assist you with all the required documentation when you are buying a new car. After your car is registered with JPJ, you will receive your number plate and are ready to pick up your car.

Buying a used car

To buy a used car in Malaysia, you will need to go through the following steps:

- Pay a booking fee

- Look for financing options (Cash/Personal loan/Hire purchase loan)

- Prepare the necessary documentation

- Get PUSPAKOM to certify that the used car is in good condition

- Apply for car insurance

- Transfer ownership from the previous owner at Road Transport Department (JPJ)

If you are dealing with a car dealer or seller, they will assist you with the processes. Their service usually includes sending the car for a car inspection with PUSPAKOM, buying the car insurance for you, etc. You just need to check with them if they provide that kind of service and how much it would cost.

Here are also some tips on what you could look out for while buying a used car:

i) Physical checking

Mileage, interior & exterior condition, boot & hood condition, mechanic check-ups (i.e. brakes, engine, tires, etc.), any modifications

ii) Documents checking

Grant, service record history, cover note, any records of accidents

3 Ways to Finance Your Car Purchase

Generally, there are 3 types of financing that you can choose to pay for your car which is via cash, hire purchase loan, and personal loan.

1. Cash

This is one of the easiest and most cost effective way to buy a car regardless if it is a new or used car. A car is generally not a capital appreciation asset. Hence, using the extra cash that you have on hand to buy a car is a prudent move.

However, for used cars especially those that are 10 years and above, you might need to purchase the car via cash. This is because the older the car, the harder it is for you to secure a loan. Some banks have set the vehicle age limit up to 12 years. This applies to antique cars as well. This is because older cars are deemed to be ‘riskier’ in terms of their durability. Therefore, do make sure before you buy a used car to avoid bearing financial losses.

2. Hire Purchase Loan

A hire purchase loan (or known as car loan) is a common way to purchase a car. When you apply for a car loan with the bank, you are entering into a hire purchase agreement. The bank acts as the legal owner of the car whilst you are the user. In a simpler term, it sounds like you are ‘renting’ a vehicle that is owned by the bank.

After all your instalments are fully paid, then the legal ownership of the car would be transferred from the bank to you. Meaning to say, the car is legally yours after you have fully paid off your loan amount.

In certain cases, a hire purchase loan for used cars is difficult but still possible, as long as your car is below 10 years and still in good condition. With a hire purchase loan, you have to be prepared to secure a lower margin of financing and with a higher interest rate. This means that you will need to be prepared to pay down a larger sum of the deposit.

If you are planning on getting a hire purchase loan, it is more advisable to first prepare a deposit. The more deposit you pay, the lower the monthly instalments for your car. This will help to reduce your monthly commitments.

3. Personal Loan

A personal loan can be given to any individual and can be used for any purpose. A personal loan is known as an unsecured loan (also known as a clean loan) as the lender does not require any form of security (collateral) for the loan. This means that if you use a personal loan to buy a car, you will own the car.

For private sector employees, they are entitled to personal loans from licensed moneylenders, whereas government sector employees are entitled to bank and koperasi loans. Personal loans are approved based on the borrower’s creditworthiness whereby the lenders look at the borrower’s credit history record like CCRIS/CTOS, earning potential, and repayment ability. So, regardless it is a new car or used car, you can apply a personal loan with no worries.

So now let us compare which is a better financing option for a new car and a used car – a personal loan or a hire purchase loan?

Comparison Between Personal Loan and Hire Purchase Loan

New car

We will use the example of a brand new Perodua MYVI 1.5 (L) AV 2022 which costs roughly RM58,000*.

Usually, for a hire purchase loan, banks cap the margin of financing to 90%. So in this case, you can only borrow a maximum of RM52,200 from the bank (RM52,800 x 90% = RM52,200). And the remaining 10% (RM5,800) is the deposit that you will need to pay in cash.

For this comparison, the personal loan example that we will refer to is Co-op Bank Pertama which offers a promotional interest rate of 2.95%* (for tenure 4 to 10 years). This financing is currently extended to civil servants and selected GLCs workers only.

For the hire purchase loan example, we will refer to BSN MyAuto. The interest rate listed on their website ranges from 2.35% p.a. to 3.15% p.a. Rates will vary accordingly and at BSN’s discretion. For this example, we assume that the interest rate is 2.55%* p.a.

In the table depicted below, we will compare a personal loan versus a hire purchase loan with a 90% loan of the car price. The loan tenure is set to a maximum of 9 years.

| CBP Personal Loan | BSN Hire Purchase Loan | |

| Loan Amount | RM52,200 | RM52,200 |

| Profit Rate Per Year | 2.95%* | 2.55%* |

| Tenure | 9 years | 9 years |

| Interest Payable | RM52,200 x 2.95% x 9 = RM13,859 | RM52,200 x 2.55% x 9 = 11,980 |

| Interest Savings | RM13,859 – RM11,980 | = RM1,879 |

| Total Payable | RM52,200 + RM13,859 = RM66,059 | RM52,200 + RM11,980 = RM64,180 |

| Monthly Instalment | RM611 | RM541 |

*the information disclosed is accurate during the period it was written

In summary, the difference between getting a personal loan and hire purchase loan is not much. In this case, getting a hire purchase loan is cheaper as you get to save RM935 per month. Hence, if you have the extra cash on hand, it is advisable to apply for a hire purchase loan and pay the 10% deposit. By doing so, it would help you to save up on interest rates.

However, if you find it difficult to pay the 10% deposit upfront, you can always opt for a personal loan. For instance, if you are a government servant, you can choose to apply for a koperasi loan of RM58,000 (full car price) to finance your car.

But you have to be reminded that with a hire purchase loan if you fail to pay your monthly instalments on time, your car can be repossessed by the bank. However, that is not the case with a personal loan. The lender cannot repossess your car because a personal loan is an unsecured loan whereby there is no collateral required.

Used car

Source: Paul's Tan

Source: Paul's Tan

For this comparison example, we will use the Perodua Myvi 1.5L SE (2015). The price range now is around RM28,000 – RM40,000* depending on its condition. Assuming that the example we are illustrating costs RM30,000.

As for a hire purchase loan, depending on the condition and the age of your car, sometimes the lender might not even approve your loan at a 90% financing margin. Plus, you might also end up getting a higher interest rate for the car. For this example, let’s assume that the lender is willing to finance you with a margin of 90%. This means you can borrow from the bank (RM30,000 x 90% = RM27,000). The remaining 10% is the deposit that you need to pay upfront which is RM3,000.

Just like the new car example, we will use Co-op Bank Pertama which offers personal loans with a promotional interest rate of 2.95%* (for tenure 4 to 10 years). This financing is currently extended to civil servants and selected GLCs workers only.

For the hire purchase loan example, we will refer to BSN MyAuto UsedCar. The interest rate listed on their website ranges from 3% p.a. to 3.80% p.a*. Rates will vary accordingly and at BSN’s discretion. For this example, we assume that the interest rate is 3.60%* p.a.

We will compare a personal loan versus a hire purchase loan with 90% loan of the car price in the table depict below. The loan tenure is set to a maximum of 9 years.

| CBP Personal Loan | BSN Hire Purchase Loan | |

| Loan Amount | RM27,000 | RM27,000 |

| Profit Rate | 2.95%* | 3.60%* |

| Tenure | 9 years | 9 years |

| Interest Payable | RM27,000 x 2.95% x 9 = RM7,168 | RM27,000 x 3.60% x 9 = RM8,748 |

| Interest Savings | RM8,748 – RM7,168 | = RM1,482 |

| Total Payable | RM27,000 + RM7,168 = RM34,168 | RM27,000 + RM8,748 = RM35,748 |

| Monthly Instalment | RM316 | RM331 |

*the information disclosed is accurate during the period it was written

In summary, it is clear that a personal loan is cheaper in this case by RM1,580.

Look out for a personal loan that has an interest rate of less than 3% because it is worth taking to finance a used car. Usually, the interest rate of hire purchase loan for used cars is much higher as compared to new cars.

Depending on the condition of the car, the hire purchase loan interest rate for used cars is usually 3% and above. Plus, if you choose to apply for a personal loan, the chances of getting your loan approved at the full car purchase price are much higher.

Video: Buying New Car Tips & How to Check For Loan Eligibility Based on Salary

In this video we will summarise few key tips and formula to buy your first car. This will help in the decision making process before signing for your car.

Summary

A car is a depreciating asset and should never be seen as an investment. Once a brand new car is driven on the road, it loses about 20% of its resale value in the first year and 15% every subsequent year until the 10th year.

But with a new car, you get to save up on maintenance costs, as new cars usually offer free servicing. A used car, on the other hand, will require more maintenance costs considering its higher usage.

Whether it is a brand new car or a second hand car, it is best to assess your financial situations first before committing to purchase a car. Do your research and compare all the financing options available out there. If you want to, you can also opt for buying a motorcycle. Not only is it cheaper, many also consider it a better option for travelling, especially through congestion in major cities. Lastly, also be careful while engaging with lenders. Always make sure that the lender you are engaging with is safe and legal.

If you are a government servant and you are looking for a personal loan to buy a car, Direct Lending is ready to help. We are a personal lending platform that offers bank and koperasi loan with absolutely no charges involved. Use our smart loan eligibility checker for free today!

(This article was originally published on the 13th of August 2020 and updated on the 10th June 2024).

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.