By Sera

Marketing

Loan Koperasi: 3 Ways For Civil Servants To Apply

Are you a civil servant interested in applying for a personal loan from banks and koperasi (cooperatives), but not sure how to check your eligibility? Or perhaps you are not sure the loan amount that you are eligible for, or which documents that need presenting? To make sure you will get a fast loan approval, we will demonstrate the steps to check your personal loan eligibility and to calculate the maximum loan koperasi amount that you can apply for.

Table of contents

- Follow these 3 Steps to Check Your Eligibility:

- Check Each Bank and Koperasi’s Terms and Conditions

- Video: Customer Testimony for Bank and Koperasi Loan with Direct Lending

- 2. Calculate the Maximum Loan Amount

- 3. Documents required for application

- Video: How to Check Eligibility for Bank and Koperasi Loan (Government Servant)

- Summary

Follow these 3 Steps to Check Your Eligibility:

In order to ease your personal loan application process, it is advisable for you to check whether you are eligible to apply for specific bank or koperasi body. This can also help you to estimate the financing amount you are able to apply. Generally, there are 3 ways to check your eligibility.

Check Each Bank and Koperasi’s Terms and Conditions

Each of the loans made with a bank or loan koperasi will come with its own terms and conditions.

-

Can Provide an Income Statement

Other than providing a good reason to apply person loan, the most crucial part of applying for a personal loan is that the applicant must be able to present an income statement. Generally, income statements are used to verify the applicant’s income amount and existing salary deductions, both of which will be used to calculate the amount that can be borrowed. Lenders usually will require the most recent 3 months’ income statements in order to process loan applications.

-

Full-Time Employed

Most bank and loan koperasi for civil servants require loan applicants to be employed on a full-time basis. This is to ensure that the applicant has a steady source of income.

-

Malaysian Citizen and Not Retired

In order to apply for bank and koperasi loan, the applicant needs to be a legal Malaysian citizen. Besides that, the applicant needs to be of age 20 to 59 years old. Most banks also offer loans to civil servants up to 1 year before the applicant’s retirement age, and since the Malaysian retirement age is 60, the applicant needs to be at most 59 years old when applying.

-

Minimum RM1,500 Gross Income

To qualify, your gross income should be at least RM1,500 including fixed remuneration.

-

Not Bankrupt

A very important condition in making a loan is that the applicant must not be declared bankrupt. If you are declared bankrupt, you will not have enough assets to repay your existing loans and debts.

-

Existing Salary Deductions Not Exceeding 60%

Another important condition in loan applications is that the existing salary deductions must not already exceed 60%. This is because having more than 60% deductions reflects a high commitment and therefore you may not be left with enough for daily expenses. The salary deduction percentage can be calculated using the formula below.

Video: Customer Testimony for Bank and Koperasi Loan with Direct Lending

2. Calculate the Maximum Loan Amount

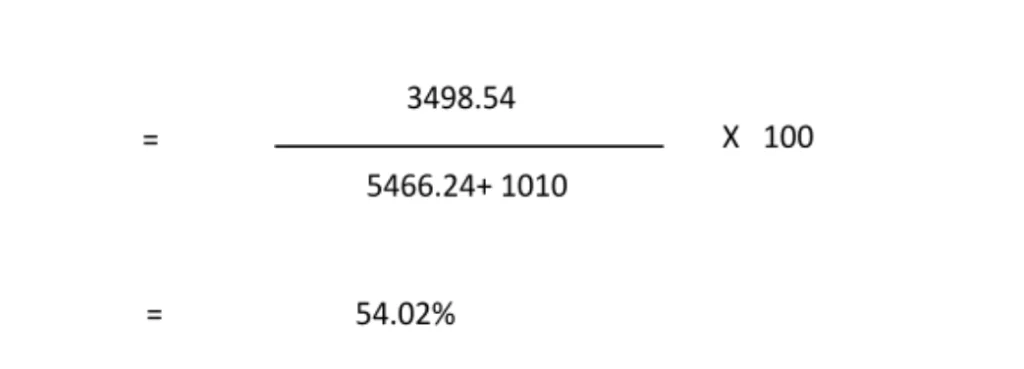

After checking whether you meet the terms and conditions required, it is also important to find out your current salary deductions. The formula below shows how to calculate your salary deduction percentage:

= Total Deductions / (Basic Salary + Fixed Remuneration) x 100

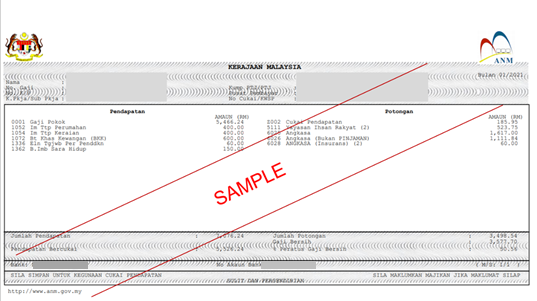

The main requisite for civil servants to take up koperasi loans is to make sure that existing total deductions do not exceed 60% of total income. The photo below shows a sample government sector income statement:

Say Individual A earns a RM5,466.24 basic salary with a fixed remuneration of RM1,010. Note that only fixed remuneration is taken into consideration for loan applications, and any other allowances, such as overtime or special bonuses will not at all be considered. Meanwhile, Individual A’s existing deductions amount to RM3,498.54.

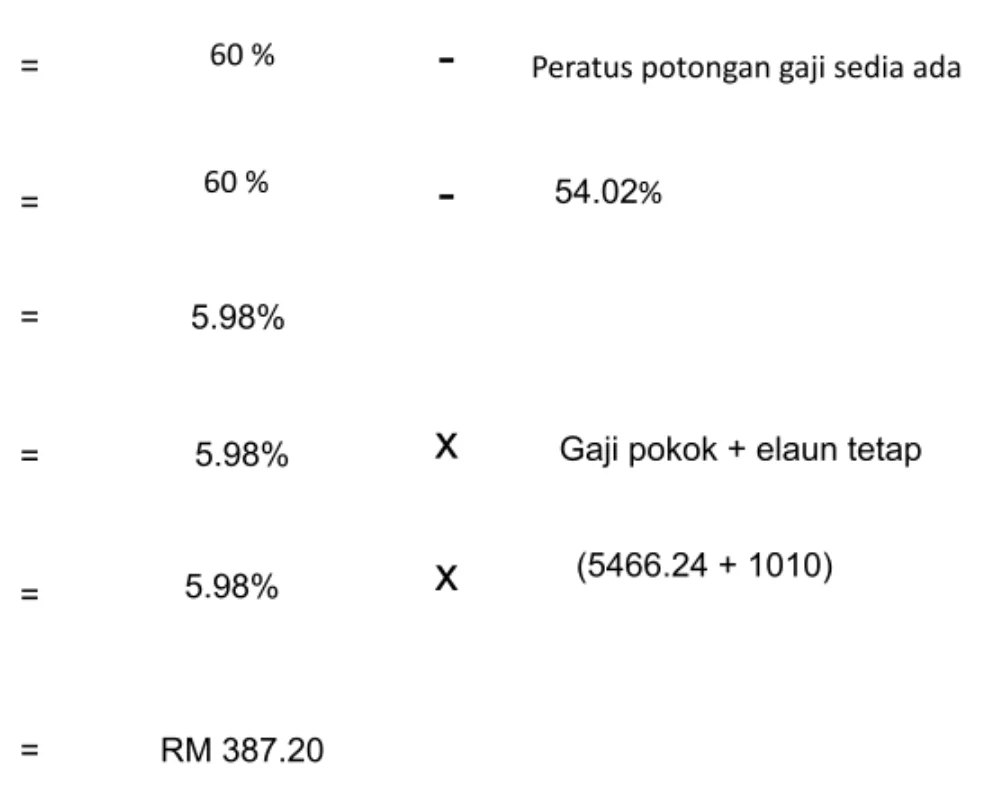

According to the above calculation, the percentage of individual A’s deductions is 54.02%. Subsequently, the calculation to find the permitted deduction for a new loan is shown below:

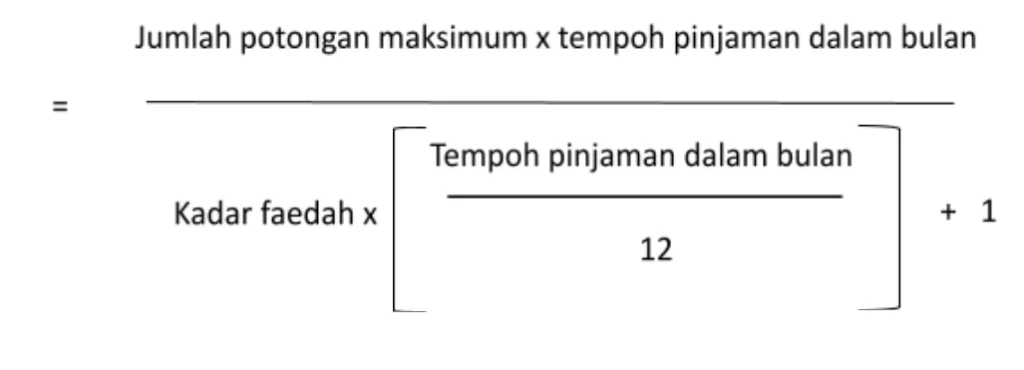

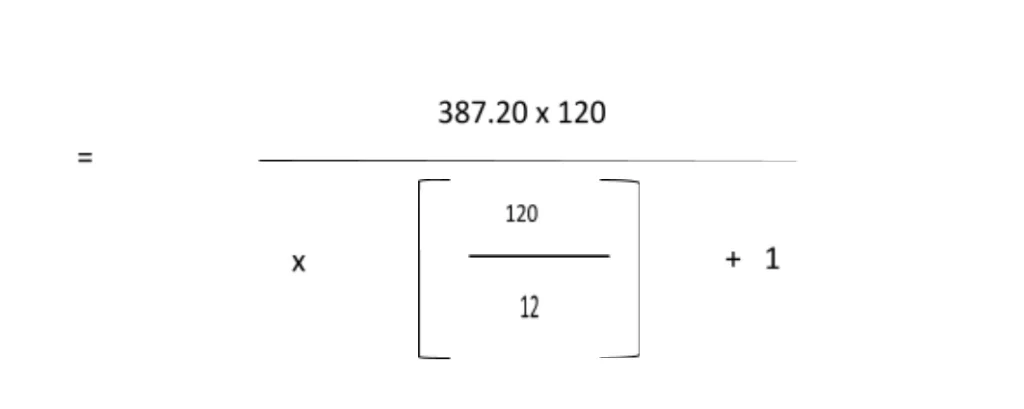

Based on the above, Individual A can still deduct 5.98% of their monthly salary, i.e. RM387.20 per month. Next, Individual A can then check the maximum loan amount they are eligible for using the formula below:

Now let us estimate Individual A’s maximum loan amount eligibility. Take an example bank or koperasi interest rate of 5.99% and a loan tenure of 10 years or 120 months.

Rest assured that bank and koperasis’ interest rates are not affected by the revision from Base Rate to Standardised Base Rate as announced by Bank Negara Malaysia recently, as all the loans offered here in Direct Lending are fixed loans. Our clients that have gotten their loans approved do not need to worry about this revision.

As shown in the example above, the estimated maximum loan amount that Individual A is entitled to is RM29,058.16. This is merely an estimate taking the example of a 5.99% interest rate, and this will differ depending on the financial institution that you are dealing with.

3. Documents required for application

Another important part of applying for loan koperasi is preparing all the necessary documents completely. Failure to do this can even cause your koperasi loan application to be rejected. Make sure that all the crucial information is made available and updated to ease the assessment and application processes.

i. Copy of Identity Card (IC)

Since one of the main requirements for loan applications is being a Malaysian citizen, presenting a proof of identification is therefore essential. This is because banks and koperasi only offer loans to Malaysians. Usually, you will be asked to bring only a copy of your IC, but specifically for Koperasi Gemilang, you are required to bring 1 coloured copy and 2 black-and-white copies with all the information viewable clearly.

ii. 3 Most Recent Months’ Income Statements

You are also required to present your income statements from the most recent 3 months. Most institutions also require these documents to be verified by your employer. Having a steady income over more than 3 months proves the ability to repay the loan, and this will give the applicant the upper hand as compared to self-employed applicants.

iii. Job Confirmation Letter

This document is used to verify the employment status, length of service, position and the applicant’s basic salary. This letter needs to be prepared using the company’s letterhead.

iv. Latest Copy of Bank Statement

This document is required by certain koperasi to verify that the bank account truly belongs to the applicant in order for the loan to be credited to the applicant. It is also used to prove the amount of income that is received monthly from their employer.

v. Copy of Utility Bills

Utility bills, including water and electricity bills, may be required by some koperasi as they want to verify your name and address, especially if the address that appears on your IC differs from your current place of residence.

Video: How to Check Eligibility for Bank and Koperasi Loan (Government Servant)

Summary

Earlier in this article we calculated the maximum loan amount that can be approved for based on one’s salary and deductions, and then we also found out the few documents that are needed for the application process. Do note that there may still be differences depending on each koperasi and bank.

One of these is that for civil servants, the loan repayment is made through salary deductions to ANGKASA. Bank personal loans usually offer lower interest rates but are strict with their requirements. This is because banks take into account outside commitments like credit cards and other loans, credit history, etc.. Conversely, koperasi are more lenient with their requirements but they offer higher interest rates than banks.

This article was prepared by Direct Lending. A digital platform that helps you to find, make comparisons and apply for the cheapest and most suitable personal loan for you. Our smart eligibility checking system is able to suggest the best personal loan from Bank and Cooperatives for you.

Our service is 100% free, with no upfront fees nor processing charges.

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.