By Yik Seong

Director

[INFOGRAPHIC] Differences between CCRIS and CTOS

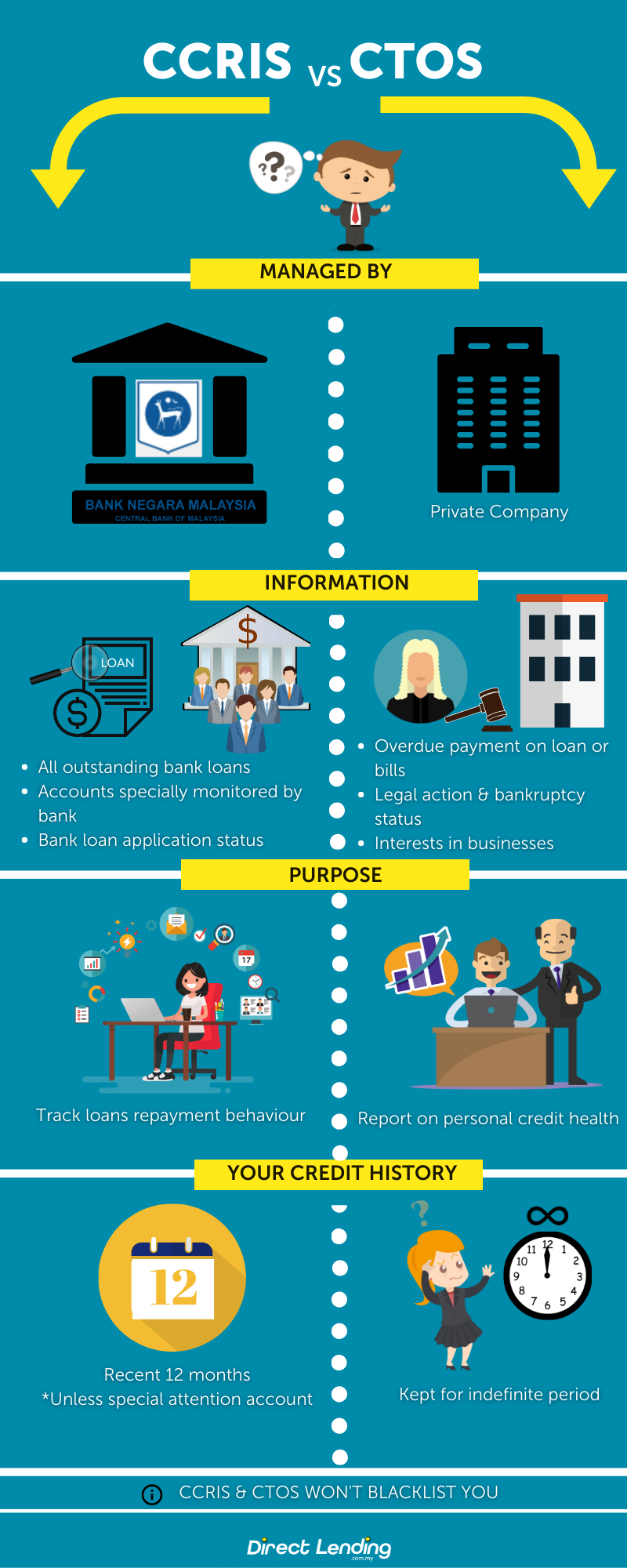

CCRIS and CTOS are some of the crucial terms that are often mentioned during loan and financing application processes. However, many of us are not clear on what they actually mean and how these two differ. In this article, we will briefly explain their differences and the important components within both reports.

What is CCRIS?

Central Credit Reporting System or CCRISis a report issued by the Credit Bureau of Bank Negara Malaysia (BNM). It tracks our loan repayment behaviour for the past 12 months based on a monthly report by financial institutions. Each individual’s bank system is already integrated with CCRIS and will automatically issue their credit report during a loan application process. Furthermore, CCRIS portrays information regarding outstanding payments, special attention accounts (SAA), and loan application statuses made by individuals.

This credit information can be issued to financial institutions (banks) and individuals (including business owners) upon request. Among the institutions that contribute to CCRIS reporting include all commercial banks, Islamic banks, investment banks, development banks, some insurance companies, payment instruments issuers and correctional facilities. They are required to disclose the credit behaviour of their clients.

Information in a CCRIS Report

- Outstanding debts

- Debt repayment record

- Special attention accounts

- Any restructured loan

How Much Will Acquiring a CCRIS Report Cost?

You will not be charged for a CCRIS report. There are 3 ways you can get them for free:

- BNM – You can visit the BNM Headquarters or a BNM branch.

- Mail – Via post, email or fax to BNM TELELINK Bank Negara Malaysia.

- Online application – You can now apply online through eCCRIS.

What is CTOS?

On the other hand, Credit Tip-Off Services or CTOSis a report issued by CTOS Data Systems Sdn. Bhd, which is a private company. CTOS Data Systems Sdn. Bhd. was established under the Credit Reporting Agencies Act 2010. It complements CCRIS by providing information on legal matters such as bankruptcy, legal actions, and case status. It also portrays an individual’s involvement in any business or corporations. Similar to CCRIS, CTOS only collects information and generate individuals’ credit reports for the usage of financial institutions.

To generate their reports, CTOS collects information from these sources:

- National Registration Department (JPN)

- Malaysian Department of Insolvency (MdI)

- Companies Commission of Malaysia (SSM)

- Published legal proceedings, newspaper reports and government gazettes

- Legal notices from newspapers

- Search in Registrar of Societies (ROS)

- Information from lenders, litigators or business partners

- Information given voluntarily by the subjects themselves

Through the CTOS report, financial institutions are able to analyse and assess the potential risk of approving one’s loan application. The CTOS report only serves as a credit report, not a blacklist record, where this is often the misconception that floats among the Malaysian public. CTOS has no rights and has never blacklisted any individual. In a nutshell, a CTOS report provides additional information on one’s credit standing, whether it is positive or negative, to support what is provided by CCRIS.

Information in a CTOS Report

- Credit history

- Spending patterns and outstanding debts

- Any legal action taken against an individual, business ownership and risks borne

How Much Will Acquiring a CTOS Report Cost?

You can acquire a MyCTOSreport for as low as RM25 on the CTOS website, or acquire a personal credit report from Experian (MyCreditInfo)for as low as RM10.60.

4 Main Differences Between CCRIS & CTOS

We have also prepared an infographic to show you a quick comparison between what CCRIS and CTOS are.

(This article was originally published on the 12th of March 2019 and updated on the 1st of April 2024).

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.