(This article is originally published on 29th March 2021 and is updated on 23rd October 2025).

No upfront payment Direct Lending's service is 100% free

Tiada bayaran pendahuluan, perkhidmatan Direct Lending 100% percuma.

By Mandy

Marketing

Did your personal loan get rejected because you have a negative CCRIS and CTOS record or you are currently listed under the AKPK programme or blacklist? The good news for civil servants is that some koperasi do accept borrowers with overdue loan amounts in CCRIS and CTOS records or even those who are listed under Special Attention Account (SAA) and AKPK. These personal loans for blacklist offer lower rate suitable to settle any financing issue. This article is to help people to make personal loan for AKPK.

Personal loans from koperasi are more lenient as compared to commercial bank loans because the repayment for koperasi loan is done through salary deduction via ANGKASA. Therefore, this personal loan is often called as koperasi loan or, government loan. This is also an alternative for unsuccessful applications from banks due to negative CCRIS, CTOS, AKPK records or blacklist issue.

Scroll down to find out which personal loan best suits you in detail as we compare each of these personal loans for borrowers with AKPK, CTOS & CCRIS records. Also do note that all of the personal loans listed are unsecured. This means that you do not need to provide any collateral or include a guarantor in order to apply for these personal loans.

Table of contents

- What is a Special Attention Account (SAA) Loan?

- What is AKPK Loan?

- List of Koperasi Personal Loan for Borrowers With Negative CCRIS, CTOS, SAA & AKPK Records

- 1. Yayasan Ihsan Rakyat (YIR) and Yayasan Dewan Perniagaan Melayu Perlis (YYP)

- 2. Koperasi Bersatu Tenaga Malaysia Berhad (KOBETA) with funding from CIMB (Speed-i)

- 3. Koperasi Putri Terbilang Malaysia Berhad (KOPUTRI)

- 4. UKHWAH

- 5. Co-opbank Pertama (CBP)

- 6. Kuwait Finance House with funding from MCCM

- Comparison Between Bank & Koperasi Personal Loan

- Summary

- Video: How to Clear Your Name From the Blacklist Record CCRIS/CTOS/AKPK/SAA

What is a Special Attention Account (SAA) Loan?

A Special Attention Account (SAA) is a record created by the bank for borrowers who have overdue loan payments that remain unsettled. When a loan is in arrears for more than 3 months, it may be classified as a Non-Performing Loan (NPL) and listed under the Special Attention Account depending on the bank’s policy. Once this happens, the bank will issue a legal notice stating the total overdue amount that must be paid to remove the Special Attention Account (SAA) status from your CCRIS report.

Having a Special Attention Account makes it very difficult to get approval for new bank loans, credit cards, or financing facilities. Your SAA status will only be cleared from CCRIS after you fully settle all overdue payments. However, the good news is some koperasi (cooperative) loans still accept applicants with Special Attention Account (SAA) records—subject to their terms and conditions.

Typically, to apply for a Special Attention Account loan, you must consolidate your existing debts with a koperasi to settle the outstanding loan listed under CCRIS. This method helps clear your SAA record while giving you access to a new financing plan.

Impacts of Having a Special Attention Account (SAA)

Being listed under a Special Attention Account (SAA) can significantly affect your financial options. SAA is a flag on your CCRIS record indicating overdue debts that are being closely monitored by banks. Here’s how it impacts you:

- Loan applications may be rejected – Banks may view SAA as a sign of high credit risk, making it harder to get new personal loans, home loans, or credit cards.

- Higher interest rates – If a bank approves a loan despite your SAA status, it may charge higher interest rates to mitigate risk.

- Creditworthiness affected – Your overall credit score and borrowing capacity are reduced, limiting financial flexibility.

Example scenarios:

- A home loan application is denied because of an existing SAA listing.

- Your personal loan is approved but at a higher interest rate compared to standard borrowers.

How to Clear or Manage Your SAA

Even if you’re on the SAA list, there are steps to regain financial standing:

- Full settlement of overdue debt – Pay off the outstanding balance in full to remove the SAA status from your CCRIS record.

- Negotiate with the bank – Some banks may allow repayment plans or restructuring to help you clear arrears.

- Leverage koperasi loans – Certain cooperatives offer loans that help consolidate debts, allowing you to settle your SAA obligations while still gaining access to financing.

Timeframe:

Once you’ve fully settled your overdue debts, your Special Attention Account (SAA) status can be updated in your CCRIS record. In many cases the update shows within one to a few months, but the exact timing depends on the bank’s reporting cycle and CCRIS data refresh schedule.

Need help with loans while having an SAA?

You can explore koperasi loans specifically designed to assist individuals with SAA records. These loans can help consolidate and repay outstanding debts while still offering a safe and flexible borrowing option.

Check Loan Eligibility for Free

What is AKPK Loan?

An AKPK loan, or a personal loan for AKPK members, is a financing plan specifically provided to help AKPK members settle overdue debts. As you know, individuals under the supervision of the Credit Counseling and Debt Management Agency (AKPK) find it difficult to apply for new personal loans due to credit issues. So far, financial institutions like banks do not accept new credit applications from AKPK members. However, selected cooperatives can offer personal loans to AKPK members, such as the Yayasan Ihsan Rakyat (YIR) and Yayasan Dewan Perniagaan Melayu Perlis (YYP). The approval status of the personal loan is still subject to the terms and conditions imposed. The cooperative may refer to AKPK while processing your loan application before allowing you to receive the loan amount.

List of Koperasi Personal Loan for Borrowers With Negative CCRIS, CTOS, SAA & AKPK Records

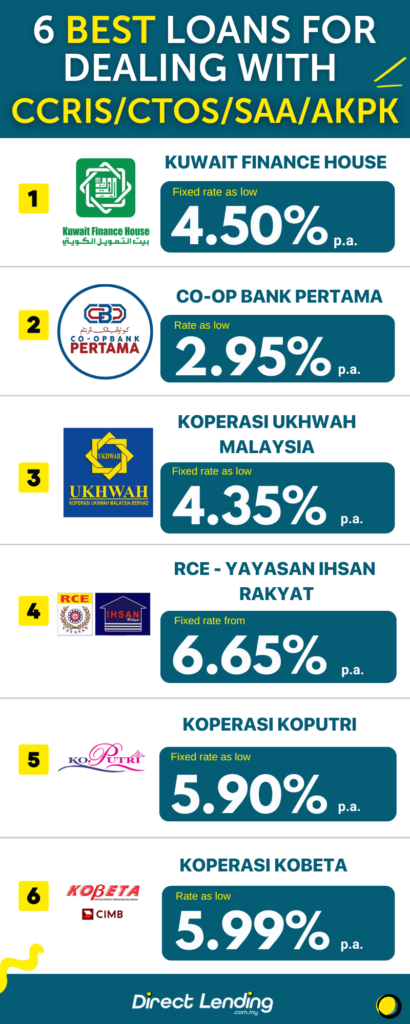

We list below 6 koperasi loans that civil servants can still apply for despite having issues with CCRIS, CTOS, SAA records, or are listed under the AKPK programme.

For koperasi personal loans, the salary deduction allowed is up to 60% of the gross income. Be mindful that just because some of these koperasi are flexible enough to accept borrowers of such credit track record it does not mean that your personal loan is guaranteed to be 100% approved. It still requires proper documentation and credit approval process by the koperasi itself. Here, is a comparison table of koperasi personal loans that accept borrowers with negative CCRIS and CTOS records and AKPK to help you better compare and decide which one best suits you.

List of Koperasi Personal Loan for AKPK, SAA, CTOS & CCRIS Problems

| Koperasi Personal Loan | High Commitment Outside of Payslip | CCRIS (Loan Overdue) | CTOS/Trade reference | SAA | AKPK |

|---|---|---|---|---|---|

| Yayasan Ihsan Rakyat (YIR) & Yayasan Dewan Perniagaan Melayu Perlis (YYP) | Acceptable | Acceptable | CTOS below RM30,000 is acceptable | Acceptable | Acceptable |

| KOBETA | Acceptable | Acceptable | CTOS below RM20,000 is acceptable | Acceptable | Not acceptable |

| KOPUTRI | Acceptable | Acceptable but overdue with more than 2 months needs to be settled with this loan | CTOS below RM5,000 is acceptable | Acceptable but need to be settled with this loan | Not acceptable |

| UKHWAH | Acceptable | Acceptable but subject to Koperasi UKHWAH’s approval | Acceptable but subject to Koperasi UKHWAH’s approval | Acceptable but need to be settled with this loan | Not acceptable |

| Co-op Bank Pertama (CBP) | Not acceptable | Overdue needs to settle first | Acceptable for non-bank CTOS. CTOS under bank need to settle with the loan | Not acceptable | Not acceptable |

| Kuwait Finance House (MCCM) | Acceptable | Acceptable but overdue with more than 2 months needs to be settled with this loan | Acceptable but if there’s an overdue CTOS with more than RM2,000 needs to be settled with this loan | Acceptable but need to be settled with this loan | Not acceptable |

1. Yayasan Ihsan Rakyat (YIR) and Yayasan Dewan Perniagaan Melayu Perlis (YYP)

Both YIR and YYP personal loan accept borrowers with:

| Outside Commitment | CCRIS | CTOS | SAA | AKPK |

|---|---|---|---|---|

| Accept high commitment outside of payslip | Overdue loan amount is acceptable | Amount less than RM30,000 is acceptable | Acceptable | Acceptable |

About Yayasan Ihsan Rakyat (YIR) and Yayasan Dewan Perniagaan Melayu Perlis (YYP) Personal Loan

Interest Rate: From 6.65% to 9.99%

Here are 3 financing packages offered by YIR or YYP that vary according to the borrower’s credit score.

| High Credit Score | Low Credit Score |

|---|---|

| 6.69% with 84% payout | 8.88% with 77% payout |

| - | 9.99% with 74% payout |

- Payout: From 74% – 84%

- Loan Amount: RM300,000 (maximum)

- Loan Tenure: 10 years or up to 1 year before retirement

- Processing Time: 2 working days

- Membership Fees: (YIR – No fees charged) / (YYP – RM20 membership fee)

- Repayment: Direct salary deduction (YIR) / ANGKASA (YYP)

- Takaful/Insurance: No

- Syariah Compliant: Yes

Borrower’s Criteria

- Income type: Permanent job with a minimum of 6 months of service

- Minimum Income: RM1,500 per month

Why choose Yayasan Ihsan Rakyat (YIR) and Yayasan Dewan Perniagaan Melayu Perlis (YYP) Personal Loan?

Both Yayasan Ihsan Rakyat (YIR) and Yayasan Dewan Perniagaan Melayu Perlis (YYP) Personal Loan is a great choice if you need to receive funds in your account fast. With YIR and YYP you will receive funds in your account as fast as 2 working days upon full documentation received. The flexibility offered by both YIR and YYP is that it accepts borrowers who has high outside commitment, overdue CCRIS record, CTOS amount less than RM30,000, listed under SAA and AKPK.

The difference between YIR and YYP is the membership fees and repayment method. There are no membership fees for YIR but there is a RM20 (monthly) membership fee for YYP. The repayment of YIR is through direct salary deduction and via ANGKASA for YYP.

As listed above, the 3 variations of financing packages are dependent on the borrower’s credit score. Of course, the higher your credit score is, the cheaper the interest rate and the higher the payout that you will get. Therefore, make sure to check with your respective agents to receive the best interest package.

Apply Yayasan Ihsan Rakyat (YIR)

Apply Yayasan Dewan Perniagaan Melayu Perlis (YYP)

2. Koperasi Bersatu Tenaga Malaysia Berhad (KOBETA) with funding from CIMB (Speed-i)

KOBETA personal loan accepts borrowers with:

| Outside Commitment | CCRIS | CTOS | SAA | AKPK |

|---|---|---|---|---|

| Accept high commitment outside of payslip | Overdue loan amount is acceptable | CTOS record listed under bank needs to settle first, non-bank less RM20,000 acceptable | Acceptable | Not Acceptable |

About KOBETA Personal Loan

- Interest Rate: 5.99% (Fixed)

- Payout: 91.5%

- Loan Amount: RM250,000 (maximum)

- Loan Tenure: 10 years, limit up to age 59

- Processing Time: 2 weeks

- Membership Fees: RM30 monthly

- Repayment: ANGKASA

- Takaful/Insurance: Yes

- Syariah Compliant: Yes

Borrower’s Criteria

- Income type: Permanent job with a minimum of 6 months of service

- Minimum Income: RM1,500 per month

Why choose KOBETA?

KOBETA personal loan is suitable for individuals with negative CCRIS and SAA records. However, if there is a CTOS record from a banking institution, the borrower needs to settle the loan first. A commitment below RM20,000 and not from banking institutions is still acceptable to proceed with KOBETA personal loan. However, those with records of AKPK are not allowed to apply.

Moreover, KOBETA is suitable for existing borrowers with personal loans from KOBETA who are looking for a low fixed interest rate personal loan with a high commitment outside of payslip or to clear out and settle negative SAA or CTOS record with this personal loan.

Generally, in total it takes about 2 weeks for the borrowers to receive the funds. The approval stage is about 2-3 days and about 5 days or more to receive the financing in your bank account. There is a 3 months advance payment deducted from the personal loan itself. On a monthly basis, there is a membership fee of RM30 for first time borrowers.

Apply KOBETA Personal Financing

3. Koperasi Putri Terbilang Malaysia Berhad (KOPUTRI)

KOPUTRI personal loan accepts borrowers with:

| Outside Commitment | CCRIS | CTOS | SAA | AKPK |

|---|---|---|---|---|

| Accept high commitment outside of payslip | Overdue loan amount of 2 months needs to settle with this personal loan | Overdue loan amount less than RM5,000 is acceptable | Not acceptable unless settle with this personal loan | Not acceptable |

About KOPUTRI Personal Loan

- Interest Rate: 5.9% (Fixed)

- Payout: 95%

- Loan Amount: RM100,000 (maximum)

- Loan Tenure: 10 years, limit up to age 54

- Processing Time: 6-8 working days

- Membership Fees: RM10 monthly

- Repayment: ANGKASA

- Takaful/Insurance: Yes

- Syariah Compliant: Yes

Borrower’s Criteria

- Income type: Permanent job with a minimum of 8 months of service

- Minimum Income: RM1,800 per month

Why choose KOPUTRI?

This option is ideal for borrowers who are looking for a fixed low interest rate loan with a high payout but with a high commitment outside of payslip. Borrowers with a record of CCRIS overdue payment of less than 2 months and CTOS amount less than RM5,000 are eligible to apply. Individuals with SAA records are eligible to apply as long as the overdue account is fully settled with this loan.

KOPUTRI personal loan can help you to sort out your financial worries especially if you need to settle your SAA or CTOS record. The overall estimated processing time is around 6-8 working days for you to receive the financing in your bank account. After submission of complete documentation, you will receive approval within 3-4 days then another 3-4 days to receive money in your bank account.

In addition to the monthly loan repayment, there is a monthly membership fee of RM10 and RM30 contribution of ‘Tabung Anggota’. The RM30 of ‘Tabung Anggota’ would be refunded back to you once your loan is fully settled. Do take note to inform KOPUTRI beforehand to cancel your membership as it would require some time to receive your money back.

Once your loan is approved, the money would be deposited into a CIMB savings account. In case you don’t own a CIMB savings account, you can always apply for a loan first and open up the account later when your loan is approved.

Apply KOPUTRI Personal Financing

4. UKHWAH

UKHWAH personal loan accepts borrowers with:

| Outside Commitment | CCRIS | CTOS | SAA | AKPK |

|---|---|---|---|---|

| Accept high commitment outside of payslip | Case-to-case basis, subject to koperasi UKHWAH’s approval | Case-to-case basis, subject to koperasi UKHWAH’s approval | Not acceptable unless settle with this personal loan | Not acceptable |

About UKHWAH Personal Loan

- Interest Rate: 4.99% (Fixed) for loan 4-10 years; 4.35% for loan 1-3 years

- Payout: 89%

- Loan Amount: RM200,000 (maximum)

- Loan Tenure: 10 years, limit up to age 59

- Processing Time: 2-3 weeks

- Membership Fees: RM30 monthly

- Repayment: ANGKASA

- Takaful/Insurance: Yes

- Syariah Compliant: Yes

Borrower’s Criteria

- Income type: Permanent job with a minimum of 6 months of service

- Minimum Income: RM1,500 per month

Why choose UKHWAH?

For borrowers with high commitment outside of payslip can apply UKHWAH personal financing. If the borrower has CCRIS or CTOS record, it would be viewed on a case-by-case basis by Koperasi UKHWAH itself. In case there is a record under SAA, UKHWAH can still accept if the borrower settles with this personal loan.

UKHWAH personal loan offers a relatively low interest rate which is a fixed 4.99% for loans that are 4-10 years and 4.35% for loans that are 1-3 years. Despite the leniency and low interest rate offered by UKHWAH personal loan, do take note that the processing time is about 2-3 weeks, whereas it takes about 3-5 days to get the loan approved. The approved funds would take about 2 weeks to be deposited into the borrower’s bank account.

Apply UKHWAH Personal Financing

5. Co-opbank Pertama (CBP)

Co-opbank Pertama (CBP) personal loan accepts borrowers with:

| Outside Commitment | CCRIS | CTOS | SAA | AKPK |

|---|---|---|---|---|

| Considers commitment outside of payslip (i.e. car loan, credit card) | Acceptable but overdue payments in the most recent months need to be settled first | CTOS listed under bank needs to be settled, non-bank is allowed | Not acceptable | Not acceptable |

About Co-opbank Pertama Personal Loan

- Interest Rate: As low as 2.95% (floating)

- Payout: 98% and deduct 2 months early payment

- Loan Amount: RM200,000 (maximum)

- Loan Tenure: 10 years or up to 1 year before retirement age

- Processing Time: 1 week

- Membership Fees: No

- Repayment: ANGKASA

- Takaful/Insurance: Yes

- Syariah Compliant: Yes

Borrower’s Criteria

- Income type: Permanent job with a minimum of 3 months of service

- Minimum Income: RM2,000 per month

Why choose Co-opbank Pertama?

This personal loan from Co-opbank Pertama is ideal for borrowers who are also seeking a low interest personal loan. Borrowers also have the option to loan up to RM200,000 for a maximum tenure of 10 years.

The eligibility criteria for CBP are much stricter as compared to other koperasi loans. CBP does consider your outside commitments such as credit card, car loan, house loan etc. Plus, if you have more than 2 months overdue in the most recent months of your commitment, you would need to settle your outstanding overdue first before proceeding to apply for this loan.

In case you have a CTOS record, those listed under banks need to be settled first before applying for a CBP loan, but a CTOS record listed under a non-bank category is acceptable. Those with records of SAA and AKPK are not allowed to apply.

The application and loan processing is rather straightforward as you would just need to present a copy of your IC, latest payslip, and consent form. From that, CBP is able to provide you with a pre-approval quotation as fast as 2-3 days. Once you agree with the pre-approval quotation, you can then proceed with the signing of BIRO ANGKASA form and employment verification letter.

Apply Co-opbank Pertama (CBP) Personal Financing

6. Kuwait Finance House with funding from MCCM

Kuwait Finance House personal loan accepts borrowers with:

| Outside Commitment | CCRIS | CTOS | SAA | AKPK |

|---|---|---|---|---|

| Considers commitment outside of payslip (i.e. car loan, credit card) | Acceptable but overdue payments in the most recent months need to be settled first | Acceptable but if there’s an overdue CTOS with more than RM2,000 needs to be settled with this loan | Acceptable but need to be settled with this loan | Not acceptable |

About Kuwait Finance House

- Fixed Interest Rate: 4.50%

- Payout: Promo 100%

- Loan Amount: RM250,000 (maximum)

- Loan Tenure: 10 years or up to 1 year before retirement age

- Processing Time: 1 – 2 week

- Membership Fees: No

- Processing Fees: No

- Repayment: ANGKASA

- Takaful/Insurance: Yes

- Syariah Compliant: Yes

Borrower’s Criteria

- Income type: Permanent job with a minimum of 3 months of service

- Minimum Income: RM3,000 per month

Why choose Kuwait Finance House?

This personal loan from Kuwait Finance House (KFH) is ideal for borrowers who want a fixed commitment every month without having to worry about increasing monthly payments due to OPR. Borrowers can consolidate a floating rate loan with a fixed rate personal loan of 3.99% from this loan, and KFH will cover the cost of takaful, so there is no deduction from the loan amount. The borrower will receive 100% payout.

Kuwait Finance House’s eligibility criteria is more or less the same as CBP loan. KFH does consider your outside commitments such as credit card, car loan, house loan etc. Therefore, it is suitable to consolidate an expensive loan with a fixed loan rate from KFH.

KFH also accepts applications with CCCRIS, CTOS & SAA records provided the arrears are need to be settled first by applying for a loan from KFH. For those who have AKPK records are not allowed to apply.

This application process usually takes 1-2 weeks. Once the borrower submits the form, the application and approval will be processed directly by Kuwait Finance House. After that, you just need to go to their branch to sign the offer letter. Funding will be credited directly into your bank account.

Apply Kuwait Finance House Personal Financing

Comparison Between Bank & Koperasi Personal Loan

So, if you are a government servant and are looking for a personal loan, you must be wondering, between banks and koperasi, which one best suits you? Here are two scenarios for you to compare and decide:

A: If you are looking for a lower interest rate personal loan and you have a good credit record, meaning no overdue in CCRIS or CTOS, and not listed under SAA & AKPK; then BANK personal loan is the best option for you.

B: If you are in need of extra cash and want it quick, but you have some negative CCRIS or CTOS record, and are listed under SAA or AKPK; then KOPERASI personal loan is something that you can consider provided its leniency in its credit approval.

Summary

Please be mindful that all koperasi personal loans listed above do not require any upfront payment or charges before approval. Legitimate fees, if any, will be directly deducted from your approved loan amount.

Be cautious when applying for a personal loan, especially if you have bad credit or a Special Attention Account (SAA), as loan scams are on the rise. Legitimate lenders will never ask for upfront fees or claim they can ‘clear your CCRIS or CTOS record.’ Understanding CCRIS, CTOS and SAA is crucial before applying.

If you are unsure which bank or koperasi personal loan suits you, check your eligibility 100% free on our platform. Our team can help you find, compare, and apply for loans for bad credit or other personal loans, even if you have a special attention account, that match your financial situation.

Direct Lending is a digital platform that helps you find and apply for the cheapest and most suitable koperasi personal loan, including options for borrowers with bad credit. Our smart eligibility system considers your CCRIS, CTOS and SAA records to suggest the best personal loan.

Video: How to Clear Your Name From the Blacklist Record CCRIS/CTOS/AKPK/SAA

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.