By Yik Seong

Director

Home improvement or home renovation is one of the most exciting endeavours house owners undertake on a periodic basis to beautify, remodel or expand their existing dwellings. For some, it is the ‘project of a lifetime’. Minor repairs or refurbishments need little preparation.

However, for major home makeovers, there is plenty of planning required. It is not limited to design or construction but also clever financial planning.

If this is your first time on planning to get a renovation loan from a bank and koperasi personal loan for home improvement or renovation, fret not. We have listed an easy guide for you to follow through.

Table of contents

- 5 Guide to Use House Renovation Loan in Malaysia

- House Renovation: 7 Rules That You Need to Know

- Video: House Renovation Cost Under RM 30K Idea

- Advantages of Using a House Renovation Loan

- Disadvantages of Using a House Renovation Loan

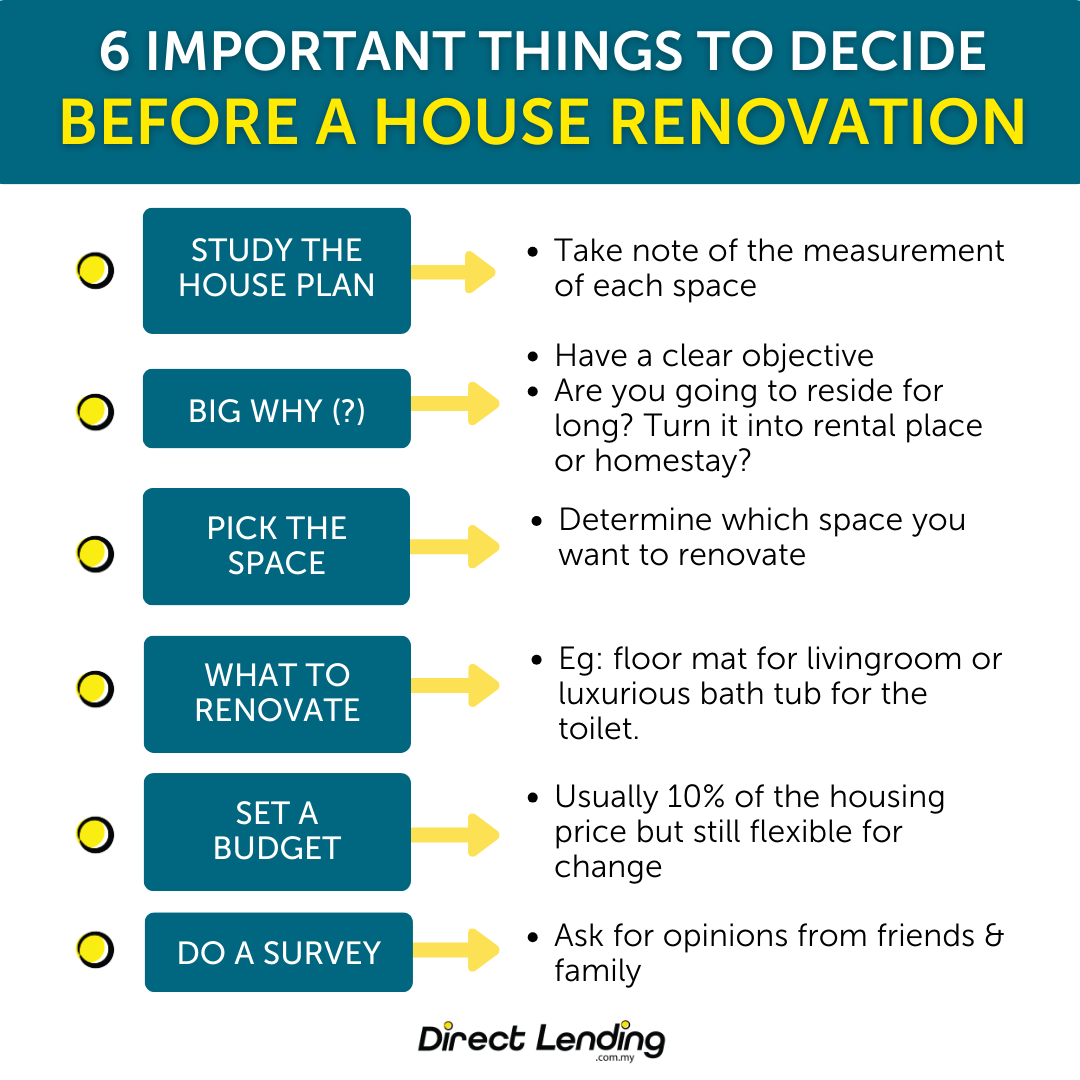

- Infographic: 6 Important Things To Decide Before A House Renovation

- How to Decide?

- Video: Easy Way to Renovate House With Personal Loan

- Experience in Taking a Loan to Build a House

- Need a Funding For Your Home Renovation?

5 Guide to Use House Renovation Loan in Malaysia

This step-by-step guide is a sure-fire way to turn your home renovation concept into reality. You can expect a problem free project, from conceptualisation and construction, up to funding support.

1. Project Concept

The idea of home renovation usually comes when the owner feels that his or her house needs a major overhaul. It can be in the form of expansion, remodelling or complete ‘newness’ that would change the overall ambience. Once the concept is firmed up, the planning begins. To visualise better, you can look up on Pinterest for design inspirations. From contemporary design to minimalist, Scandinavian, traditional, Balinese, industry, and more.

2. Project Costing

Some home renovation projects would need the services of an architect to design the concept. If perfecting the design would not demand professional help, then you can save on expenses by securing only the services of a contractor to do the job.

Look for a contractor that is qualified, reliable, has an efficient management and most importantly quality past work. Do a background research on the company and read reviews from other previous customers.

You can also have a couple or more contractors to survey your house on estimating how much the home renovation project would cost. Review each proposal and compare them. Look at the bill of materials, labour costs and related expenses, including bonds, permits and other incidental charges.

3. Select the Contractor & Quotation

The quotations will provide you an estimate of the total project cost or at least the price range. Make sure that the time frame for completion is also included. That will indicate how long the inconvenience will last while the renovation is ongoing.

The selection of the contractor is crucial. The low priced quotation might not necessarily turn out to be of quality work as compared to perhaps a more expensive offer. Always seek out recommended contractors to have that level of comfort by ensuring that the quotation price matches with the quality of work to be done.

In any case, this is optional but would be wise to draft out a House Renovation Contract that states the terms and conditions of the renovation work. This contract acts as your protection in case of any disputes with the contractor.

4. Budget Preparation

When you have decided on the project contractor, then assess your cash position. See if you can set aside a budget for house renovation to meet the stipulated project cost. If the cost is too steep to pay at the moment, you can defer the project to a later date. You can also recycle old furnitures or try to do-it-yourself (DIY) to save cost.

You can also opt to do the project on a piecemeal basis or phase-by-phase construction in order not to disrupt your financial situation. Since a major home renovation project would involve a huge amount, carefully evaluate the funding support or the type of renovation loan facility you would need.

5. Decide on Funding Support

With the contractor selected and the total project cost calculated, you can decide the best funding support to begin the project. If the renovation cost is really high, a renovation loan or home refinancing facility is a good option. The advantages are a higher loanable amount, lower interest rate, longer repayment period and affordable monthly amortization.

However, if you want to secure a loan package without having to offer a collateral, then a personal loan is your best option for funding support. This is the reason why many Malaysians prefer this type of loan because of its advantages. Applying for a personal loan is less complicated and the faster processing time favours the borrower who is eager to start the home renovation. Some personal loan providers even offer Syariah concept financing. Just make sure that you apply with a trusted loan provider.

Still unsure if you should apply a house renovation loan? Here is our take on the advantages and disadvantages to help you decide better.

House Renovation: 7 Rules That You Need to Know

1. Make sure that the house is legally verified

House owner are not allowed to reside in their property before they get their Certificate of Completion and Compliance (CCC) or Certificate of Fitness for Occupation (CFO) or Occupation Certificate (OC). You need to make sure that you have received this legal documents before starting any house renovation projects.

2. Make sure that you know what kind of rennovation is allowed by the local authority

Make sure to double check with the local authority pertaining the house renovation project that you wanted to carry out. Minor renovation like kitchen upsizing might not require a written permission from the local authority or arcitech.

3. Get permission from the city council

Based on Deed of Mutual Convent, signed by the owner when they bought the property from the property agent, joint management body (JMB), management corporation (MC) have the right to asess the proposal or your house renovation draft plan to ensure the comfort of the neighbourhood is intact.

4. Make sure that your contractor provide a construction security deposit

Generally for fenced and guarded area, MC will ask the house owner to provide deposit as a compensation if the contractor broke rules. For example, the failure to throw away debris and the material used for the renovation or damaging the public property like road and sewer in the neighbourhood.

House owner who is not in the fenced or guarded area also have to make sure that they provide the security deposit fund. If not, when there is a broken law, you will be the only one paying the penalty broken by the contractor.

5. The house renovation period

Time limit are usually set for renovation work. The usualy operation hour for renovation are from Monday to Friday, 8 am to 6 pm and Saturday, 8 am to 1 pm. House renovation work are not allowed on Sunday to ensure the that the neighbourhoods’ peace are not disrupted by the renovation work especially in the evening and on weekend.

6. Follow the approved renovation plan

The failure to follow the building plan resulted to many house owner unable to obtain CFO, CCC or OC certificates for their house renovation work. The owner could be panelize if they were to amend the approved plan without going through the right process.

7. Make sure your budget is sufficient

Prepare and list down the budget for your house renovation. If you do not make a precise estimation on the house renovation, you might have to postpone the process and the project will be abandoned as you run out of fund. Get the help from quantity surveyor to help estimate the precise cost, unless it is only a minor renovation.

Video: House Renovation Cost Under RM 30K Idea

Advantages of Using a House Renovation Loan

1. It can be considered a ‘good debt’

There is such a thing as good and bad debt. Borrowing for a house renovation loan can be a good debt if it will increase the value of your home. In fact, certain changes like remodelling your kitchen, landscaping and adding space to your home can help drive up its value. If you’re thinking about buying a house instead of do renovation, read more on how to buy house in Malaysia with little-to-no deposit money.

2. Upgrading can save you money

Upgrading your home with green technology like solar panels, energy-efficient lighting and heat-deflective roofing will hurt at first because the upfront costs are quite expensive. But in the long run, you will get to save some money. For instance, you can save on your utility bills as well as heating and cooling appliances. You might also want to renovate to upkeep and maintain the home so you can avoid major, costly damages later on.

3. Improve the standard of living and safety

Some renovations are not unnecessary but emphasis should be given on modifications that can really bring comfort instead of purely for vanity. Renovations that are aimed to improve safety should also be given the utmost priority!

Disadvantages of Using a House Renovation Loan

1. Possibly higher interest rates

It is true that a refinancing loan or renovation loan itself could offer lower interest rates. But do keep in mind that you will essentially be taking on a new home loan and be pledging your property as collateral.

2. Living above your means

This is a concern that most people have with borrowing to make home improvements. You might be tempted to make changes to your home that are unnecessary or that you cannot afford and incur unnecessary debt as you go along.

Infographic: 6 Important Things To Decide Before A House Renovation

How to Decide?

At the end of the day, there is no definite answer as to whether is it a smart choice to take up a house renovation loan or not. However, if you are still having a little trouble figuring out if you should apply for a personal loan to fund your home renovation project, do not worry, here are some helpful hints.

Consider a house renovation loan if:

- You do not need a huge sum and are only making minor renovations to your property

- The loan comes with very low interests and affordable repayment plans

- You need the money for emergency home repairs

- You are looking for a convenient loan that is flexible and easy to apply

Look for other financing options if:

- You are doing major renovations and require a large sum of money (more than RM100,000)

- You can wait for the loan funds

- You do not mind using your home as collateral

Lastly, you might want to hold off on renovations if you cannot afford repayments for either type of loan. In this case, it is best to play it safe, save up and renovate with cash. Other suggestions that you may consider are small modifications or try to do it yourself (DIY). An example of a store that sells hardware at affordable prices is Mr.DIY.

Video: Easy Way to Renovate House With Personal Loan

Experience in Taking a Loan to Build a House

Some people also want to compare whether to take a loan to buy and renovate an existing house or to build their dream home from scratch. This is because the costs for both options are substantial. Previously, we shared information about the process and steps to take a loan for renovating a house. So, we will now share the experience of Mrs. Aznira in taking a loan to build a house for those who want to make comparisons.

Mrs. Aznira already owns land in Semenyih. Therefore, she only took a personal loan amounting to RM100,000 for the construction costs of the house. This monthly payment is shared with her husband, and almost all construction matters are managed by her father-in-law.

She mentioned that the construction cost of the house is not exorbitant, and this is one of the advantages of building a house within budget. However, this also depends on the design, labor, and materials used for the construction of the house. Therefore, the unpredictable construction cost is also a major disadvantage if you want to take a loan to build a house. Make sure you assess your financial capability beforehand.

*Experience quoted from iProperty.com.my

For those planning to take a loan to build their dream home, it should be noted that banks only approve 90% of the applied loan. Before starting the house construction process, ensure that you have prepared a budget list that covers all the costs of land and house. Among the house construction matters that require cash are the cost of drawing plans, application for approval at the local authority (PBT), and legal fees. So, depending on your financial situation, is it more worthwhile to take a loan to renovate a house or to build a house from scratch?

Need a Funding For Your Home Renovation?

This article is written by Direct Lending – An online personal lending platform that provides bank and koperasi personal loan as well as licensed moneylenders personal loan. We can help you find, compare and apply personal loan that best suits your financial needs. Check your eligibility for free, no upfront payment or processing fees and get a loan rates from 2.95% p.a. or 2 working days.

(This article was originally published on the 27th of October 2017 and updated on the 2nd of April 2024).

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.