By Mandy

Marketing

8 Popular Scams in Malaysia

“This won’t happen to me” or “How can anyone fall into a trap like this?”. These days, anyone can be a scam victim. Recently, a teacher lost RM1.13 million to Macau Scam. The syndicate pretended to be a ‘police officer’ claiming that her car was involved in a fatal accident whereby money laundering was involved as well. She even took personal loans to prepare for the ‘bail money’.

Well, the point is these syndicates are so well-trained that they are capable in convincing you to believe in everything that they say. Our purpose of writing this article is to build awareness and educate users so that everyone of us don’t fall into the ‘scam trap’ like many did. Here we explain some of the common scams and the meaning of each scam that you may come across or heard off happening in Malaysia.

1. LHDN Scam

Before this, we were already aware that phone numbers claiming to be from government agencies, LHDN, and the like were undoubtedly scams, right?

LHDN has also issued a statement that they never make calls from mobile phone numbers.

But did you know that the latest scammer tactic now uses landline numbers to confuse the public?

Moreover, those who have 'fallen victim' claim that these scammers even use operators and have personal information about the person they are calling!

What should we do to avoid LHDN scams?

- Don't trust and hang up if someone claims to be a bank officer, police, LHDN, and asks you to disclose any personal information.

- Check the phone number through the CCID (Commercial Crime Investigation Department) website at this link.

- Verify with the police, LHDN, or any agency through the official phone number or official website of the respective agency.

- You can also use apps like TrueCaller to screen scammer phone numbers.

Image Source: Rojak Daily

2. KWSP Scam

KWSP money, as you know, is savings for the future. Usually, retirees and those who want to withdraw their savings, especially through i-Sinar and i-Citra, are the targets of scammers. Here are some KWSP scam tactics:

-

Calls from "KWSP Agents"

Hang up immediately if you receive a call from someone claiming to be a KWSP agent. KWSP never appoints agents to manage your savings.

-

Via SMS

If you receive a message containing an OTP number even though you never applied for it, it means scammers are using your personal data.

-

Fake i-Sinar Apps

Some scammers create seemingly real apps to facilitate KWSP money withdrawal transactions. For safety, contact KWSP to verify whether the app belongs to them or not.

Watch this video to know how to avoid KWSP scams through fake i-Sinar apps.

3. Part-Time Job Scam

"Easy Work From Home!" "RMXXX-RMXXX Per Week." Do you often receive messages with phrases like these? These are actually among the commonly used lines by scammers running work-from-home schemes, promising substantial income for easy work. Given the current trend of many seeking part-time jobs for a side income, imagine landing a job only to discover it's a deceptive tactic. Surely, it can be disappointing.

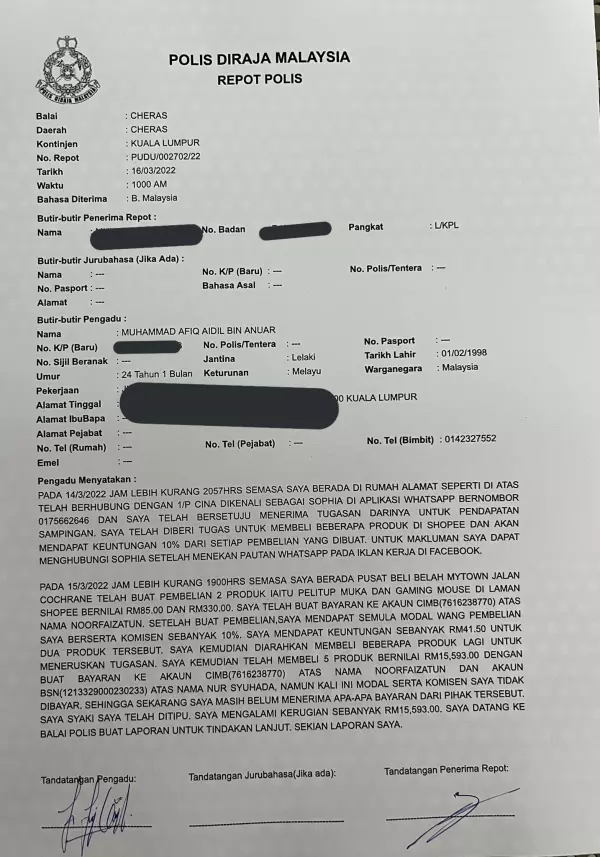

In the latest incident, a Twitter user, @aboiii98, shared an image of his police report claiming to have been scammed by a Shopee scammer.

According to him, he lost RM16,000, depleting his savings and borrowing from others. It all began when he came across a Facebook ad offering part-time work with high commissions. He then contacted an individual named Sophia on WhatsApp to inquire further about the job. Before long, he was given several tasks to complete in order to earn the promised commission. According to the victim, the first task was to purchase several products on the Shopee shopping app, with the promise of a 10% profit from the purchases.

The victim earned the profit from the first transaction. However, when it came to the sixth transaction, when the victim requested a refund of his money, he was asked to pay a penalty of RM3299. Quite a sum! After making the payment, the admin suddenly claimed that the system was down, and they had to wait until the next day to refund the victim's money. It was at this point that the victim realized he had been scammed and filed a police report.

Here is the victim's police report. You can read the full story here:

(Fn8 Tdnamamj2Ia).

(Fn8 Tdnamamj2Ia).

What can you do to avoid falling for part-time job scams?

To avoid falling victim to the tactics of these scammers, here are some tips to help you identify whether a job offer is genuine:

- Immediate job offers without the need for an interview.

- Overly brief job offer explanations.

- Lack of information about the company on the internet.

- Being asked to pay a deposit for registration.

- Use of a regular domain email address.

4. Macau Scam

This is one of the most popular scams in Malaysia recently. Usually, in the case of Macau Scam, it starts with a phone call. The scammer will impersonate themselves as an officer from Royal Malaysia Police (PDRM), Bank Negara Malaysia (BNM), Malaysia Anti-Corruption Commission (SPRM) or other related agencies i.e. debt collection. Generally, Macau Scam would take place according to the following situations:

1. Spoofing

This is a technique whereby the perpetrators would use a Voice Over Internet Protocol (VoIP) to mask the voice from a trusted local number that the victim is familiar with. Then, the scammer would request the victim to transfer a sum of money to a third-party bank account. This drives the victim to panic and follows the scammer’s instructions blindly without even thinking twice, just to avoid being caught by the authorities.

2. Disguise as bank officers

The syndicate would call to pretend with the identity of a bank officer. They would create a scenario indicating that the victim has missed out on their credit card payments. Then, the victim would be directed to contact with an individual from Bank Negara Malaysia (BNM) for example. Then, the syndicate will ‘pressure’ the potential victim by saying that if they don’t settle the fine or payment within a short time, he or she would face serious charges or consequences like they will get ‘blacklisted’ or their accounts would be frozen.

3. Lucky draw

The victims would receive calls or messages saying that they have won a lucky draw or in some cases, the lottery. The scammer would then ask the victim to transfer a sum of money in order to claim the prize.

4. False kidnapping

The scammers would make a phone call to a potential victim and claim that the victim’s loved one(s) have been kidnapped. In some cases, the scammers would stage a kidnapping scene whereby it would involve the kidnapped victim to yell for help in the background. Then, the scammer would request the victim for a ransom.

What should we do to avoid becoming a Macau Scam victim?

- First, don’t panic. Contact the police or financial institution involved before following any instructions given by the scammer.

- Don’t disclose any private information to any unidentified individuals i.e. IC number, bank account number or credit/debit card number.

- If you feel suspicious, check and call the organisation involved with their official contact number.

- In the case of kidnapping, check again the location of your family members before performing any transactions.

5. Loan Scam

“0% interest rate” or “100% guaranteed loan approval”. Sounds too good to be true right? While these deals may sound unrealistic but in times of desperation, a high-skilled scammer can persuade any victim easily. Usually in the case of a loan scam, the scammer pretends to be from a financial institution or personal loan platform.

The syndicate would then ask for an upfront payment or processing fees before depositing the loan amount into the victim’s bank account. Often, the easy targets of loan scam are those with a bad CCRIS and CTOS record and in desperate need for cash. Check out our article on the 6 warning signs of personal loan scam that you should watch for.

What should we do to avoid becoming a Loan Scam victim?

- If you are applying with a licensed moneylender or known as credit community, check if they have a KPKT license through the eMAPS If it is a legit company, their registered business address and company phone number should appear in the system.

- If you are applying through a loan platform or financial agency, check if there are any fees or charges. A legitimate loan platform will never ask the borrower to pay any fees or charges.

- If you want to apply after seeing an online advertisement, SMS or cold calling, first check on what the source is offering and where is the source from. If you feel suspicious with the individual you are dealing with, you can check on the Portal Crime Investigation Royal Malaysia Police by the Commercial Crime Investigation Department (CCID). This portal would help you to identify if there are any cases reported previously with the bank account number or telephone that you have key-ed in.

6. Love Scam

Steal your heart and then steal your money. That is exactly how the love scam works. Usually romance scammers, set up fake profiles on dating sites and social media. They portray themselves as an attractive individual by using pictures of models or influencers on their profiles. So, these scammers will interact with the potential victim especially lonely and desperate women. They will then deceive you with their sweet-talk and hoping that you will fall in love with them.

Then, to show their love to the victim, the scammer would claim that he sent over an expensive gift to the victim. But the gift gets stuck at the airport’s customs. So, the scammer would ask the victim to transfer an amount of money to retrieve the gift. Some scammers even go to the extent of creating tampered documents to persuade the victim into trusting the scammer.

What should we do to avoid becoming a Love Scam victim?

- Never share your personal information with a stranger i.e. your full name, residential address or even birth date.

- Never transfer money to someone that you have not met in person or even receive it. Don’t reveal your bank account number, credit/debit card number.

- Be extra cautious while you are on dating sites or social media. Only use trusted dating sites.

- If you feel suspicious, try using Google search by image to verify that individual.

- Trust your gut feeling. If you feel something is not right or suspicious, you are probably right.

7. Get Rich Quick Scheme

This is a type of investment that promises victim unrealistic or high return by investing through a small or short period of time which claims to be easy and risk-free. These schemes are not registered under Bank Negara Malaysia, Securities Commission Malaysia, Ministry of Domestic Trade and Consumer Affairs or any other related authorities. The main targets of this scam are government servants, retirees and students.

Some of the Get Rich Quick Scheme includes the following:

- Deposit-taking scheme

- Pyramid or Ponzi scheme

- Direct selling

- Commodity market investment

- Foreign exchange trading (Forex)

What should we do to avoid becoming a Get Rich Quick Scheme victim?

- Only deal with trusted finance institutions and licensed investment firms. Check the list of licensed institutions on the Bank Negara Malaysia website.

- Practice cautiousness while dealing with investment that are performed online.

- Check with the authorities beforehand and make sure that you don’t force yourself to invest in anything that you are not comfortable with.

- Don’t be too greedy. If a deal seems ‘too good to be true’, then it probably is.

8. Parcel Scam

The scammer would call, email or text the victim claiming that the mail carrier or delivery service could not deliver a parcel or package to your home. Even if you did not order anything in the past few weeks, the scammer would convince you that the parcel is from your friends or family.

For example, in the case of email, it is usually structured to look like it’s a from the company that you purchased goods from or the delivery company. The scammer will then ask you for your personal information such as credit/debit card information to proceed with delivery. The email would also include a link for you to click to retrieve the said parcel. Once you click, you are likely to download a malware into your computer. This would provide the scammers the opportunity to have access to your personal information and passwords, allowing them to hack into your internet banking accounts.

What should we do to avoid becoming a Parcel Scam victim?

- Be careful with the friends that you make over the internet especially through social media. Don’t trust that easily and receive parcels as a sign of friendship.

- Do track your parcels if you have made any online purchases recently. Take note of the tracking number to know when you will expect a parcel delivery.

- Never share your personal information without verifying the source. Make sure that the individual that you are dealing with is legitimate.

- Never click on links from unsolicited emails, especially from individuals and companies that you don’t know or not familiar with. Be cautious when you receive these kinds of emails. Immediately report as spam if you receive them.

- In case of any suspicious activities, check with the customs or courier services.

Stay Alert & Protect Yourself

Overall, we need to be aware and practice vigilance so that we will not be deceived by the scammer’s dirty tactics and tricks. Take this opportunity and remind your loved ones especially your parents if they are not that tech savvy; so that they can inform you whenever they receive any suspicious phone calls or messages.

We hope that you will find this article useful to help you stay a step ahead. Remember to stay alert and protect yourself from being scammed. Always check and confirm with the authorities if you are unsure about anything.

[INFOGRAPHIC] Protect Yourself From These 5 Types of Scams

Most of these syndicates are well trained and skilled with the ‘ins and outs’ of fraud. That is why and how most victims fall so easily into their scam trap. It is crucial for us to know the tricks that scammers use so that we can educate ourselves and not become a potential victim. To know more about these scams and precautions steps to take, you can refer to this article the top 5 types of scams in Malaysia.

We hope that this infographic would provide you and your loved ones some exposure on how to be more careful in the future. Always remember, if you are unsure about something, there’s nothing wrong with checking or confirming with the respective party.

Need a Trusted Personal Loan?

Direct Lending is a personal loan platform that offers bank and koperasi loans. Let us help you to source for the best personal loan that fits your financial situation. As usual, our service is 100% free with no hidden charges or processing fees. Our rates are as affordable as 2.95% or as fast as 2 working days. Check your eligibility with us today!

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.