By Yik Seong

Director

6 Smart Ways To Grow Your Emergency Fund

Have you ever thought of what you might do if you are suddenly faced with a RM40,000 medical surgery bill? You are lucky if you own Takaful or insurance, but what if you do not, and what if the insurance coverage is insufficient? This is where emergency funds and their importance come into the picture.

Many would advise preparing an emergency fund of 3 to 6 months’ worth of income to be equipped for rainy days, though it is undeniable that some people may find saving difficult to do. Some may simply earn a low income, while some may have too many other commitments, including personal loan repayments and daily expenses.

We are all different in terms of our financial capabilities. You may often come across financial advice from finance gurus or mentors, but take them all with a grain of salt. It is fine to alter the savings advice to suit your needs and abilities, and also remember to follow your own pace when saving.

Before we dive into how to build an emergency fund, these are the 3 types of emergency funds that you should know of:

Table of contents

1. Professional Emergency Fund

Source: Home Depot

Source: Home Depot

The recommended amount for this fund is around RM500. This is used for emergency situations where the money is needed fast. Therefore, it should be saved where it can be accessed easily.

For instance, set aside this RM500 in a debit card that is not the one you would use for daily expenses. This is so that it does not get spent by accident. When you need the money for an emergency, just use this debit card.

Some of the reasons for using the money from this fund are vehicle repairs and scheduled car servicing.

2. World Class Emergency Fund

Source: Freepik (@Pressfoto)

Source: Freepik (@Pressfoto)

The recommended amount for this fund is around RM1,000 to RM2,000.

This fund is used to supplement the professional emergency fund above, say which is insufficient. Similar to that, this fund should be saved in a separate savings account that can be accessed using a debit card.

This is used only if the professional emergency fund has been used up. Some of the reasons for using this money are for hospital admissions or dental treatments.

3. Legendary Emergency Fund

Source: Freepik (@Torwaiphoto)

Source: Freepik (@Torwaiphoto)

If your monthly income is RM2,000, then the amount for this fund is between RM7,500 to RM15,000.

In other words, this fund should amount to 3 to 6 months’ worth of your basic expenses or monthly income. Unlike the previous two emergency funds, this one is better invested in Amanah Saham Bumiputera (ASB) or Tabung Haji, and if they are for your children, then the savings can be done in the SSPN i-Plus education fund.

The purpose of this fund is to cover daily expenses say if you have a medical condition that does not allow you to work for some time, or if you ever get retrenched from work.

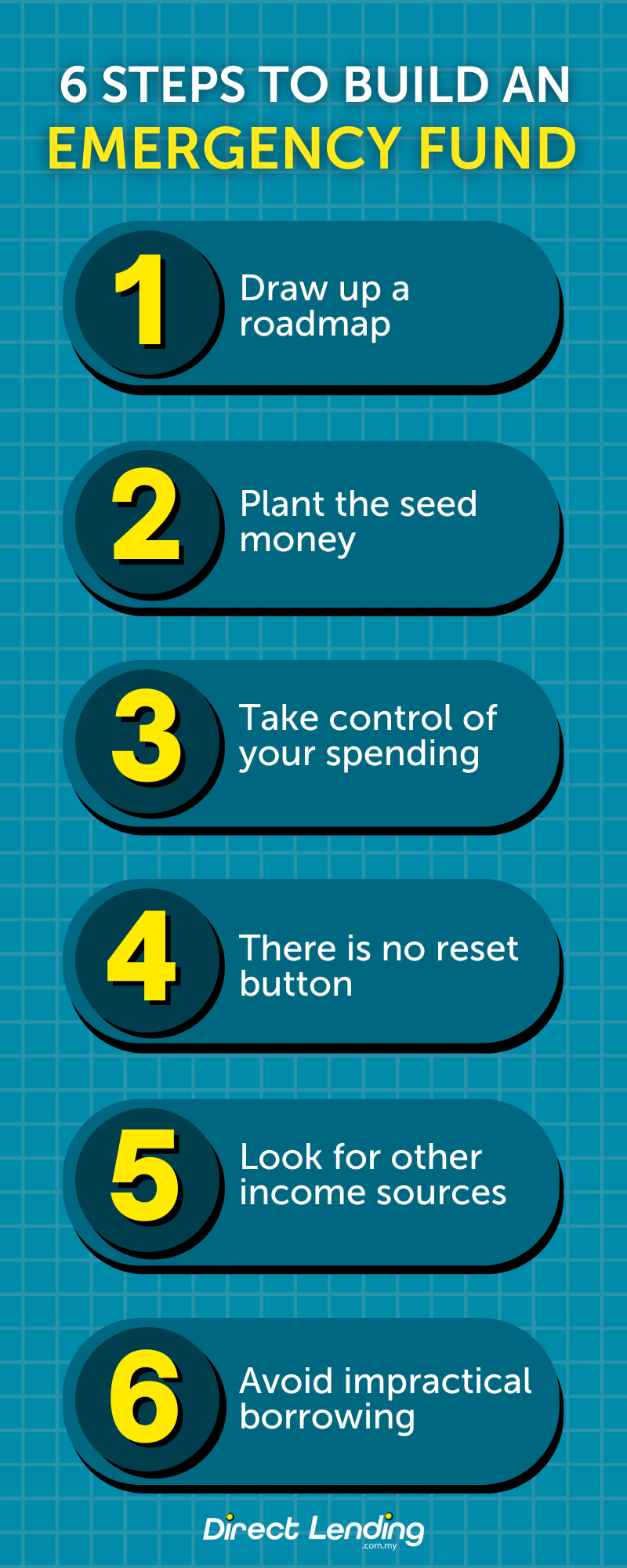

6 Steps to Build an Emergency Fund

1. Draw up a roadmap

In any endeavour, particularly when it comes to saving money, there has to be a fine blueprint. You need to draw up a road-map to guide you to achieve your financial goal. It would be best to set a definite monetary target over a period of time. For instance, aim to deposit RM50 per week into your savings account for this purpose.

2. Plant the seed money

Once you have a road-map in place, avoid detours and follow the route accurately. You do not actually need to allocate a greater chunk of your income at the start. The first thing is to assess your net monthly take-home pay. Compute all basic, recurring expenses and other payables. From the remaining cash, set a fixed amount that shall be your seed money, for example, 10% of your net monthly pay. Save this amount consistently from here on and perhaps increase gradually when permissible.

3. Take control of your spending

Be business-like as you build your emergency fund. Even blue-chip companies implement cost-cutting measures when the situation calls for it. The same applies to personal finance. You can free up some of your money by preparing your own packed lunch to work, doing away with junk food, and curbing your smoking or drinking vices. You can also save more when you sacrifice other items you can live without like magazine or cable TV subscriptions. Every penny counts so resist the temptation of indulging in non-essentials as well as impulse buying.

4. There is no reset button

The greatest pitfall in building an emergency fund is when you lose steam midway in your journey. Treat this mission as a game without a reset button. Unless of course, you are aborting the mission because of a real emergency.

In truth, working to grow your emergency fund is a test of determination. It is not a switch that you can turn on and off. The objective should be to fulfill the goal because it can quite literally save a life during a true emergency. What is at stake is your future financial security, no less.

5. Look for other income sources

Resourceful individuals will not rely solely on their regular incomes in their quest to build an emergency fund. Having a second or third source to supplement your current income would be helpful. There are boundless earning opportunities in this era of the digital world.

If you have the talent to do online jobs like blog and article writing, graphic designing, and other tech-related or non-tech-related stuff, earn from it. Sweat it out too if odd jobs in the retail and food service spaces are available. Take advantage of your propensity to earn while you are in your productive years.

6. Avoid impractical borrowing

One reason why an emergency fund is important is that it averts the need to borrow and pay for interest costs. However, there would be instances when borrowing is inevitable. Unfortunately, many are caught in the debt trap simply because they are borrowing for the wrong reasons. The biggest blunder is borrowing to pay off debts unless the intention is consolidation. Impractical borrowing is like digging your own sinkhole which will eventually lead to financial misery.

If you really need to borrow, do it reasonably. Do not borrow an amount more than you can afford, because this can only deteriorate your quality of life in the future. You can opt for small loan amounts or choose to split up your payments into instalments instead.

For instance, you might need to pay for a major car service. Some workshops require car owners to pay up the full amount. But if you don’t have enough to pay for the car service, you can opt for car service fees instalment plans, particularly the Service Now, PayLater instalment plan offered by Direct Lending. You can choose to split up your service payments into 3 to 6 months. This can allow you to get the repairs done without impacting your finances too much at once.

At the end of the day, using an emergency fund or savings is still better than borrowing for less important reasons.

Conclusion

Life is full of surprises that you need to roll with the punches at times. Some blows are manageable but financial emergencies hit the hardest. A buffer or emergency fund will serve as your safety net to cushion those blows.

You will even thank yourself if you succeed in building a cash reserve for any eventuality. Not every day is sunny but when dark clouds appear, you know you have enough shelter from the rain. The advice to set up an emergency fund, although repetitive, is always well-meaning not exaggerated. Act fast. Prepare now.

This article is written by Direct Lending. A digital personal lending platform that helps you to find, compare and apply affordable personal loans best suited for your funding needs.

(This article was first published on the 23rd of December 2019 and updated on the 4th June 2024)

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.