By Mandy

Marketing

Buying New Car vs Used Car In Malaysia: Which One’s Worth Your Money?

The majority of Malaysians, especially those living in the urban city areas will own at least a car. Many conclude that the main reason to own a vehicle is to facilitate convenience. As for some, the option of using the public transport system for daily transportation may not be as convenient.

The problem is, cars do not come cheap in Malaysia either, especially imported cars since there are several taxes that you have to pay for. So, you may then be wondering whether you should buy a used or a new car in Malaysia.

Is Buying Car A Necessity or Convenience?

Of course, this really depends on your individual financial situation. Here are some of the important questions you should ask yourself before buying a car:

- What is my overall budget for a car?

- Can I afford to pay at least 10% of down payment for the car that I want?

- Am I eligible to apply a hire purchase loan (in addition to all my existing loans)?

- Can I afford the annual insurance and road tax?

- How long do I plan to keep the car?

- What is the purpose of me owning a car?

These questions play an important role. Ask yourself these questions so that you do not end up making big mistakes. For example, if you are looking for a car to transport your large family, then you will have to consider a larger car like an SUV, MPV, etc.

If you would like to modify your car, then you probably would not want to buy a brand new one for the fear of damaging or spoiling it as you may add and replace certain parts. Now let us compare both the new and used cars briefly in terms of price, maintenance costs, loan and road tax insurance.

Comparison Between Buying New Car VS Used Car

1. Price

Used cars generally cost way less than new cars. This is because used cars depreciate faster and can reach up to half of the original price in just 5 years. Let us do a simple comparison between new and used cars. We have selected the most popular car brand and model that Malaysians prefer as an example.

| Brand New | Price* | Used (Carlist) | Price |

| Perodua Myvi 1.5 LH 2021 | RM 50,530 | Perodua Myvi 1.5 SE 2012 | RM27,800 |

| Perodua Axia 1.0 G 2021 | RM32,485 | Perodua Axia 1.0 G 2014 | RM21,000 |

| Honda City 1.5 S 2021 | RM74,191 | Honda City 1.5 S 2013 | RM42,800 |

*The prices quoted above are correct at the time of writing

2. Maintenance Costs

For any car that is over 5 years old, you can expect that the maintenance costs will go up. The average lifespan of a car is almost 12 years in 2018 so naturally, cars older than this age will start showing technical problems which means you will have to fork out more for repairs.

Additionally, most Malaysian car vendors only provide 5 years or 100,000 km of free service warranty. For example, Honda offers a 5 years warranty with unlimited mileage to their new models. This means that after 5 years, you will need to maintain the car yourself.

Therefore, you will need to set aside some funds for unexpected situations, for instance a damage that requires a major service. In case you receive a massive bill for a single repair work and are short of funds, you can try this Auto Service Financing facility to assist you. With this safe and trusted plan, you can split up your car service payment to 3 to 6-months instalments.

3. Loan

If a used car is priced less than RM10,000, usually you would not need to apply for a hire purchase loan to purchase it. Most people would just save up and pay for the car in cash. The downside of taking a loan for a used car is having to pay an interest of approximately between 3 – 4.45%* p.a. depending on the bank itself. This is much higher than the interest you pay for a new car which can be as low as 2.5%* p.a. (interest rates quoted are accurate at the point of writing).

You will also have to ask yourself whether you can afford to apply for a hire purchase loan as the monthly repayments (when added with your other loan repayments) should not exceed 60% of your income.

Especially if you are a civil servant, you are entitled to an alternative financing option which is through a bank and koperasi personal loan. You can buy a used car or a new motorcycle with interest as low as 2.95%, plus there is no requirement for collaterals or loan guarantors.

4. Road Tax and Insurance

In addition to the loan that you may want to take, you also have to consider whether you can afford the insurance and road tax. Insurance is higher for new or imported cars and lower for used cars since their values are also lower.

Here is a comparison table for annual insurance premiums according to the car age and model. Calculations are based on standard comprehensive coverage plans without any extra policies and done at CarBase.my’s estimation calculator (with location: Peninsula, no NCD discounts).

| New Car | Insurance Premium | Used Car | Price** |

| Perodua Myvi 1.5 LH 2021 | RM1,593 | Perodua Myvi 1.5 SE 2012 | RM1002 |

| Perodua Axia 1.0 G 2021 | RM1,092 | Perodua Axia 1.0 G 2014 | RM826 |

| Honda City 1.5 S 2021 | RM2,208 | Honda City 1.5 S 2013 | RM1,392 |

**The prices quoted above are correct at the time of writing.

As for road tax price, it is the same for both used and new cars. For 1.0 cc vehicles in Peninsular Malaysia, the yearly repayment is RM55 whereas 1.5 cc vehicles is RM90.

So Should I Get a New Car or Used Car?

Both new and used cars have their own pros and cons. New cars often get a bad reputation because they depreciate in value very fast and do not represent a good investment, unlike houses or other assets. However, new cars function well and can last longer than used cars.

Moreover, used cars are much more affordable in terms of pricing whereby you have the option to pay in cash. For those car owners who do not mind driving an older version car or do not want to spend the extra time and money to take care of a car, a used car is a more viable option. Users can enjoy the freedom and worry less about the depreciation rate as well.

Tips For Buying a Used Car

For those that cannot yet afford buying a new car, a used car can still do great at serving its purpose and bring you long term benefits, provided that you make the right choices.

1. Prepare a budget

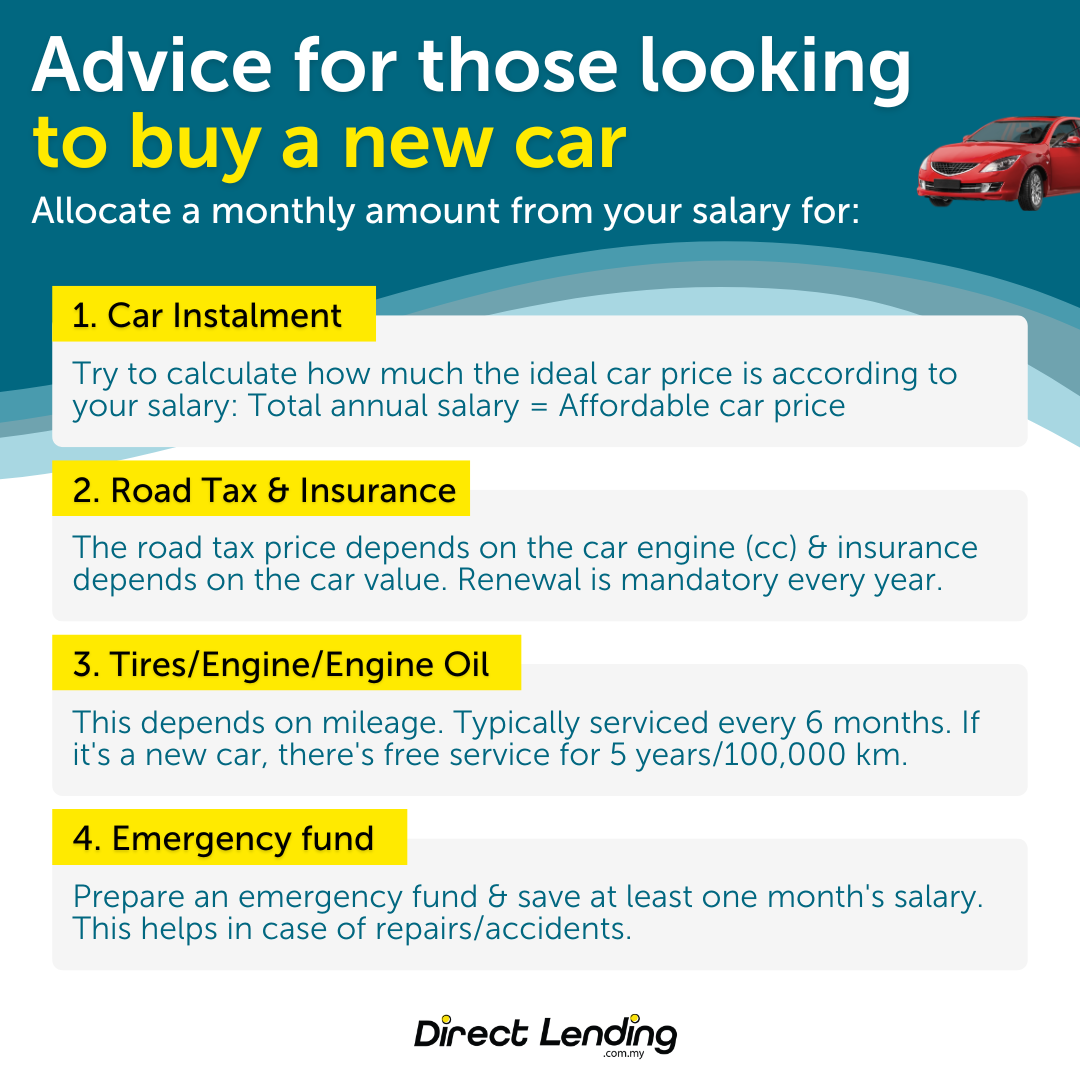

Preparing a budget that is best suited to your own financial situation is a necessity before buying a new car or a secondhand car.

For instance, you can narrow down your options to only cars priced below RM100,000, set a monthly instalment limit to RM500 and a repayment tenure of up to 5 years. This, of course, varies according to your own income and commitments.

2. Be informed of the car’s age

Identifying or limiting the age of a used car that can be bought is also crucial. Bear in mind that an older car might cost you more on maintenance.

3. Get to know the car’s past records

It is very important to know a car’s history before agreeing to purchase it.

You should check on whether the car has been submerged in floods before, how many past owners it has, whether it has been involved in major accidents or if it has recorded a big mileage.

Some cars may look great externally, but be sure to check the insides too!

4. Check its mileage

When buying a used car, you should check whether it has recorded a high or average mileage.

Usually, the higher the mileage, the lower its selling value. This, however, still depends on car’s model and also the buyer’s budget.

5. Survey online and offline

These days, you no longer need to visit a used car dealer to learn about what is being sold in the market.

There are many trusted online platforms that also allow you to filter options according to your own preferences.

All you need to do is enter your budget and the system will display the available options for you.

Try not to be tempted by offers made by used car dealers. They might trap you into buying something beyond your budget, or worse still, be scammed into buying something of lower quality than disclosed.

6. Check the service records

Look out for car owners that regularly get their cars serviced by authorised brand dealers. These service centres will record each visit accordingly.

You can also ask for maintenance records or receipts from the owner to know if there have been repairs made in private workshops. This is important in noting any previous spare part replacements or if there are any damages.

You can use technology to manage this; by using the SERV mobile application. This app allows you to record your car maintenance history, as well as booking online service appointments.

7. Inspect both the interior and exterior

You must check for any damages. If the owner refuses to repair any existing damages, you should negotiate for a discount.

You should also check all basic features like the wipers, lights, sockets, signal lights, air conditioner, horn, radio, doors, side mirrors, boot, spare tyre, meter panel, etc to make sure they function well.

8. Check the engine and do a test drive

The engine is the most essential component for a car. If you are unsure, you can use the help of a mechanic to check the car’s engine.

They can identify if there are any problems regarding the engine oil, radiator, connecting cables and other components.

You also have the right to ask for a test drive before confirming your purchase to make sure you are truly satisfied with the car’s quality.

Test the brakes, steering wheel, driving in different areas and the overall feel of the car to you.

Car Caring Tips

It is good to know the essentials of caring for a car as not only can it save you money, it can also back you up from having to make unnecessary payments to workshops and mechanics that may want to take advantage of you.

Engine oil

The engine oil’s purpose is to make sure the car engine rolls smoothly while driving.

You should also know the type of engine oil suitable for the car. There are different types of engine oils;

- Semi-synthetic engine oil, can last for up to 5,000 km or 3 months

- Fully-synthetic engine oil, can last for up to 10,000 km or 6 months

Tyre air pressure

Check whether the car tyres have enough air pressures or not. Insufficient air pressure may cause the tyre to burst.

Also check the overall tyre condition to check how well they ‘grip’.

Spark plug

Just like the engine oil, the spark plug also comes with some usage limit. It can usually be used for about 30,000 to 40,000 km.

If the mileage is above 40,000 km, you are advised to replace the spark plug because the electrode in the component may have weakened which can cause your car to lose its power.

Battery

There are two types of car batteries, the wet cell and the dry cell. Their maintenance are also different. The wet cell requires you to refill the distilled water from time to time, and it can last up to 2 years and also depends on the car usage.

If your car battery has some problems, the car may not be able to be ignited and you will have to get a replacement battery.

Radiator coolant

A radiator coolant is not similar to regular tap water. The air coolant serves to regulate the car engine’s temperature. It is advised to replace the coolant at every 60,000 km mileage.

Conclusion

In conclusion, choosing a new or used car really depends on your personal financial condition and what you want from your car. An alternative to cars is a motorcycle, where many praises it to be the option that is more affordable, especially in terms of maintenance. There are also different financing options to buy a motorcycle, whether through a conventional hire purchase loan or through a personal loan from licensed moneylenders. For the latter, you can receive benefits in terms of lower rates and ownership of the motorcycle.

If you require any financial assistance by getting a personal loan, please reach out to us here at Direct Lending. Our team of consultants is ready to help you search, compare and apply for a personal loan that best suits you. Check your eligibility with us for free today!

Our service is 100% free, no upfront payments and no processing fees.

(This article was originally published on the 15th October 2017 and updated on the 22nd April 2024).

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.