By Yik Seong

Director

Credit Card Loan: 10 Effective Ways To Get Out Of It

Observing the current payment trends of Malaysians, the method of cashless payments is becoming increasingly popular and rapidly evolving. This is true for individuals across various income brackets, from the middle class to professionals.

Despite showing an increase, concerns are raised as many Malaysian youth are failing to repay personal loans, and vehicle loans have contributed to almost half of the recent cases of bankruptcy.

There are several things you need to know about credit cards and effective credit card payment methods to help you settle debts more efficiently.

Table of contents

- What Happens If You Pay a Credit Card Loan Late?

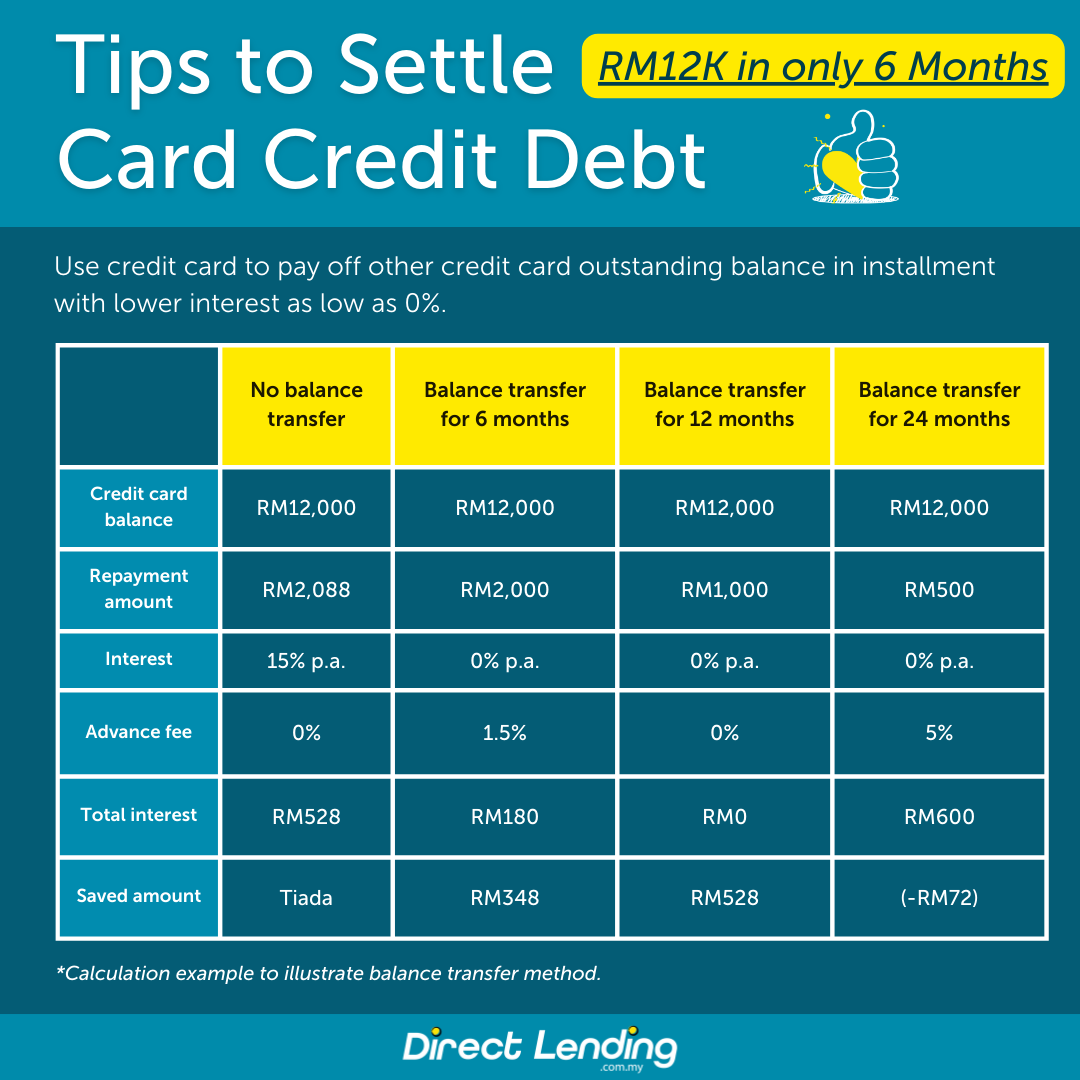

- How to Use Balance Transfer Credit Card to Settle a RM12K Loan in as Fast as 6 Months

- Credit Card Loan Repayment Methods

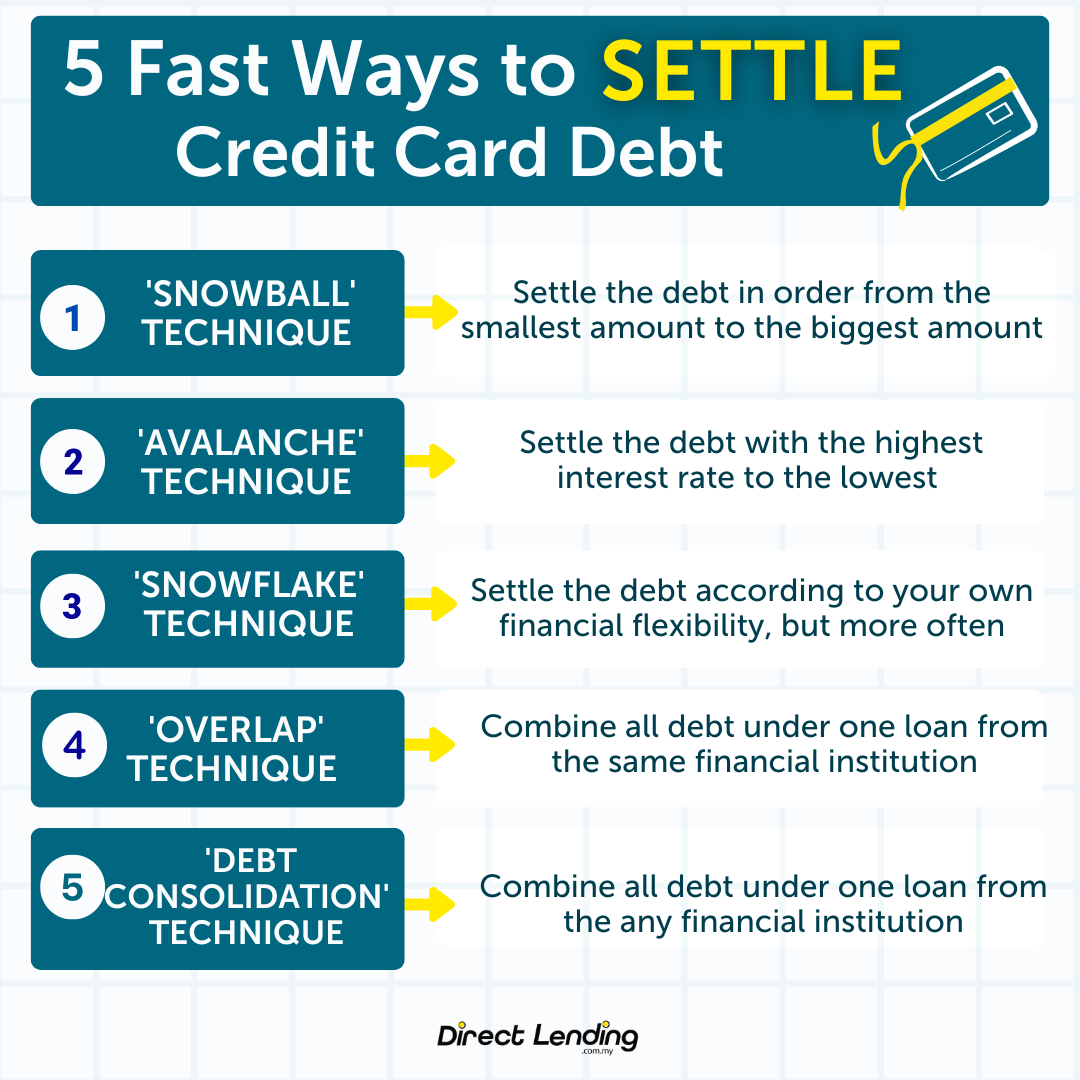

- Infographic: 5 Fastest Ways to Settle Credit Card Debt

- Tips To Settle An Outstanding Balance Of Credit Card Loan

- Du'a to Settle Debt Quickly

What Happens If You Pay a Credit Card Loan Late?

Some of us may have made mistakes with our credit card spending that have driven us to carrying large debts as a result. These are the 5 things that will happen if you are constantly behind on your credit card loan payments.

1. High Interest Rate

You can be charged up to 18% interest if you pay your debt past their due date.

In order to save your money from paying high interests, be sure to make payments early or on time.

2. Late Fee Charges

You can also be charged with a late payment penalty, although this differs from bank to bank.

Usually these penalties are charged on the outstanding balance and will continue to be charged until the balance is cleared out.

3. Negatively Impacts the Credit Score

A healthy credit score is essential in ensuring the approval of your loan applications. For your information, all credit card users’ repayment histories are recorded and systematically stored so that they can be accessed by financial institutions.

Your credit score report can be obtained through CCRIS and CTOS. Any outstanding payments are all recorded within this report and can affect the approval rate of your loan applications.

4. Getting Chased by Debt Collectors

Banks have the rights to send debt collectors to hunt you down, whether at your home or workplace.

They can legally seize your belongings without prior warning and if this happens, it can cause deep trouble and shame towards you and your family.

5. Risk of Going Bankrupt

Did you know that a failure to pay off credit card debts can push one to being declared bankrupt? Subsequently, a bankrupt will be forbidden from leaving Malaysia, while their assets will be repossessed and held by the Director General of Insolvency until all the outstanding debts are fully repaid.

Especially if they are working in professional sectors like legal and medical, this can afflict their careers and their bank accounts will be blocked.

How to Use Balance Transfer Credit Card to Settle a RM12K Loan in as Fast as 6 Months

This method is called a balance transfer credit card where you use a credit card to pay off outstanding balances from other credit cards in installments, with a lower interest rate. This way, you consolidate debt from multiple credit cards onto one card and pay it off in installments at a low-interest rate. You can choose the amount of outstanding balance to transfer. However, usually, the bank will set a minimum and maximum amount of up to 80% of the credit card credit limit you are transferring.

Let's take Adam's situation as an example. Adam has a credit card debt of RM12K with an annual interest rate of 15%. He plans to settle it within 6 months, and he can afford to pay RM2,088 each month. If Adam doesn't do a balance transfer, the total amount he actually pays is RM12,528, which is more expensive because of the 15% interest. And that's if he can afford to pay RM2K every month. If there is a month where he may have to use money for something else, Adam will be charged a penalty and still have to pay interest, which is even more expensive.

In this table, there are 3 realistic balance transfer scenarios available in the market today: 0% for 6 months with a 1.5% upfront fee, 0% for 12 months with no upfront fee, and 0% for 24 months with a 5% upfront fee.

By using a balance transfer plan to pay back the RM12k debt over 6 months with 0% annual interest, a 1.5% upfront fee, and a monthly repayment of RM2K, the total interest paid on the credit card is only RM180. Adam can save RM348 compared to when Adam did not do the balance transfer earlier.

Secondly, if Adam does a balance transfer for 12 months, with 0% annual interest, no upfront fee, and a monthly repayment of RM1,000, Adam can save RM528, and this plan is the most ideal because technically, Adam does not need to pay any interest at all!

If Adam cannot afford to pay RM1,000 every month, there is a way to reduce the monthly installment. But this method is suitable if you don't mind extending the repayment period and paying the upfront fee. This third plan does not save as much as the other plans, but it can reduce the monthly installments. So, in this third plan, Adam needs to repay the RM12K debt over 24 months, with 0% annual interest, a 5% upfront fee, and a monthly repayment of only RM500.

In summary, if you cannot afford to pay off a large purchase or credit card balance in full before or on the due date of the statement, the best way is to make a balance transfer. This method not only saves on interest but also improves your credit score.

Check Eligibility for Personal Financing

Credit Card Loan Repayment Methods

If this was 20 or 30 years ago, credit cards would be deemed a luxury as they were not easy to acquire.

That is no longer the case, as bank agents now promote their credit cards only through pop-up stores in shopping malls, offering the public with various rebates and rewards.

Since their usage is now so extensive, there are also many instances of consumers being ‘trapped’ by their credit cards, that is by being very heavily indebted. These are some of the approaches that can be taken in repaying such debts.

1. The Snowball Technique

This is a technique where payment is focused towards one debt account, while the rest of debts held are paid for on a minimum basis.

After completely paying off the lowest-valued debt, you then gradually move towards the second lowest-valued commitment.

2. The Avalanche Technique

This method is pretty similar to Snowball, except the order of the debt to be approached first is reversed.

This means that the commitment that bears the highest interest rate is paid off first, and subsequently the next highest interest. This allows borrowers to save from paying high interest rates over time.

3. The Snowflake Technique

This is a more flexible method that does not require committing large sums every month in repaying debts.

You can repay your debts at any time following your own ability. This method only emphasises on using ‘spare cash’ found through small savings, such as cashbacks from shopping, rebates, and even a random RM20 note you found in your pocket to pay off debts. It can be used as a complimentary method to the Snowball or Avalanche techniques.

4. Debt Overlap

This method brings together all previously separate debts into a single new personal loan account. This allows the borrowers to ‘renew’ their loans with a lower interest or a longer loan term.

The key to this is that those separate commitments and the new personal loan account all need to made through the same financial institution, through its own overlapping facilities.

5. Debt Consolidation

This method also conjoins all previously separate debts into a single new personal loan account, where the interest rate on the loan should be lower than the average of all the interest rates of the separate debts.

To put it simply, money from the personal loan is used to pay off the existing debts. The way this method differs from debt overlap is that it can be done in any financial institution that offers this product.

For example, Azli has two outstanding loans that require debt consolidation. Azli has an unsecured personal loan with an annual interest rate of 8%. Additionally, he also has a credit card with an interest rate of 18% per year. Therefore, the average interest rate for both loans is 13%.

So, Azli needs to find a new loan with an interest rate lower than the average of 13% so that he can reduce the interest rate payable to the bank. Here's an example calculation:

| Personal Loan | Credit Card | New Personal Loan |

| Amount | RM10,000 | RM10,000 |

| Interest Rate | 8% p.a. | 18% p.a. |

| Term | 3 years | years |

| Monthly Installment | RM313 | RM499 |

| Total Interest | RM1,281 | RM1,981 |

| Total Savings = RM231 |

Note: This calculation is an estimated example and is not guaranteed based on credit offers.

Based on the example calculation above, Azli can save RM231 per month, and if calculated annually, he can save up to RM2,772 by consolidating his debt. If you are a government employee, you can apply for the First Co-op Bank Loan, which offers a promotional interest rate as low as 2.95%* for a period of 1-3 years. *The information provided is accurate as of the time of writing.

Infographic: 5 Fastest Ways to Settle Credit Card Debt

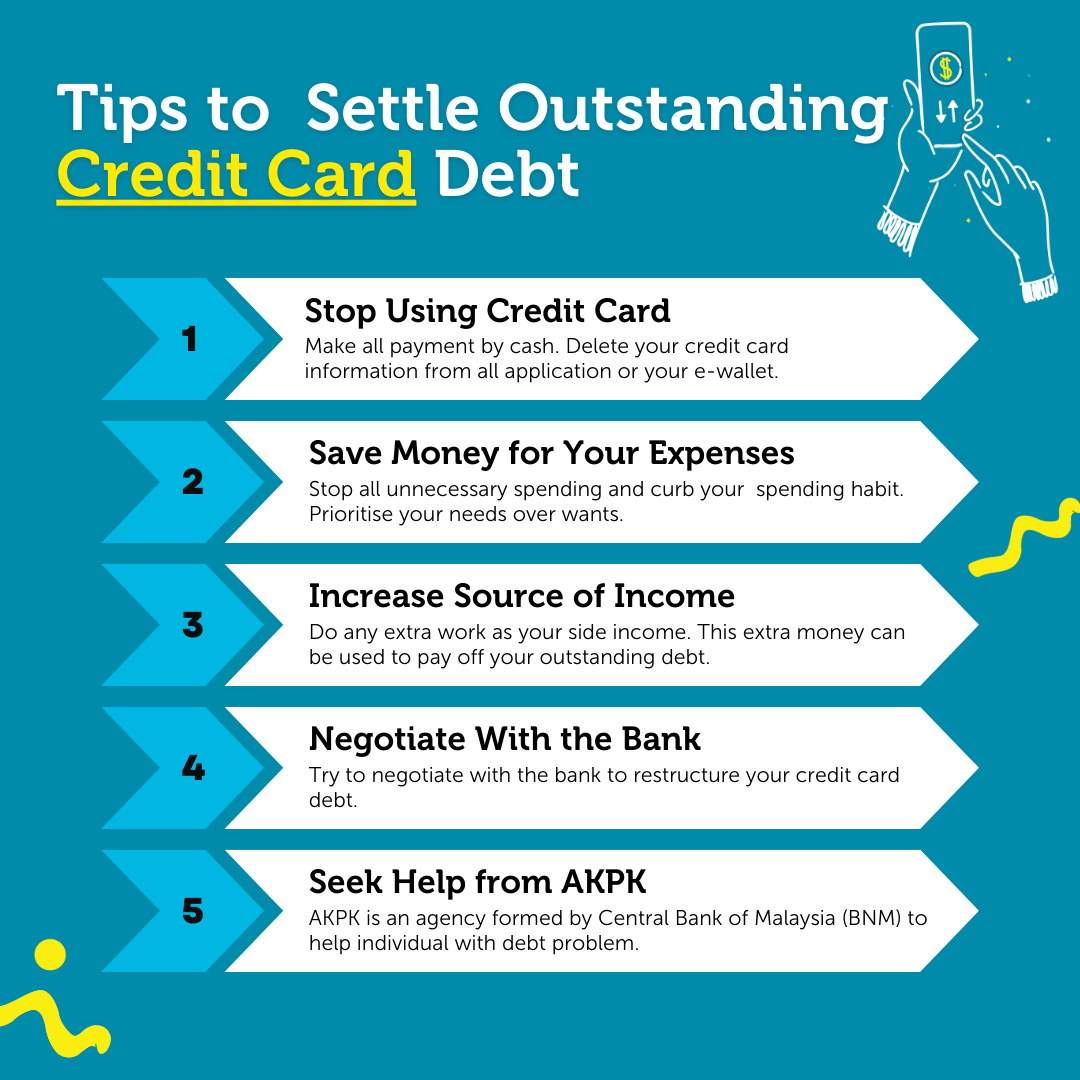

Tips To Settle An Outstanding Balance Of Credit Card Loan

Going back to the issue of outstanding credit card debt, the root of the problem lies not on this ‘plastic’ means of financing, but on its users’ management. If you are already faced with a sizeable credit card debt and are looking for ways to solve this problem, these are the things you should do.

1. Stop Using Credit Cards Altogether

If you have already experienced trouble from a credit card usage, you might be better off not using one at all.

You can stick to conducting transactions on cash, debit card or online transfers. Perhaps it is more helpful to control your spending if you can see the amount deducted directly from your bank account. This way can also help you focus on repaying the outstanding credit card debt without adding more to the amount.

2. Cut Down on Expenses

It is never unwise to spend frugally and reasonably. By having a healthy spending habit, you can aim to always have remainders from your salary that can be used to repay the outstanding debts.

3. Get An Additional Source of Income

You might start a side hustle for the sake of repaying commitments, but who knows if it might turn into a steady income source once the debts have been paid off. There are many ways to generate side incomes these days, whether online or physical jobs.

4. Consult Your Bank

You can arrange a visit to your bank to consult matters regarding your loans, including interest rates and loan tenures. Be sure to prepare all the documentations needed.

It is best to be honest about your situation to the bank officer that you deal with. They should be ready with solutions that can help you.

5. Seek Assistance From AKPK

Agensi Kaunseling dan Pengurusan Kredit (AKPK) has been established by Bank Negara Malaysia (BNM) as a certified body that provides financial management assistance for free to all Malaysians, and this includes those with credit card repayment issues.

Lastly, all credit card users should always be smart with their usage. Weigh out whether a purchase to made is a necessity or a desire, and make careful calculations and comparisons prior to spending to avoid waste. If a credit card purchase has to be made, calculate first the monthly instalments after taking into account interests and other charges, then decide if it is within your ability to repay.

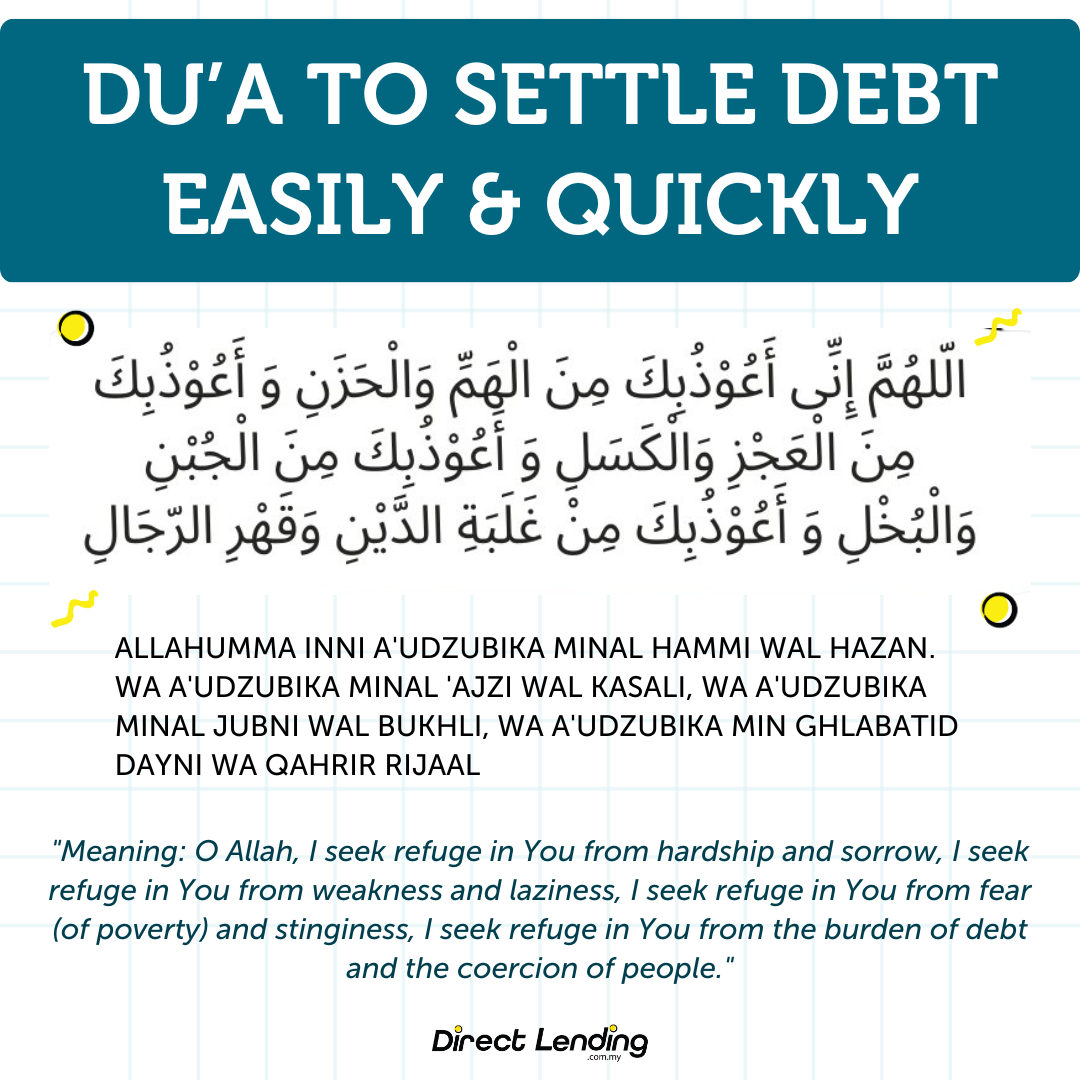

Du'a to Settle Debt Quickly

When you have made every effort, trying all methods to settle your debts, persevere and do not despair. However, in addition to your efforts, you can also incorporate prayers to settle debts. This practice can be performed by Muslims burdened with debt, no matter how overwhelming it may seem. This prayer can be recited to expedite the clearance of debts and to seek blessings for increased sustenance, enabling freedom from debt.

This article was prepared by Direct Lending. A digital platform that helps you to find, make comparisons and apply for the cheapest and most suitable personal loan for you. Our smart eligibility checking system is able to suggest the best personal loan from Bank and Cooperatives for you.

Our service is 100% free, with no upfront fees nor processing charges.

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.