By Sera

Marketing

16 Ways To Buy House in Malaysia With Little-to-No Money Down

Owning a home is definitely one of the things that people would name as a ‘life goal’, and it even serves as a status symbol apart from being a source of comfort. Especially now that land and property prices are shooting upwards, more and more people are rushing to buy house in Malaysia before they become completely unaffordable. This notion is also why some people opt to acquire property as a form of investment. In spite of that, more people are left to only dream of owning homes, as the costs and capital that are involved with buying a house are unattainable by many. Some might also settle for renovating their existing homes instead of buying. Do not lose hope just yet, as there are still a number of ways for you to own a home without needing a large capital. We have outlined 16 of these tips for you in this article.

Table of contents

- Buying a House in Malaysia Without Downpayment

- 1. Calculate your Debt Service Ratio (DSR)

- 2. Calculate the house price affordable by your income

- 3. Find out all the costs involved when buying a first home

- 4. Buy ‘Sell-Then-Buy’ property, get up to 10% discount

- 5. Buy from property developer’s panel banks

- 6. Mark up the house price

- 7. Alternative modes of home financing

- 8. Home Refinance Loan

- 9. EPF Withdrawal

- 10. Rumah Pertamaku Scheme (SRP)

- 11. BSN MyHome 2021

- 12. Perumahan Belia BSN Scheme

- 13. Skim Perumahan Rakyat Malaysia (PR1MA)

- 14. Lembaga Pembiayaan Perumahan Sektor Awam (LPPSA)

- 15. Rumah Selangorku 2022

- Additional tip: Save up for your home deposit

- Video: Tips to Buy PR1MA House 2024!

- Summary

Buying a House in Malaysia Without Downpayment

We know how illogical that sounds, so here is a more honest explanation for that.

No downpayment or capital does not mean absolutely free of charge, but with much research and careful negotiations, you can save up to thousands of ringgit when buying a house.

In some cases, after a house purchase transaction is completed, you might discover that the net amount you have spent on the purchase totals to zero.

This is what we mean by ‘no capital’. Sometimes you can earn back the money you first put in as capital, and sometimes you can even earn more than what you had put in!

1. Calculate your Debt Service Ratio (DSR)

Take this example of individual A who earns RM2,500 monthly. After accounting for EPF, SOCSO, and income tax deductions, A is left with a net income of RM2,200.

Usually, the maximum DSR that banks would allow for those earning below RM3,000 is 60% of their net income.

E.g. CIMB, maximum DSR: 60% x RM2,200 = RM1,320

Say Individual A owns a car loan with RM350 monthly installment. This leaves the total commitment to: RM1,320 – RM350 = RM970

Meanwhile, another RM500 is needed for daily expenses. The Net Disposable Income (NDI) depends on the location of residence and marital status.

E.g. NDI RM500: RM970 – RM500 = RM470

Individual A can then get a rough estimation of the house they can afford through the ‘Rule of 200’.

Calculate the estimated monthly installment from the example before with 200, and the answer is roughly the house price that Individual A can afford.

Example of calculation:

Monthly Instalment x 200 = Rough House Price

RM470 x 200 = RM94,000

With a monthly installment of RM470 and taking into account other commitments, the house price that Individual A can afford is not more than RM94,000.

Disclaimer: This is only a rough estimation for reference purposes. Check with a bank for more accurate calculations.

Another example: Buying a house worth RM400K and above

Net income: RM4,000

House price: RM400,000

Loan tenure: 35 years

Interest rate: 3.2%* (taken from Maybank)

*fixed rate

Existing commitments:

Car loan – RM800

MARA – RM200

New home monthly instalment – RM1,584

Total commitment – RM2,584

The DSR is set at below 60%. Following the information above, the DSR is 2584/4000 = 64.6%

In conclusion, if your income and commitments are around the example information given, you should opt for houses priced RM350,000 and below.

You can still buy a home above your price range and to ease the loan approval process, you can add a ‘co-applicant’ to the loan. The co-applicant must be a family member who is employed, has a stable income, and has a good credit record.

You must bear in mind, however, that being a co-applicant in applying for a mortgage means that all the repayment history for the mortgage will be recorded in their CCRIS records. Make sure that there is a mutual agreement to this.

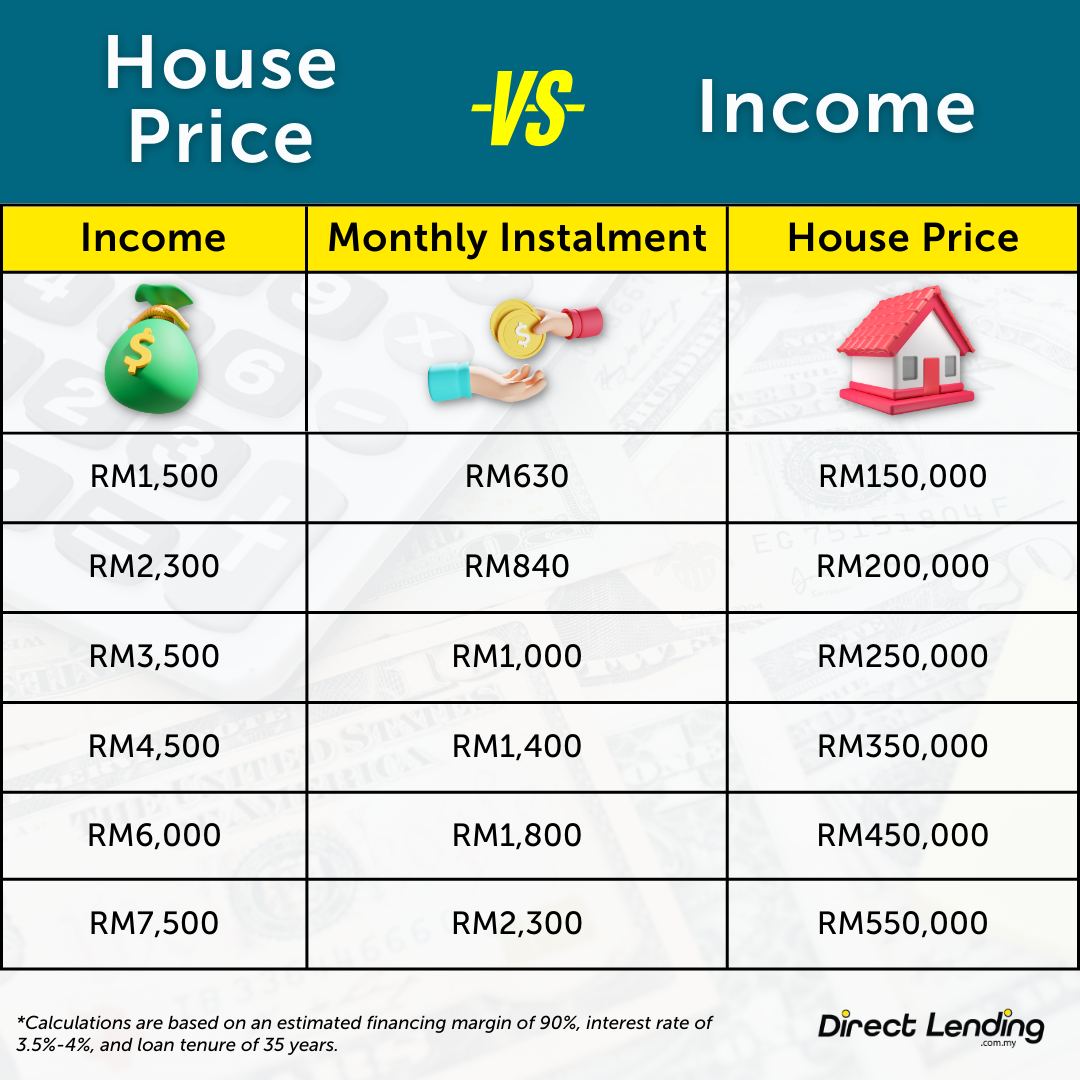

2. Calculate the house price affordable by your income

The calculations are made based on a 90% margin of finance, 3.5%-4% interest rate, and tenure of 35 years. Do not forget to also consider other purchase costs, i.e. 2-3% booking fee, 10% deposit, MoT/stamp duty, and Sale & Purchase Agreement (SPA) legal fee. You can calculate these costs using this housing loan calculator.

3. Find out all the costs involved when buying a first home

During the tabling of Budget 2021, the government had announced a stamp duty exemption to first home buyers.

The full exemption is granted to both the Memorandum of Transfer (MoT) and loan agreement for first time home purchases valuing not more than RM500,000.

This exemption is valid for Sale & Purchase Agreements (SPA) that are signed within January 2021 to 31st December 2025.

You can save up to RM11,250 with this incentive. Here is a detailed calculation:

Stamp Duty on MoT + Stamp Duty on Loan Agreement = Total Stamp Duty Due

[(First RM100,000 x 1%) + (next RM400,000 x 2%)] + 0.5% from loan total, assuming loan granted is 90% of house price (RM450,000)

= (RM1,000 + RM8,000) + (RM0.5% x RM450,000)

= RM9,000 + RM2,250

= RM11,250

4. Buy ‘Sell-Then-Buy’ property, get up to 10% discount

Sell-Then-Buy property refers to a model where the property is sold to buyers while it is under construction.

Certain property developers offer discounts of up to 10% of the house price to attract buyers.

Some, on the other hand, may offer free legal fees and stamp duties.

These allow buyers to not have to provide a large capital in owning a property, sometimes it only costs 1% of the house price as a ‘booking fee’.

All affairs regarding S&P and other documentation are fully managed by the developers and their panel lawyers.

A drawback of this model is that buyers may not receive full disclosure of their rights upon buying the property.

5. Buy from property developer’s panel banks

Some property developers might also offer mortgage loans from their panel banks to buyers.

This can allow buyers to obtain a mortgage loan margin of 100% compared to the usual 90% with non-panel banks.

This way, buyers do not have to provide a 10% deposit, but they will have to be subjected to the interest rates that are set by the panel banks.

6. Mark up the house price

Buyers can also negotiate with developers and lawyers to mark up the house price in order to receive a full loan according to the actual price of the house.

For instance, if a house is priced at RM320,000, a deposit of 10% amounting to RM32,000 needs to be borne by the buyer, while the bank will finance the other 90% i.e. RM288,000.

After negotiations and mutual agreement, the house price may be marked up to RM360,000.

With a loan margin of 90% at this new price, the buyer can now receive full financing according to the actual price of RM320,000.

But, a higher loan margin means a higher installment, plus developers might also charge additional fees for this type of dealing.

7. Alternative modes of home financing

Some property investors might recommend using alternative methods to finance home buying costs, such as using credit cards or personal loans. For example, if you are a civil servant, you are entitled to alternative financing in the form of bank and koperasi loans.

Some cooperatives (koperasi) offer very cheap rates for home financing, especially for first home purchases.

This method is common among property investors so that they do not have to prepare large capitals to invest in their properties. They often choose to fund or cover the loan repayments through the rent they receive on their properties.

8. Home Refinance Loan

This process known as home loan refinancing is described as replacing the existing mortgage loan with a new loan with different terms and conditions.

It is almost like borrowing again from the same (or different) bank in order to clear your existing mortgage loan.

This method is suitable for properties that are priced far below market prices.

Some things that need to be considered before opting for this method are ‘lock-in’ periods for the mortgage loans, cost of refinancing, CCRIS or CTOS records, and make comparisons between the different packages offered by banks. If you are unsure, read this article for more advice or try to avoid it if you are uncertain of its risks.

9. EPF Withdrawal

An EPF contributor is entitled to withdraw from Account 2 to buy house in Malaysia. However, that also depends on their own preference.

10. Rumah Pertamaku Scheme (SRP)

This government scheme was first introduced in 2011 to incentivize younger homebuyers.

This Rumah Pertamaku Scheme (SRP) allows buyers to receive a 100% loan margin on the houses purchased, therefore removing the need to provide the 10% deposit.

Buyers are of course subject to certain terms and conditions and the 100% loan margin makes the monthly installments higher and the loan tenure longer.

11. BSN MyHome 2021

This is a special financing scheme catered towards those who are self-employed without fixed incomes. The amount of financing offered is up to RM300,000 which is within the range of affordable house prices.

The loan margin offered can also be up to 100%, including MRTA? MRTT and LTHOT with a maximum tenure of 35 years.

12. Perumahan Belia BSN Scheme

This scheme is made to help those that are short on funding for home buying, whether they are completed homes, subsale properties, or properties still under construction.

For the time being, the government has run this scheme from the 1st of January 2020 to 31st December 2021.

This will allow more time for eligible buyers to apply for their first home purchases.

The Ministry of Housing and Local Government (KPKT) has announced that this scheme, run by Bank Simpanan Nasional offers a 10% loan guarantee via Cagamas.

Meanwhile, for purchases of RM300,000 and below, buyers are eligible for 100% stamp duty exemptions for the MoT and sales agreement documents.

13. Skim Perumahan Rakyat Malaysia (PR1MA)

Homes built within this scheme are designed as part of integrated communities where buyers can choose for themselves the property sizes they prefer.

This is specifically to cater to urban households, All PR1MA houses are priced from RM100,000 to RM400,000 only.

This makes them affordable to middle-income urban residents, plus registration is FREE.

14. Lembaga Pembiayaan Perumahan Sektor Awam (LPPSA)

This is a board formed specifically for providing government home financing towards civil servants.

Some of its benefits include:

- Loan margin up to 100% with a lower interest rate at 4.0%

- Buyers are eligible for second loans, provided that the first loan has been paid off completely, and monthly instalments should not be more than 50% of the current salary

- The loan tenure for the first loan has to be up to 30 years, while the second one is 25 years. This is also dependent on the borrowers’ age

- Offers housing packages for buyers up to 90 years of age (as compared to 75 years of age for conventional banks)

- Interest on outstanding balances is made based on a declining balance method, so interests reduce each month

15. Rumah Selangorku 2022

Rumah Selangorku is a special housing scheme by the Selangor local government to its residents.

It is made to provide affordable housing for eligible applicants.

This initiative is spearheaded by Lembaga Perumahan dan Hartanah Selangor LPHS, which is the state’s own housing organisation.

Some of the eligibility requirements include:

- Age 18 years and above

- Malaysian citizen

- Resident of Selangor

- Have not yet owned any property

- Maximum household income of RM10,000

- Only one Rumah Selangorku application per household

- Single applicants with dependents are eligible to apply

There are actually still a number of other government housing schemes for all income groups including the M40 & B40.

Additional tip: Save up for your home deposit

If you are determined to buy a house, you should start by setting aside part of your income each month towards a home deposit fund. Set a realistic duration for saving and stay committed to it.

There are many ways to obtain large savings over a relatively short time period. These are not impossible, but they can require strict self-discipline.

One way to save more is also by cutting down on food expenses. Eating out can often cost you up to RM10 per meal. Alternatively, you can bring packed lunch and coffee from home where it might only cost you about RM5 per day.

These spending cuts may seem small, but over time, you can save up to hundreds and thousands of ringgit from this habit!

However, if you still lack the capital to buy a new home there are also lenders who offer personal loans for home renovations. Renovating your existing house and transforming it into your dream house is still not a bad idea.

Video: Tips to Buy PR1MA House 2024!

Summary

This pandemic has brought a silver lining to property investors, as the fall in property prices alongside the many incentives has allowed them to invest without needing as much capital. Property investment can be considered if you are keen on increasing your asset returns.

Nevertheless, you must always remember to take into account your own finances. Do not jump onto opportunities without proper planning and calculations.

Interested in renovating your home? Or want to pay off a big debt? Direct Lending can help you find, compare & apply for the loan that best suits you. Check your eligibility for free & get a loan as low as 2.95% or as fast as 2 working days.

(This article is originally published in 28th June 2021 and is updated on 23rd April 2024)

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.