By Mandy

Marketing

What is Islamic Personal Loan & the Differences with Conventional Personal Loan

A typical conventional bank earns money from interest by lending out money to consumers. You will enter into a loan agreement and the agreement will state, amongst others, the amount you borrow, interest rate, the installment amount, and the loan tenure.

But that concept does not apply to Islamic banks. In Islamic banking, every banking activity must not involve interest. This is because Islamic teachings refrain their followers from giving or receiving interest. Therefore, Islamic banks only offer Shariah-compliant personal financing to their customers. Islamic personal loan is also offered by other financial institutions, such as cooperative loan (koperasi loan).

To have a better understanding of what halal financing is, let us share with you what is Islamic financing and the differences between Islamic Personal Loan and Conventional Loan.

Table of contents

- What is Islamic Banking?

- Islamic Shariah Financing Principles

- Differences between Islamic Personal Loan & Conventional Loan

- Benefits of Islamic Personal Financing

- Considerations for Islamic Personal Financing

- Which Shariah terms to take note of in Islamic Personal Financing?

- Need a trusted Islamic Personal Financing?

What is Islamic Banking?

Islamic banking is a financial system that complies with Islamic Law (Shariah). The main reason for the establishment of Islamic banks is to provide and fulfill the Muslims’ banking needs based on the teachings of the Al-Quran and Al-Sunnah. Islamic banking principles focus on the concepts of mutual risk and profit sharing, the practice of fairness and transactions are performed based on underlying business activity or assets.

Islamic Shariah Financing Principles

All of the Islamic banks in Malaysia practice Shariah compliance whereby all financing activities must not contribute to the following:

- Riba (Paying or charging interest)

- Haram (Investing in business conducting prohibited activities i.e. alcohol, gambling)

- Gharar (Uncertainty and excessive risk)

- Maysir (Speculation or gambling)

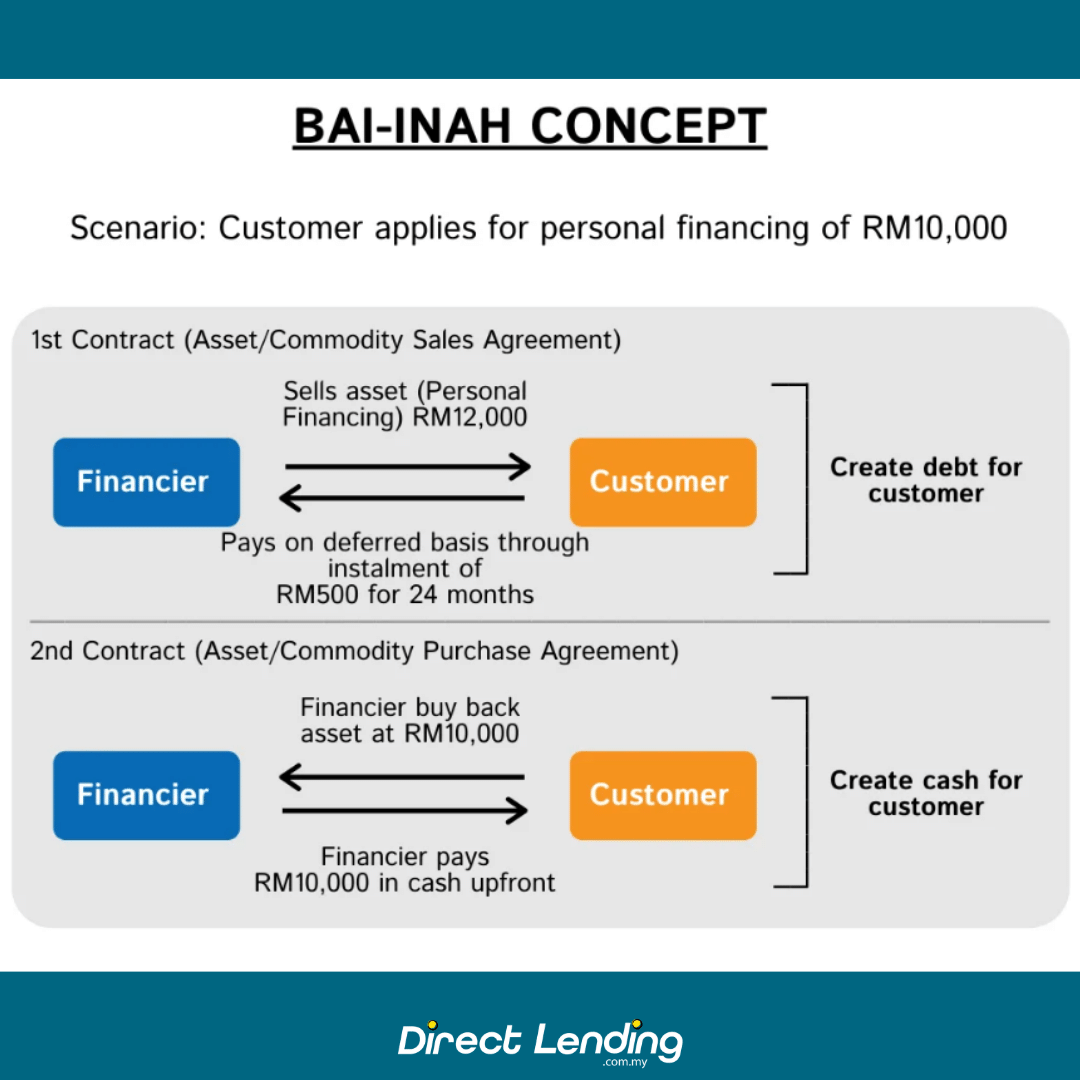

Generally, Islamic personal loan falls into one of the 2 concepts below – Bai’ Al-Inah and Tawarruq. Here we explain these 2 concepts in more detail.

Bai’ Al-‘Inah (Bai-Inah)

To break down the terms of Bai-Inah, Bai = sale, tijarat = trade and ribbh = profits on a sale. In simpler terms, Bank Negara Malaysia (BNM) defines Bai-Inah as “a sale contract followed by repurchase by the seller (the financier) at a lower price”.

Here is an illustration to describe how does the Bai-Inah contract work. Basically, there are two contracts in the Bai-Inah concept. The first contract is known as Asset (or Commodity) Sales Agreement. The second contract is known as Asset (or Commodity) Purchase Agreement. To start, let us assume that a customer applies for a bank and koperasi personal loan of RM10,000 without any loan guarantor.

- In the first contract, Financier sells its asset to Customer at the price of RM12,000 on deferred payment.

- Customer will pay a monthly installment of RM500 for 24 months to the Financier as per the agreed contract.

- In the second contract, Customer then sells the asset back to Financier in order to obtain cash.

- Financier pays RM10,000 to Customer on a cash basis.

To summarise, the financing amount that the Customer would receive is RM10,000. The additional RM2,000 from the RM12,000 deferred payment is the profit earned by the Financier. The contract will be considered ‘fulfilled’ when the customer receives the cash and sells back the asset/commodity to the Financier. This means that in order for the Bai-Inah concept to work, the first contract (Asset/Commodity Sales Agreement) has to happen before the second contract (Asset/Commodity Purchase Agreement).

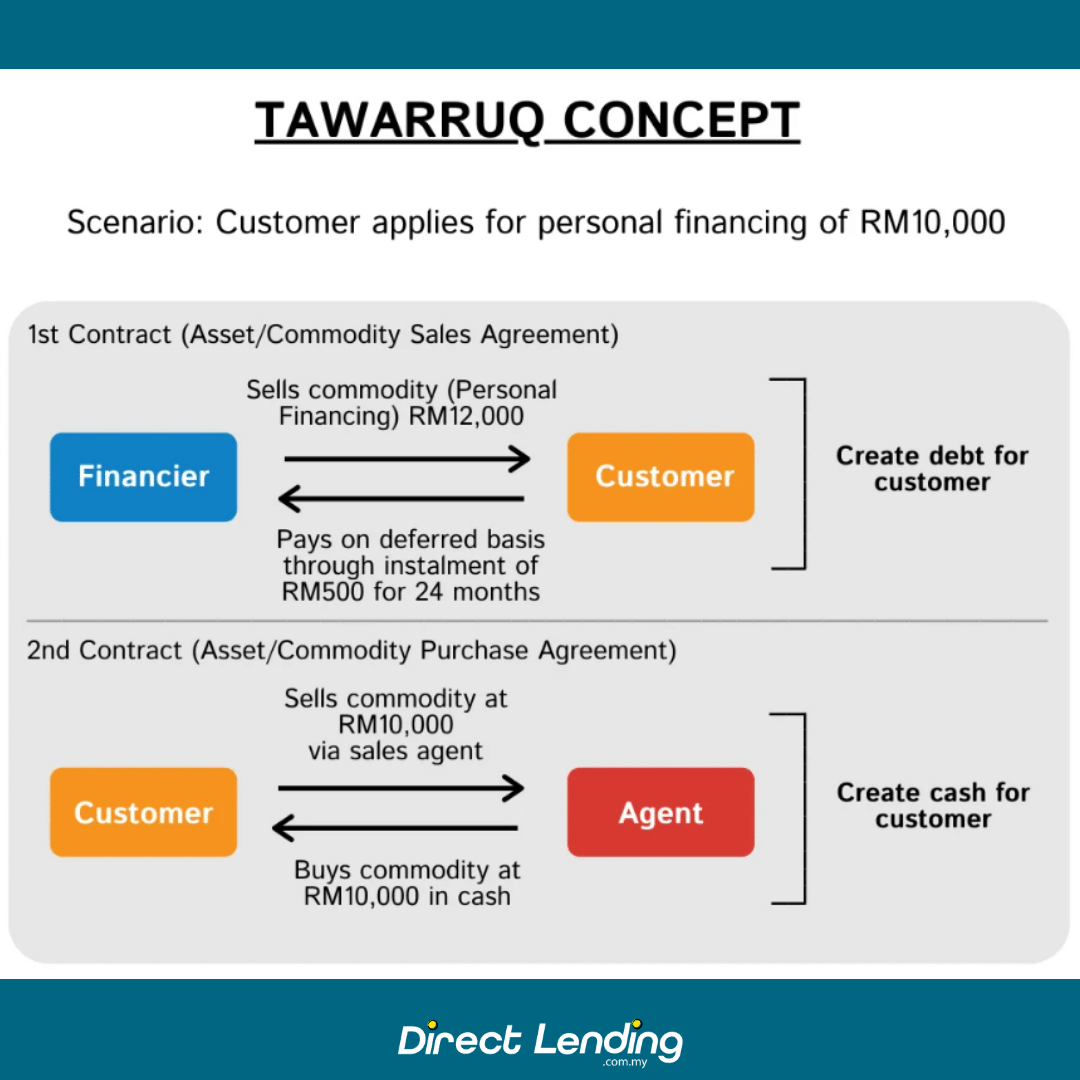

Tawarruq

Generally, the concept of Tawarruq is similar to Bai-Inah; except that Tawarruq involves an existence of a third party in between, usually known as an agent or broker, unlike Bai-Inah. Tawarruq is described as a buyer who buys an asset or commodity on a deferred basis. Then the buyer sells the asset on a cash basis to a third party. Here is an illustration to describe how does the Tawarruq contract work in a simplified manner.

Customer wants to apply for personal financing of RM10,000. Similar to Bai-Inah, there are 2 contracts involved:

- In the first contract, Financier sells the commodity of RM12,000 to Customer.

- Customer will pay the purchase of the commodity on a deferred basis through installment of RM500 for 24 months.

- In the second contract, the Customer then sells the commodity at RM10,000 through a sales agent appointed by Financier.

- Agent buys the commodity RM10,000 in cash and Customer obtains the cash as the financing.

In summary, the total financing amount that the Customer would receive is RM10,000. Similar to the Bai-Inah concept, the additional RM2,000 from the RM12,000 deferred payment is the profit earned by the Financier. The Tawarruq contract is considered complete when the customer purchases a commodity from the Financier and then the customer sells that commodity to a third party (agent) to obtain RM10,000 in cash.

In more detail, the first contract under Tawarruq is called “Murabahah”, where the cost-plus-profit has been made known to the Customer, i.e. the Customer is aware of the profit made by the Financier.

Generally, it is important to know which Islamic concept is being applied by the financial institution to ensure that the Islamic personal loan you are getting is Shariah-compliant.

As you can see now, when you enter into an Islamic personal loan, you will encounter an asset/commodity sales agreement rather than a loan agreement. But do not worry, you will not be physically receiving or selling the commodity involved as you can see from the flow chart, the buying and selling are happening at the same time and the process will be handled by the financiers.

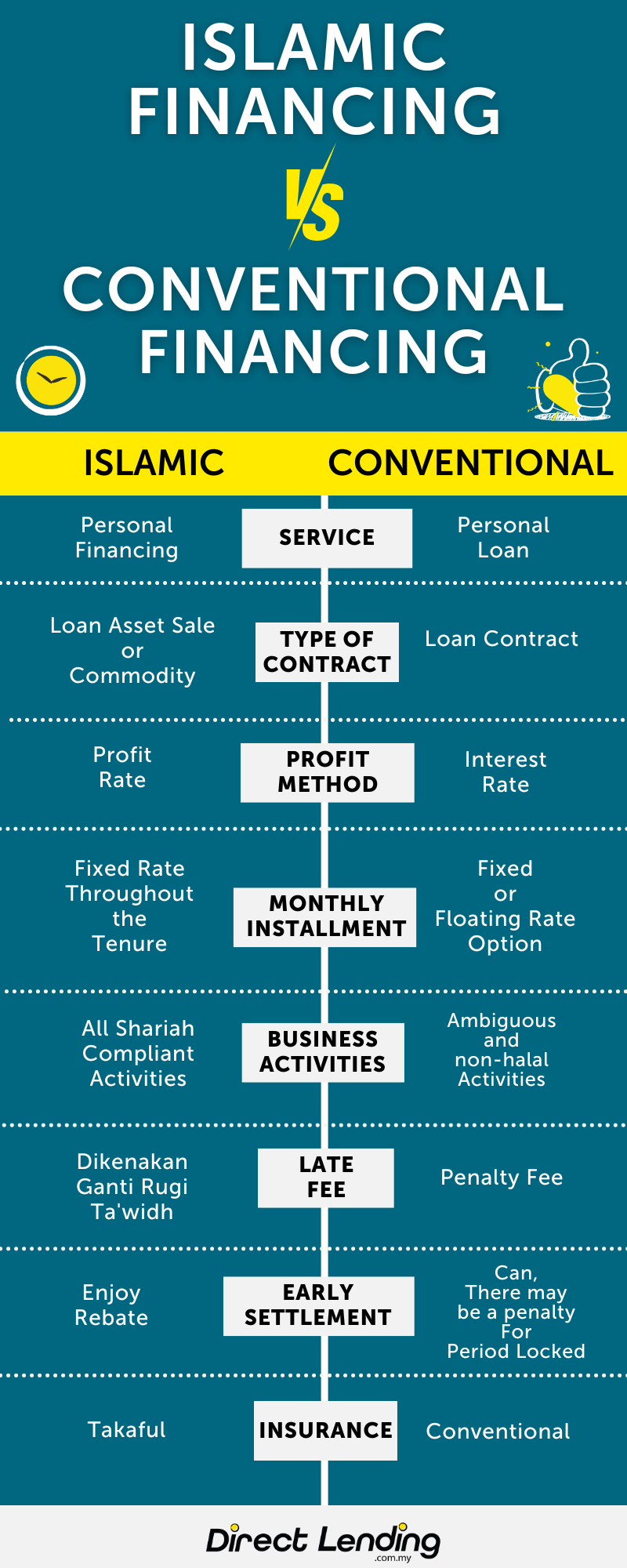

Differences between Islamic Personal Loan & Conventional Loan

This is a simplified table to help you better understand the key differences between Islamic Personal Loan and Conventional Loan. While both products will allow you as a consumer to receive the financing you require, but the documentation and terminology used are differently:

| Islamic Personal Loan | Conventional Loan | |

| Facility | Personal Financing | Personal Loan |

| Contract | Asset or Commodity Sales Agreement either using Tawarruq or – Bai’ Al-‘Inah concept | Loan agreement between borrower and lender |

| Financing/ loan amount | The asset or commodity sales agreement will state both the – asset sales price (this is basically the amount customer has to pay back for the whole agreement) – the asset purchase price (this is the financing amount the customer receive on day 1) |

The loan contract will state the loan amount |

| How does the lender make money? | Profit rate: Profit earned from buying something on behalf of the customer (borrower) | Interest rate: Interest charged on the principal amount and paid by the borrower |

| Business scope | Financing of illegal/non-Shariah compliant activities is prohibited i.e. gambling, drugs, alcohol, etc. | Provide loans to individuals/businesses that do not engage in illegal activities but could be non-Shariah compliant activities |

| Late payment | Compensation (ta’widh) will be charged on the unpaid amount | The penalty of compounding interest will be imposed on the outstanding loan |

| Early settlement | Generally, rebate (ibra) is provided by the financier on the sale price for early settlement | Allowed. May have a penalty for early settlement if the loan has ‘lock-in’ period |

| Insurance | Takaful | Conventional Insurance |

In this infographic, we compare the main differences between Islamic personal financing and conventional personal loan in terms of contract type, profit rate, late payment, and so on. Hopefully, this infographic can help you to better understand the differences between these two types of financing.

Benefits of Islamic Personal Financing

Source: Freepik (@Tone Foto Grafia

1. Promote financing that aligns with Shariah

The main principle practiced in the Islamic model is financial justice. The concept of risk-sharing and the sharing of profit or loss between the bank and lender creates a more balanced distribution of income and wealth; instead of making the borrower liable for all the risks involved.

2. Non-compounding on late payment fees

There is no compounding late payment interest charged. Borrowers only need to pay for the late payment fees that are charged on the outstanding balance. This means that Islamic personal loan has a lower late payment fee.

3. Flexibility for early settlement

Islamic personal loan allows you to perform an early settlement at any time and a ‘ibra’ (rebate) will be given. For conventional personal loans, there might be a ‘lock-in’ period where a penalty will be incurred if you wish to settle your loan early during that period.

4. Open to everyone

Islamic banking is not only restricted to Muslims despite being based on Shariah principles. Non-Muslims are also welcome to apply Islamic Personal Financing to enjoy its benefits.

Considerations for Islamic Personal Financing

Source: Freepik (@Pixfly)

1. More documentations for Shariah-compliant financing compared to conventional loan

To comply with Islamic financing requirements, there will be both asset/commodity sales agreement and asset/commodity purchase agreement. In addition, there might be ‘agents’ involved to assist in the sales and purchases of commodity for personal financing following the Tawarruq concept. But once you understand the concept, then it will be straightforward. Before applying for any kind of loan, learn more about what is a personal loan before you sign any loan agreement.

2. New documentation will be required in the event of a financial restructuring

Compared to a conventional loan, if the financing requires restructuring or changing key terms, it will likely require entering a new contract. This may result in a higher cost.

Which Shariah terms to take note of in Islamic Personal Financing?

Source: Amanie

Before you decide to apply for personal financing, let us share with you some Shariah terms that you may generally come across in the application form or in the contract itself.

| Shariah Term | Description |

| Bai’ Al-Inah | A sale contract involving the sale of assets to the buyer on a deferred payment and the subsequent purchase of the asset sold at a cash price lower than the deferred sale price. |

| Tawarruq | A contract involves a buyer who buys an asset or commodity on a deferred basis. Then the buyer sells the asset on a cash basis to a third party to obtain cash. |

| Wa’d | A promise of one party refers to an expression of commitment given by one party to another to perform certain actions in the future. |

| Akad | An agreement between two parties. The financier offers the customer to enter into a personal financing transaction and the customer agrees to accept the offer. |

| Takaful | Insurance coverage is provided by the financier to cover death and total permanent disability (TPD). |

| Ibra | Known as a rebate. Depending on the financier’s discretion, an ‘Ibra’ would be given to the borrower if the facility has been fully settled before its maturity. |

| Wakalah Fee | Known as agency or service fee to be paid to the agent or ‘wakil’ (representative) to manage the authorised task or matters. |

| Ta’widh | A penalty is charged to the borrower for the delay in payment. |

Watch our video for more explanation on Islamic Personal Financing vs Conventional Loans.

Need a trusted Islamic Personal Financing?

Regardless of whether you need some extra financing for emergencies or even to consolidate your expensive debts, Direct Lending is a personal financing platform that can offer Shariah-compliance banks and government loan from trusted bank and koperasi.

Check your eligibility with our smart financing eligibility checker today and we will recommend the best and most suitable personal financing tailored to fit your financial needs. Our service as always is 100% free.

(This article was first published on the 22nd of March 2021 and updated on the 1st of April 2024).

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.