By Mandy

Marketing

[INFOGRAPHIC] 8 Islamic Personal Loan for Civil Servants (Syariah Compliant)

One of the benefits of working as a civil servant is that you are entitled to a variety of Islamic personal loan that are Syariah-compliant, which serves as a great alternative as compared to those who are self-employed or working in the private sector. Despite having a pretty stable income with guaranteed wage increments, perhaps you may still be posed with the need for extra financial funding.

For instance, you may need extra funds for healthcare, emergencies, home renovations, etc. The nature of public sector jobs, i.e. the steady income and permanent position offered, makes it more attractive for financial institutions like conventional banks and credit community lenders to approve the loan applications for those working in this sector.

Besides conventional banks and credit community lenders, koperasi (cooperatives) loans are another way for civil servants to access safe and convenient financing. Many opt for this as koperasi loans offer lower interest rates than credit community and conventional banks.

In this article, we will explore deeper into Islamic personal financing and list out several Syariah-compliant personal loans for civil servants.

Some of the characteristics of Syariah-compliant personal financing are:

- Banks or financial institutions will ‘finance’ a product on behalf of their clients. The financier ‘buys’ a product and then re-sells it to the client with an agreed upon profit margin. Since interest is prohibited in Islamic finance, banks generate profits through the profit margin that is fully disclosed in the contract.

- Transactions are made based on Syariah principles, i.e. free from non-ethical practices including riba (unjust interest that puts burden on clients), gharar (uncertainty/deception), maysir (gambling), and zulm (oppression/injustice).

- No compound interest on late payments charged. The borrower only has to pay a late fee charged upon the outstanding balance. This makes the late fees on Islamic personal financing lower than conventional financing.

- The repayment amount is clearly presented and fixed throughout the financing tenure.

- The financier offers rebate (ibra) on the sales price in the case of early settlement.

- This financing is not exclusive only to Muslims despite being based on Syariah principles. Non-Islamic practitioners are also welcome to apply for Syariah-compliant personal financing and benefit from their advantages.

- Borrowers are protected by Takaful insurance. This insurance plan is Syariah-compliant and is based on the concept of cooperation and risk-sharing.

Islamic Personal Loan Syariah Compliant Schemes for Civil Servants

SYARIAH-COMPLIANT PERSONAL FINANCING

Kuwait Finance House

- Financing up to RM250K

- Fixed rate as low as 4.50%, up to 100% payout

- Permanent position, minimum service of 3 months

- Applicants with high outside commitment and CCRIS record are eligible to apply

Ambank

- Financing up to RM250K

- Fixed rate as low as 3.99%, up to 98% payout

- Permanent position, minimum service of 3 months

- Applicants with outstanding in PTPTN loan are eligible to apply

Public Bank

- Financing up to RM350K

- Fixed rate as low as 3.99%, payout up to 98%

- Permanent position, minimum service of 6 months*

- Applicants with outstanding in PTPTN loan are eligible to apply

Co-opbank Pertama

- Financing up to RM200K

- Fixed rate as low as 2.95%, payout up to 95%

- Permanent position, minimum service of 3 months

- Considers outside-payslip commitments

RCE – Yayasan Ihsan Rakyat & Yayasan Dewan Perniagaan Melayu Perlis

- Financing up to RM300K

- Rates starting from 6.65%

- No fees, no upfront payments

- Permanent position, minimum service of 6 months

- Applicants with high outside commitments are eligible to apply

- Early settlement rebate

Koperasi KOBETA Loan

- Financing up to RM250K

- Fixed rate of 5.99%, payout up to 91.5%

- Permanent position, minimum service of 6 months

- Applicants with high outside-payslip commitments are eligible to apply

Koperasi Ukhwah Loan

- Financing up to RM200K

- Fixed rate as low as 4.99%, payout up to 89%

- Permanent position, minimum service of 8 months

- Applicants with high outside-payslip commitments are eligible to apply

Koperasi KOPUTRI Loan

- Financing up to RM100K

- Fixed rate of 5.90%

- Payout up to 95%

- Permanent position, minimum service of 8 months

- Applicants with high outside commitments are eligible to apply

In summary, all of these Syariah-compliant financing is open to civil servants employed on a permanent basis with an income RM1,500 and above.

- Kuwait Finance House

This loan offers a high amount of financing with fixed rate and high payout. It is suitable to be used to overlap outstanding debt as applicants with high outside commitment and CCRIS record can apply - Ambank – MCCM Personal Loan

This loan offers the lowest interest rate and high payout to civil servants through salary deduction. It is offered to civil servants at the federal & state levels, statutory bodies and GLCs with ANGKASA deduction. - Co-opbank Pertama (Bank Persatuan) Personal Loan

You can apply for this financing for any purpose at all. Many have applied with Co-opbank Pertama for the purpose of debt consolidation where all expensive debts can be combined into a new personal loan. This low-rate personal loan can help to lessen your monthly commitments. - Koperasi KOBETA Loan

This loan can help to clear your negative CCRIS records by overlapping or settling outstanding loans. This KOBETA loan offers a low rate and high payout. - Koperasi Ukhwah Loan

This loan does not take into account commitments outside your payslip, such as car loans, credit cards, mortgages, etc. Therefore, you can still apply even if your outside-payslip commitments are high. - Koperasi KOPUTRI Loan

You can apply for this loan by KOPUTRI to help you solve outstanding loans or clear negative credit records using the overlap facility. It can also be used to fund a new vehicle purchase, home renovations, starting or expanding businesses, healthcare bills, etc. - Public Islamic Bank – MCCM Personal Loan

This loan considers commitments outside your payslip, including car loans, credit cards, mortgages, etc. Therefore, you will need to settle those first before applying for this loan. - RCE Yayasan Ihsan Rakyat & Yayasan Dewan Perniagaan Melayu Perlis Loan

Koperasi loan from RCE accepts loan applicants with negative CCRIS/CTOS records, provided that the loan amount is RM30,000 and below only. Besides that, Yayasan Dewan Melayu Perlis also accepts borrowers listed under SAA (Special Attention Account).

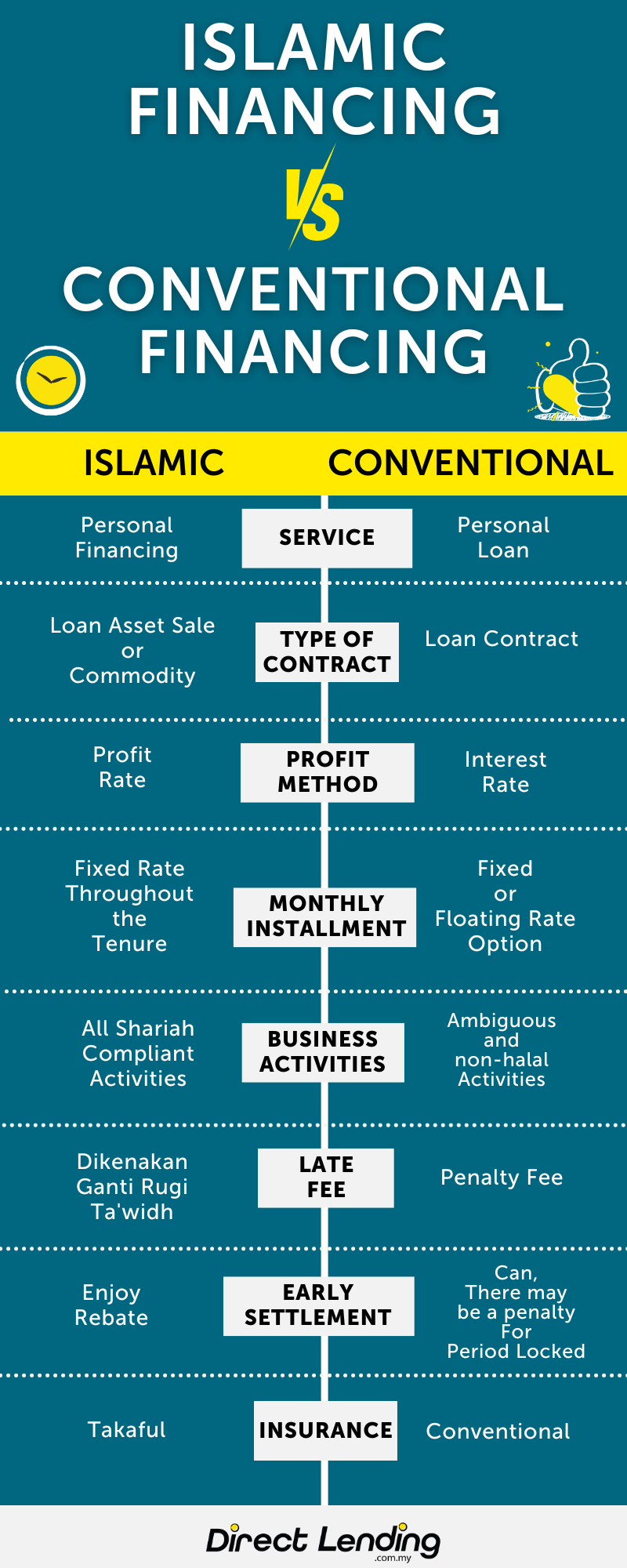

Difference Between Islamic Financing And Conventional Financing

This infographic is prepared by Direct Lending. A digital platform that helps you to find, compare and apply for the cheapest and most suitable personal loan for you. Our smart eligibility checking system is able to suggest the best bank and koperasi personal loan for you.

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.