By Yik Seong

Director

Should You Apply For Debt Consolidation Personal Loan?

The biggest cargo people carry these days is debt. Borrowing, including the use of credit cards, is habit-forming. Once you get caught in the habit, you run the risk of spending more than you can really afford. Try to imagine, what if 50% of your monthly income goes to paying your debt repayments? Would you be able to save up for your emergency fund or retirement fund? Don’t just rely on your KWSP funds or pension funds as your backup. When your loan balance begins to rise, it becomes a heavy burden. Your possible remedy like many others with the same problem is debt consolidation.

Table of contents

- What Is Debt Consolidation?

- When To Consider Debt Consolidation?

- Factors To Consider Debt Consolidation

- Benefits Of Debt Consolidation

- Downsides Of Debt Consolidation

- Infographic: Debt Consolidation With Personal Financing

- How To Apply For Debt Consolidation?

- Video: Is Debt Consolidation Beneficial? (How to Use Debt Consolidation Calculator)

- Summary

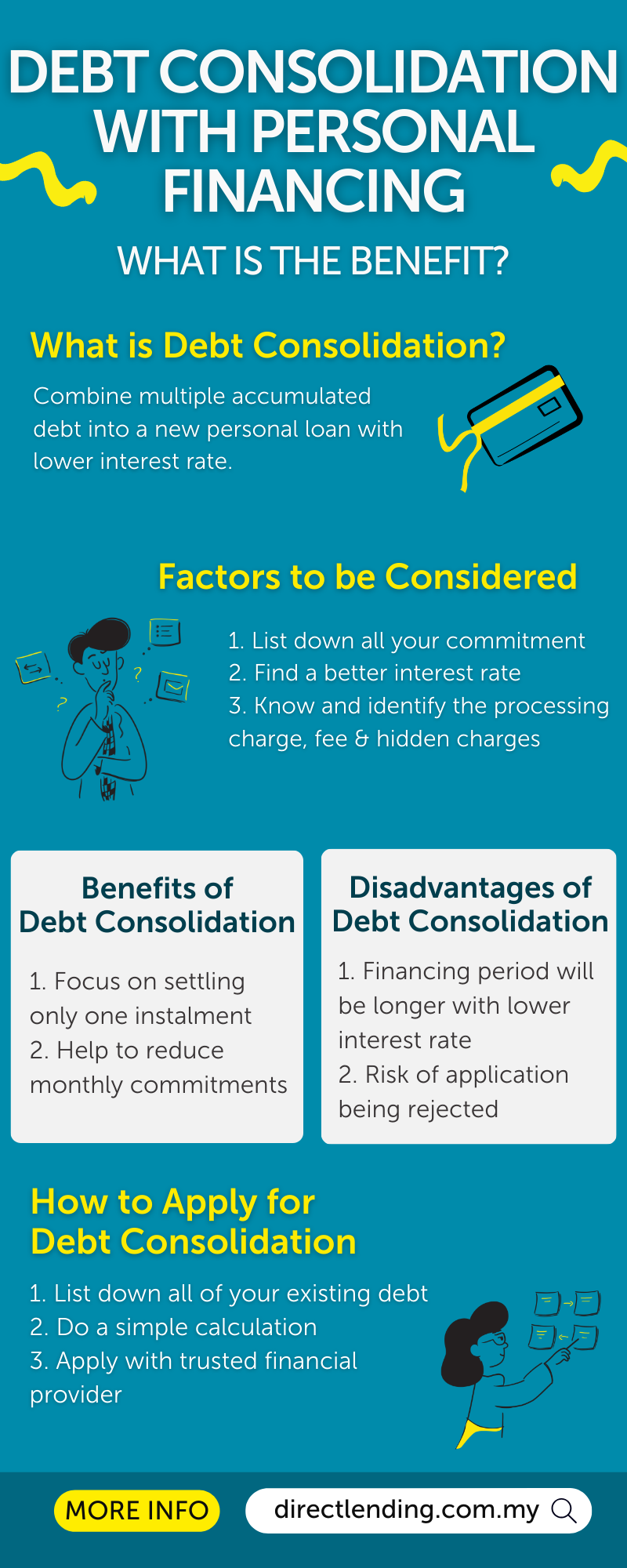

What Is Debt Consolidation?

Debt consolidation is not debt elimination or debt settlement. It is a type of loan you obtain if you want to merge multiple loans into a single loan. For people deep in debt, it serves as debt relief. The lender will combine all your outstanding loans and book them in a single account (new personal loan). Debt consolidation is similar to debt restructuring although the two options are different. When you are consolidating debts, you sign new loan documents for a new account. The total sum of all your outstanding loans becomes the principal amount of the fresh loan which is charged with the same interest rate. In simpler terms, it means that you are using the money from your new personal loan to pay off your existing debt. To ensure the resulting monthly loan repayment is within the limits of your affordability, the interest rate of the consolidated loan should at least be lower than the average rate of your existing loans.

When To Consider Debt Consolidation?

- You begin to miss your monthly loan repayments and you are unable to deal with your current debt burden. Missing monthly installment will also cause your loan balance to increase due to late payment charges

- You find it troublesome to manage multiple loans from different banks and would like to focus on one payment

- You want to save more by reducing the amount of your monthly installments

- You have the habit of making minimum payments for your credit cards. In the long run, you will end up paying more interest for your credit card bills

Debt consolidation is also a way of protecting and maintaining your good credit standing. You are given the chance of redeeming your creditworthiness if you can make timely payments on the loan. If you face any of the signs above but you are unsure if you really need debt consolidation, read the following section to help you with that.

Factors To Consider Debt Consolidation

Before deciding on consolidating your debts, know the important factors for consideration. Carefully evaluate if the personal loan will put you on solid footing. You do not want the situation to be worse than before.

1. Conduct due diligence on yourself (list down your debt)

Panic will grip you in this situation but you need to remain focused. Have you reassessed your actual financial condition and exhausted all possible means? Take time to evaluate your ‘actual’ cash flows before coming to a conclusion you need to consolidate your debts.

Sometimes all you need to do is improve your budget planning. Revisit or prepare a new budget, list down in detail all funds coming in and out. Reallocate the budget on some items and earmark excess funds for loan payments. In case there is really no room to gain extra after your comprehensive evaluation then you can pursue a debt consolidation plan.

2. Look for better interest rates

To find out if it is worth it to do debt consolidation, let us compare in this example below. Let’s assume that Adam has two outstanding loans. A short-term unsecured loan personal that is 8% p.a. and a credit card debt of 18% p.a. Hence, the average interest rate comes out to 13% p.a.

So, what Adam should be looking for is a personal loan that offers a rate that is lower than the average interest rate of 13%. That way Adam can reduce the interest he is paying for his loan. Let us show a calculation example:

| Criteria | Credit Card | Personal Loan |

Personal Loan |

| Amount | RM10,000 | RM10,000 | RM20,000 |

| Interest Rate | 18% p.a. | 8% p.a. | 2.95% p.a. |

| Loan Tenure | 2 years | 3 years | 3 years |

| Monthly Repayment | RM500 | RM329 | RM581 |

| Total Interest |

RM1,982 | RM1,281 | RM922.61 |

| Total saved = RM248 |

From the table depicted above, Adam can save roughly RM248 monthly. By converting that to 12 months, he can save RM2,976 by doing debt consolidation. If you are a civil servant, it is worth it to take up Co-op Bank Pertama Personal Loan which is currently offering a promotional interest rate of 2.95% p.a. Moreover, a fixed-rate personal loan is ideal for budgeting and monitoring purposes. You know exactly the amount you need to set aside to pay the monthly loan repayment on every due date. The lower interest rate is the primary reason why you should opt for debt consolidation.

However, do not expect all lenders to apply uniform rates. Sometimes the rate will also depend on the borrower’s credit score. If getting lower rates is improbable, defer your plan. It defeats the purpose of consolidating debts. You will be creating more debt than solving your problem. In the meantime, improve your payment habits until you can find a suitable personal loan provider.

3. Know the processing costs, fees and hidden charges

Do not be misled by lenders that guarantee the lowest rates and most convenient payment periods. Know the details of the personal loan such as processing fees and related charges. Also, check if there are any hidden charges. If the lender’s offer seems too good to be true like 0% interest rate or 100% guaranteed loan approval, then most likely you are dealing with a scammer. Protect yourself by knowing these common warning signs of a personal loan scam.

Plus, longer payment terms mean higher interest costs. So you should arrive at the ideal loan tenure aligned with your paying capacity. The sooner you can fully pay the loan, the earlier you can achieve peace of mind.

Benefits Of Debt Consolidation

Here are two obvious benefits of why you should consider using debt consolidation.

1. Focus on paying one installment

It can feel like a hassle to keep track and pay all of your loans across multiple banks. Especially when you are caught on to something, sometimes you tend to miss out on your monthly repayments. This is where debt consolidation acts as a solution to help combine all of your loans into one lump sum. That way it would be easier for you to focus on paying one installment and manage your payment deadlines more efficiently.

2. Help to lower your monthly commitment

The second obvious reason why you should use debt consolidation is to pay less. When you consolidate all of your existing high interest rate loans with a low interest rate personal loan, your monthly installment would be reduced. In the long run, you will be paying less and save up on interest.

Downsides Of Debt Consolidation

Debt consolidation is an effective tool to help borrowers climb out of the debt quicksand. However, there are also downsides when you consolidate debts through a personal loan.

1. Longer repayment offsets low-interest rate advantage

For an individual with a lot of debts, only lower interest rates and extended payment periods will make it possible to meet the loan commitment. You will be swimming in debt quite lengthier while paying higher interest costs in the end. In effect, the extended period virtually erases the low rate advantage.

2. Probability of rejection

There is a higher probability of rejection if you have a low credit score when applying for debt consolidation. Due to your current commitment, you might be offered less favourable terms compared to if you are in a healthier credit position. Before you decide, make sure that you calculate to see if it is worth applying for debt consolidation.

3. Will not eliminate debts

Debt consolidation can either work for you or destroy your credit reputation. The new loan does not absolve you of the responsibilities to make prompt and timely payments. The debts remain collectible until it reaches zero balance.

Some borrowers do not learn from their mistakes. Unless you change your behavior and exercise discipline to win back creditors’ trust, you will be years away from financial freedom.

Infographic: Debt Consolidation With Personal Financing

How To Apply For Debt Consolidation?

1. List down all of your existing debts

Write down all of the debts that you have on hand. Choose which debts you want to consolidate. Check on the debt’s interest rate, loan tenure, and current outstanding balance. Refer to your financial provider if you are unsure of how to retrieve that information.

2. Do a simple calculation

Using the example that we highlighted previously on Adam. Let’s assume that Adam has:

| Personal Loan | Credit Card |

| Amount: RM10,000 | Amount: RM10,000 |

| Interest Rate: 8% p.a. | Interest Rate: 18% p.a. |

| Tenure: 3 years | Tenure: 2 years |

If you add (8% + 18%), the average interest rate comes out to 13% p.a. So, debt consolidation is worth it when your personal loan’s interest rate is lower than the total average interest rate of your existing debts. In Adam’s case, the interest rate for the new loan should be lower than 13% in order for Adam to save more.

You also can use the Debt Consolidation Calculator to estimate your savings with a consolidation loan. Our debt consolidation calculator does the math for you. All you do is enter some basic info for a quick breakdown of how much you can save.

3. Apply with a trusted financial provider

If you have decided to use a personal loan to pay off your credit card debt or other loan commitments, but you don’t know which personal loan best fits you; check out Direct Lending – an online personal lending platform. Our smart eligibility checker will provide you with the best recommendations for bank and koperasi and license moneylender personal loan instantly. We can assist you to search, compare and apply for the lowest interest rate personal loan. Receive funds as fast as 2 working days. As always, our service is 100% free, with no upfront payment or processing fees.

Video: Is Debt Consolidation Beneficial? (How to Use Debt Consolidation Calculator)

Summary

Although debt consolidation is a useful tool when used correctly, if you don’t change your spending habits; you won’t get out of debt. Only apply for debt consolidation when you have unmanageable loan commitments. If your debt is a small amount that could be paid off within the period of 6 months to 1 year then might as well save the hassle, as you will only get to save a fraction of the amount by consolidating.

(This article was originally published on the 7th of February 2019 and updated on the 6th of February 2024).

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.