By Sera

Marketing

10 Financial Tips Every Working Adults in Malaysia Should Know

Recent statistics have shown that more than half of Malaysians admit to not having enough savings to survive on for longer than 3 months. This is alarming as it demonstrates an unpreparedness in case emergencies strike. This can also lead to more financial problems, such as indebtedness and bankruptcies that can deteriorate the quality of life of the average Malaysian.

With this in mind, we have written this financial tips to guide you into planning your personal finances and managing monthly commitment better, so that you can be one step closer to financial freedom!

Free Loan Eligibility CheckTable of contents

- 1. Create a Budget

- 2. Track your expenses

- 3. Build up your savings

- 4. Use multiple bank accounts

- 5. Know your needs and wants

- 6. Paying down your debts

- 7. Learn how to refinance or consolidate your debts

- 8. Keep your credit score healthy

- 9. Consider investing

- 10. Remember to claim your income tax reliefs

- Infographic: 10 Financial Tips for Working Adults

- Summary

1. Create a Budget

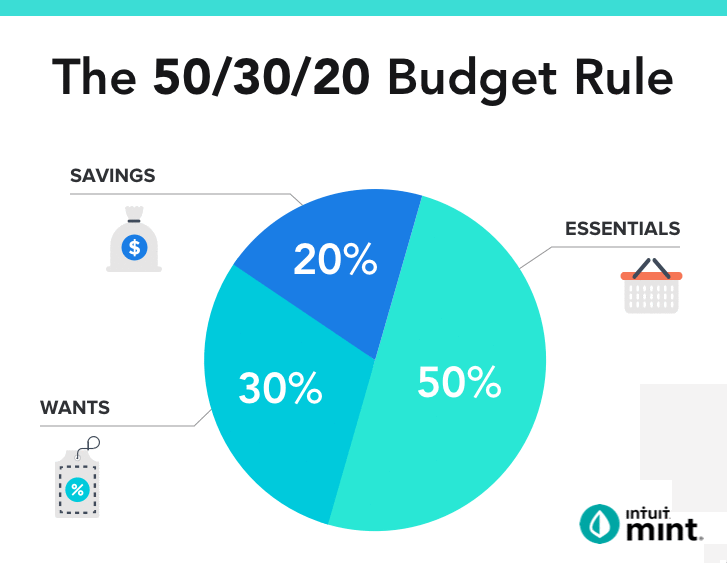

You can plan your monthly budget by allocating different percentages of your income towards different purposes. One rule of thumb that you can follow is the 50/30/20 Rule. Allocate 20% of your monthly income towards savings, 30% towards wants or desires, and 50% towards necessities. The 20% savings can simply be saving some money in your regular bank account, or it can also be in the form of investment. The 30% for desires can be used for eating out, short vacations or moderate ‘self-rewards’. Lastly, the biggest 50% chunk is to cover your monthly debt commitments and necessary daily expenses.

Besides allocating the money for your own use, it is also important to save some money for your family, such as by giving some allowance to your retired parents, or saving for your children’s education. Sharing is caring, and making sure your family’s wellbeing is well taken care of is a noble practice.

2. Track your expenses

It may sound tedious, but tracking each and every one of your expenses is crucial in making sure you do not spend more than you can afford to. You can do this the analogue way, by writing them down in a notebook, or you can use mobile applications that can also offer other features besides logging expenses, such as debt reminders and saving goals.

3. Build up your savings

Saving little by little is better than none, even if it takes some time. In a way, you have already built some protection to cushion yourself in case of any financial emergencies. To be better equipped, many advise to build an emergency fund that is worth 3 to 6 months of your monthly income.

Each month, allocate some of your income for this emergency fund. For instance, using the 50/30/20 rule given above, allocate 20% of income for savings. If you earn RM3,000 per month, save at least RM600. This is of course just a guide! You can also start by saving 10% first and gradually increase over time.

4. Use multiple bank accounts

The reason for having at least two different bank accounts is so that you can clearly distinguish between disposable income and savings. Putting all your money in one place surely is convenient but it may affect your discipline in saving.

You can also choose a savings account that pays higher interest so that you can earn some returns on your savings. For instance, UOB Stash offers a bonus interest of 0.5% p.a if you retain or increase your account balance monthly, and pays 2.3% interest p.a when your savings exceeds RM100,000.

5. Know your needs and wants

Learn to manage your needs and desires. It is human nature to have infinite wants, but it is down to each individual to not go overboard.

For example, limit your spending on trending fashion items that can easily be bought online. They can be tempting, but bear in mind that some fads will quickly go away, leaving you with items you no longer want to keep.

It might get tricky to cut down on necessities, especially when you have several mouths to feed. Try to save on necessities by buying in bulk, and choose cheaper brands that can deliver the same quality.

6. Paying down your debts

There are two simple techniques to manage your debts; the Snowball technique and the Avalanche technique.

The Avalanche Technique

This technique focuses on repaying the debt with the highest interest first, before moving on to the subsequent highest rate. This process is repeated until all debts have been settled. This is helpful if you want to save on accumulating too much interest over time.

The Snowball Technique

Conversely, this technique is focused on incrementally building a discipline in repaying debts. You will start by paying the debt of the smallest amount first, while at the same time making minimum payments to your other commitments. Then, you will move towards the next smallest debt.

To demonstrate how these techniques work, imagine that you currently hold these commitments:

Credit card debt of RM7,000, with 16% p.a interest

Car loan of RM12,000, with 3.5% p.a interest

Student loan of RM6,000, with 1% p.a interest

Through the Avalanche technique, you will be solving your credit card debt first. The total interest you will be paying is RM2,955.61 and will pay off all your debts 31 months earlier than without this technique. With the Snowball technique, you will be paying a total interest of RM4,562.11 over 6 years. What causes this difference is the interest on the credit card. Regardless, choose the technique that works best for you, as long as you are determined in repaying all the debts that you own.

7. Learn how to refinance or consolidate your debts

Debt refinancing and debt consolidation are two strategies you can take to have a more manageable amount of debt which will also ease your repayment process.

Debt consolidation means combining all of your existing debts into a single new personal loan account. This can help reduce your monthly instalments and can lower your interest payments significantly. For instance, if you have a credit card that charges 18% interest p.a,, you can lower this interest by taking up a bank and koperasi personal loan with interest rate as low as 2.95% p.a to consolidate all of your debts into one single monthly instalment. This can also help you focus your payment towards one single creditor only.

Debt refinancing works by replacing your existing debts with a new loan with a lower interest rate. Besides offering a lower interest rate, this technique also helps to reduce your monthly instalments by extending the loan tenure. You can opt for debt refinancing if you have a good credit score and want to get a better interest rate.

Video: Should You Overlap Your Loans? (Ways to Use Debt Consolidation Calculator)

8. Keep your credit score healthy

A credit score is a way to measure your creditworthiness. It is determined based on your credit history, taking into account all your loans, outstanding balance, repayment history and other credit-related information.

In Malaysia, a CTOS report is used to verify your credit score. CTOS is a leading private Credit Reporting Agency (CRA) that is authorised to obtain individual credit information from public sources.

A good credit score proves that you are responsible with your financial commitments, which in turn makes financial institutions trust to lend you their money. This will then allow you more access to credit and give you lower interest rates with your loans.

9. Consider investing

We can thank movies for making it seem like investing is only reserved for the rich and knowledgeable. The truth is, there are many investment funds in Malaysia that are low-risk and accessible by everyone.

Amanah Saham Bumiputera (ASB) is a low risk unit trust fund with fixed unit price of RM1 open for all Bumiputera citizens. It invests fund provided by investors in several low-risk funds and has consistently brought moderate returns. For non-Bumiputera citizens, you can save in a similar fund known as Amanah Saham Nasional Berhad (ASNB). These funds do vary from each other, which gives you the opportunity to invest in both to diversify.

Another opportunity for low-risk investment is by investing in retirement funds, whether the government-provided Employees Provident Fund (EPF) or in Private Retirement Schemes (PRS). There are several private retirement schemes by PRS providers, such as the growth fund, moderate fund or conservative fund, that differ by needs and risk appetite.

Besides that, you can simply invest in your savings account. It is very low-risk and can offer interest of 2% to 4.75% p.a. Be sure to check with the respective banks that you deal with.

Alternatively, bonds are as if you lend your money to the bond providers, and they repay you through dividends. When you purchase a bond, the bond provider will invest your money elsewhere, and when the bond matures, you can earn money by selling the bond, perhaps at a higher market price.

10. Remember to claim your income tax reliefs

Say if your annual income is RM46,000 and are eligible for tax exemption of RM6,000. This makes your taxable income amount to only RM40,000 and the tax will be calculated based on this revised taxable income.

If you are unsure of what spending is entitled to tax rebates and exemptions, this list is for you. Remember to collect all your receipts from the entire tax year!

Video: How to Do Individual e-Filing & Pay Income Tax LHDN Online (1st Time)

Infographic: 10 Financial Tips for Working Adults

Summary

Financial literacy is not all that difficult, but it is important to be taught and practised early. It is perfectly fine to start small and then gradually increase as you grow older and hopefully achieve more financial stability with your life and career. You also do not have to start all of these 10 financial tips at once – pick the few that best suit your current situation. Your future self will thank you for being committed and disciplined.

This article is prepared by Direct Lending. A digital platform that helps you to find, make comparisons and apply for the cheapest and most suitable personal loan for you. Our smart eligibility checking system is able to suggest the best personal loan from Bank and Cooperatives for you. Our service is 100% free, no upfront fees or processing charges.

(This article was first published on the 13th of May 2021 and updated on the 5th of March 2024)

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.