By Sera

Marketing

What Is Bankruptcy in Malaysia And Best Ways To Discharge From It

Bankruptcy is something that is justifiably feared by many as it carries a bad reputation to the offender and to an extent, their loved ones. Many are unaware of the consequences of failing to manage debts. If debts are left overdue for months, it will turn into bad debt. In addition to that, the COVID-19 pandemic has left many businesses severely affected, leaving incomes lost and employees retrenched. Before we get further, let us first understand what bankruptcy in Malaysia means and what needs to be done in order to be free from a bankruptcy charge.

What Is Bankruptcy?

According to the Malaysian Department of Insolvency (MDI), it refers to a process where a debtor will be declared bankrupt pursuant to a court order on the creditor’s petition or the debtor’s petition. The Malaysian Department of Insolvency (MDI) is the government agency that is entrusted with cases of individual bankruptcy and company wind down incidents, among others.

Many Bankruptcies Come from the Younger Generation

Did you know that 60% of bankruptcies in Malaysia come from the younger age group of 25 to 44 years old? A report from the Malaysian Economic Monitor in December 2019, published by the World Bank and cited by Berita Harian, estimates that 60% of the total bankruptcy cases in Malaysia are from this age group. This is largely due to spending habits exceeding income.

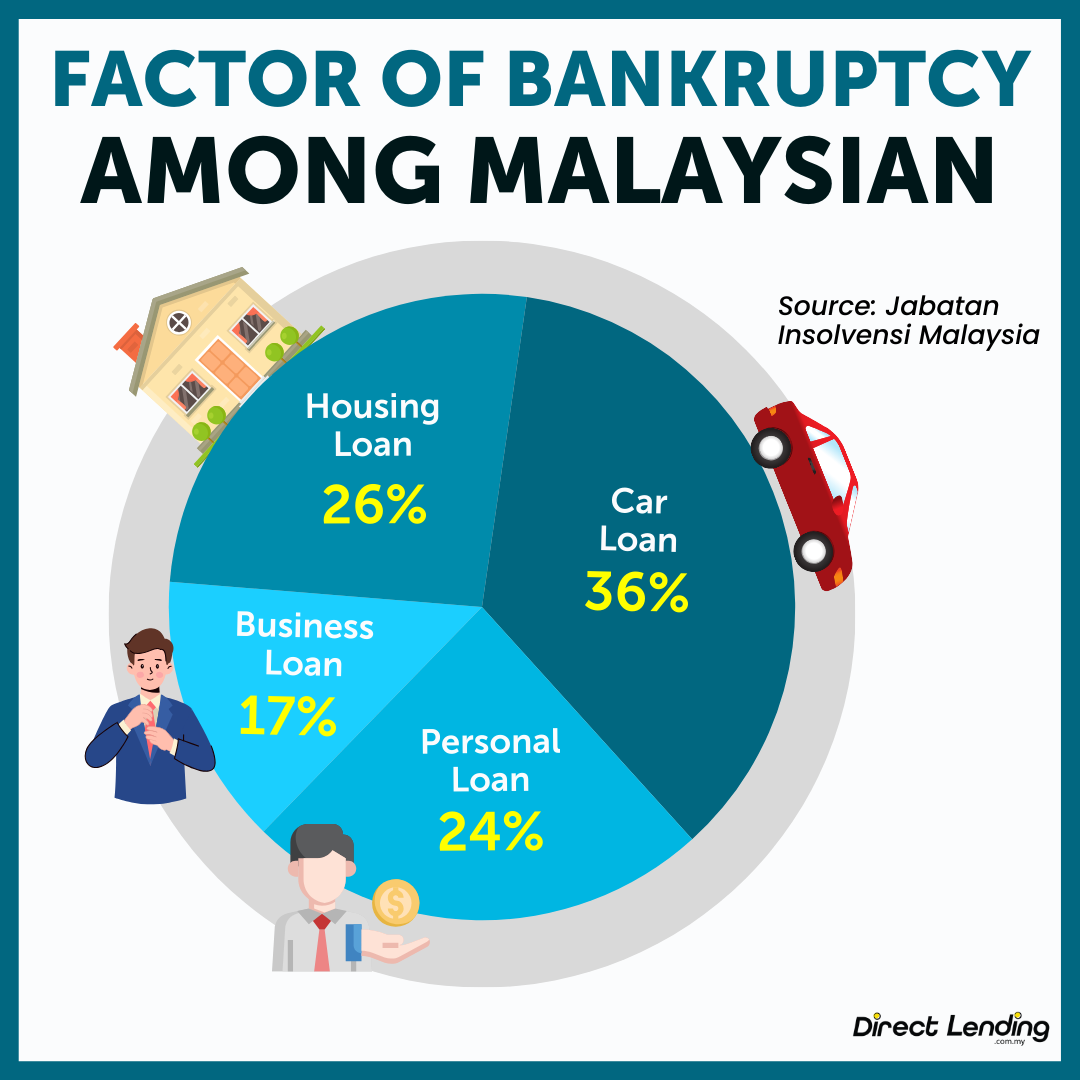

What is the Main Reason Malaysians are Declared Bankrupt?

The majority of Malaysians declared bankrupt fall in the age range of 35-44 years (35.25%), while those aged 25-34 years are the second-highest (22.52%). The primary cause of bankruptcy cases in Malaysia is often associated with car loans due to defaults on unpaid vehicle loan debts. Additionally, other reasons Malaysians are declared bankrupt include defaults on housing loans, personal loans, and business debts.

Individuals can also be declared bankrupt if they act as guarantors for others. Banks will initially seek repayment from the borrower, but if the borrower cannot settle the debt, the bank will then demand payment from the individual who acted as a guarantor for the borrower.

3 Criteria To Be Declared Bankrupt in Malaysia

- Unable to repay the debt of no less than RM50,000;

- Possess an outstanding debt of more than six (6) months;

- Having resided in Malaysia for at least a year

An individual can also be declared bankrupt without their knowledge when:

- Legal documents are sent to an address no longer in use;

- The bankruptcy charge is served through substituted service;

- The individual does not show up for court proceedings;

- The individual does not receive nor respond to legal documents that have been sent to them.

Bankruptcy Court Order

By Creditor’s Petition: A bankruptcy petition can be presented by the creditor to the debtor for a debt amounting to over RM50,000.

By Debtor’s Petition: An individual can also voluntarily apply for or declare a bankruptcy status to protect themselves from creditors when they know they have debts that they cannot solve. There is no minimum amount for declaring oneself as bankrupt. After this petition has been presented, it cannot be withdrawn unless with a court order.

Once an individual is declared bankrupt, all aspects regarding their financial procedures are placed under the responsibility of the Malaysian Department of Insolvency (MdI).

How to Check for Bankruptcy Status

Malaysians can check their bankruptcy status on the e-Insolvensi portal.

What Happens After Being Declared Bankrupt?

1. Placed under the supervision of the Director General of Insolvency (KPI)

The Director General will seize all the bankrupt’s assets and use them to repay the remaining bad debts.

2. Travel ban

The bankrupt cannot travel overseas unless with written permission from the Director General or court.

3. Credit

Bank accounts will be frozen and any withdrawals will be blocked. A bankrupt is also not allowed to spend more than RM1,000 on a credit card or borrow more than RM1,000 from any creditor.

4. Assets

All assets are seized by the Director General and will be used for debt repayment.

5. Occupation

A bankrupt individual is not able to work certain professional jobs, such as lawyer, surveyor, accountant and doctor. They are also unable to be a company director, own a business, or hold any degree of ownership of a business.

Can a bankrupt person apply for a personal/bank loan?

If you have been declared bankrupt, you can only apply for a loan with an amount not exceeding RM1,000.00. If a bankrupt individual intends to apply for a loan exceeding RM1,000.00, they must inform the lender of their bankrupt status to allow the lender to decide whether to proceed with the loan. If unsuccessful, the bankrupt individual is considered to have committed an offense under the Insolvency Act 1967.

Can a bankrupt person request KPI to reduce the amount of debt?

The Insolvency Department (KPI) is responsible for administering bankruptcy affairs and managing the bankruptcy estate. KPI does not have the authority to reduce the amount of debt filed by creditors. If a bankrupt individual intends to seek a reduction in the amount of debt for the purpose of making a full settlement, they must write to or meet with officials at the relevant bank to request the reduction. If the creditor agrees to reduce the amount of debt, the bankrupt individual must make payments with the newly agreed-upon amount to the Insolvency Department, and the department will take action to declare dividends to the creditors.

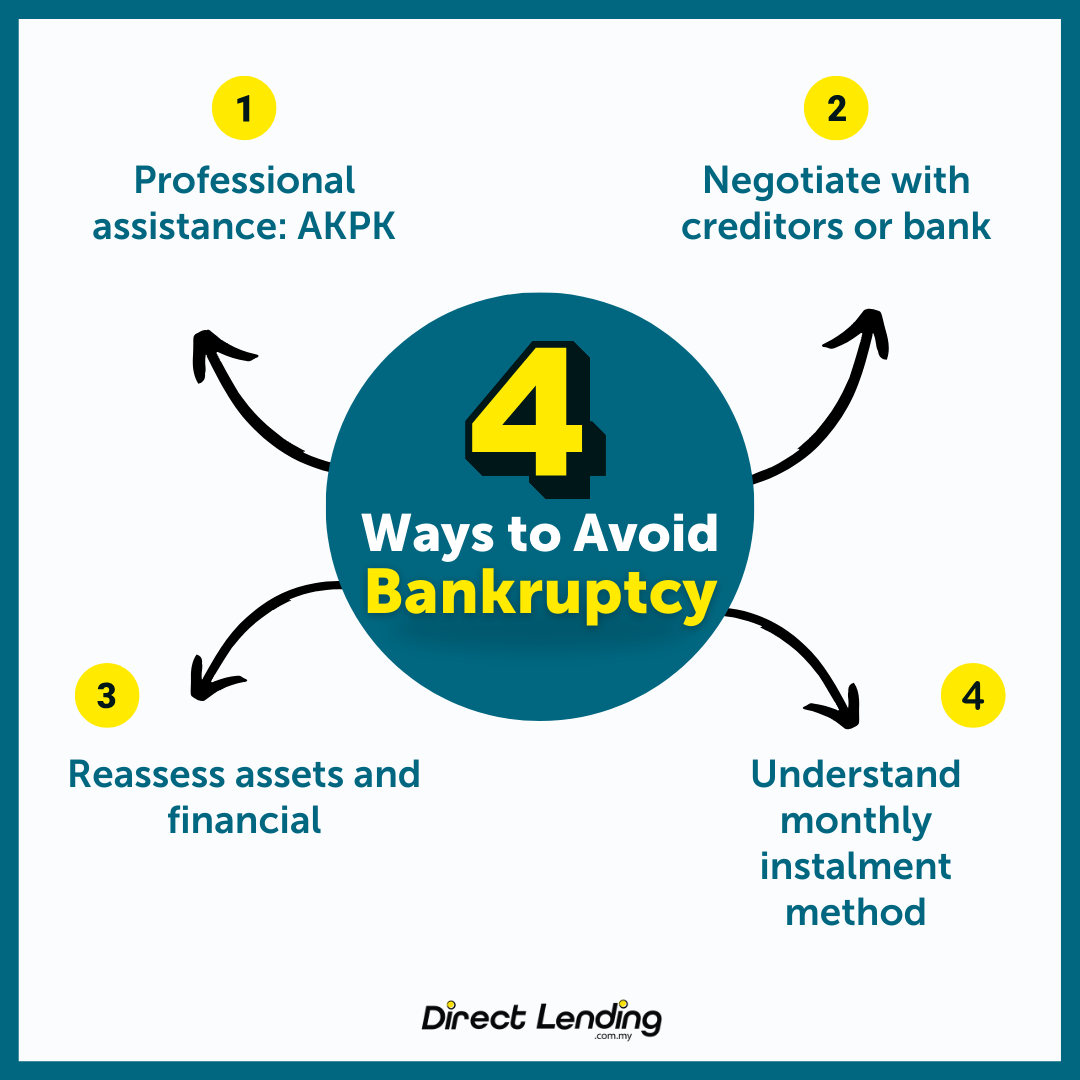

4 Ways to Avoid Bankruptcy

It's understandable if you're not afraid of being declared bankrupt, right? So, if you find yourself declared bankrupt, here are four ways that can help you resolve it.

i. Professional Assistance If you're stuck or facing problems settling mounting debts, don't hesitate to seek help.

You can seek assistance from the Credit Counseling and Debt Management Agency (AKPK). It is an agency established by the Central Bank of Malaysia to offer services on how to clear CTOS records for free.

Among the services offered are financial counseling and advice, assistance in clearing negative records, and financial education programs.

ii. Negotiate with Creditors or Banks

You are always welcome to negotiate and discuss with creditors and banks. They are open to negotiation and reconsidering the terms of your loan.

The tendency for non-performing loans by banks can also be reduced. Strive to reach an agreement between both parties.

iii. Reassess Assets and Financial

Commitments Remember, spend wisely. You may also consider using savings or investments to settle debts or loans.

If you have various assets, selling them might help settle debts and quickly resolve car loans.

It's also important to know effective techniques for debt settlement. Various ways to settle debts are now at your fingertips.

iv. Understand Monthly Installment

Payment Methods Installment payments should be made according to the set amount each month. However, if there are difficulties in making the prescribed monthly payments, the bankrupt individual is advised to contact the officer managing the case.

There are 3 ways in which a bankrupt can be released from his bankruptcy status:

- By way of annulment – The bankrupt can make an application in court at any time to annul the bankruptcy order under certain grounds eg. the debt has been settled fully or the bankrupt ought not to be made a bankrupt on certain grounds.

- By way of discharge in court – The bankrupt can make an application in court at any time to discharge himself from the bankruptcy status. The Director General of Insolvency (DGI) has to produce a report on the conduct of the bankrupt and cooperation of the bankrupt with the department.

- By way of discharge by the DGI – The bankrupt can make an application to the DGI for a discharge under Section 33A of the Insolvency Act 1967. However, it can only be made if 5 years has lapsed from the date the bankruptcy order was made and some criteria imposed by the DGI in order to discharge the bankrupt.

5 Strategies To Avoid Bankruptcy

One should always strive to never be even remotely close to bankruptcy. If you are starting to feel overwhelmed with your debts and feel like you cannot repay them, these are some of the things you can do.

1. Seek professional help

Do not hesitate to ask for help when faced with mounting debt. There are certified and professional agencies you can go to for specifically this purpose. One of them is Agensi Kaunseling dan Pengurusan Kredit (AKPK).

This is an agency established under the jurisdiction of Bank Negara Malaysia (BNM) to provide free financial counselling and debt crisis help such as Debt Management Programmes. Under this programme, AKPK will develop a personalised debt repayment plan for individuals who are unable to manage their monthly repayments to banks. This could prevents the borrower from going bankrupt.

2. Discuss with your bank

Most banks are open to renegotiating your loan terms. They, too, would like to avoid incidents of NPLs as BNM will hold them accountable for that.

The best way is to communicate openly and come to a mutual agreement on a manageable repayment plan.

3. Resell assets and properties

Missing repayments for a month or two will only be reflected on your credit score, but if you are starting to miss repayments for more than six consecutive months, you should consider reselling your liabilities. Remember, your debts comes first before saving!

4. Settle debts through overlapping

3 ways of how overlapping can help to ease your monthly commitment:

- Overlap with a lower-interest loan

- Overlap with a longer loan tenure

- Overlap in the case of salary deductions exceeding 60% (for civil servants)

Be sure to take advantage of existing debt repayment facilities in order to avoid going bankrupt. Some effective ways to settle bad debts are overlap loan that you can apply from koperasi as an alternative to conventional bank loans.

This is where your monthly commitments can be reduced and also receive some cash in hand without adding on to your existing debts. This, however, does not mean that your debts are ‘removed’.

Overlap loan is one of the techniques used to lower the amount of commitments without actually removing any debt. This is useful in easing the debtor’s burden, but it still requires discipline by the debtor to completely repay their loan.

5. Settle debts through debt consolidation

3 ways of how debt consolidation can help to ease your monthly commitment:

- Conduct due diligence on yourself (list down all of your debts)

- Find a debt consolidation scheme that offers an interest rate lower than the average interest rate of all of your loans separately

- Identify processing fees & hidden charges

Advantages of debt consolidation

- Focus debt repayments to only one party

- Helps to reduce your monthly commitments

Drawbacks of debt consolidation

- Lower interest rate means a longer loan tenure

- Chances of application getting rejected

- Does not eliminate debt

Summary

The Malaysian bankruptcy law has had several amendments, but at present, the minimum debt amount that can lead to a bankruptcy petition is RM50,000.

The common reasons for bankruptcy in this country are personal loans and credit card usage, to name a few. Therefore, it is imperative for the Malaysian public to equip themselves with debt management awareness and knowledge in order to not contribute to the worrying bankruptcy statistics. We hope that this article has been helpful to you.

This article has been prepared by Direct Lending. Our smart eligibility checking system is able to suggest the best personal loan from Bank and Cooperatives for you. We will aid in helping you to find, make comparisons and apply for a personal loan that is cheap and most suitable for you to overlap your old loans and lower your monthly commitment.

Our service is 100% free, with no upfront charges or processing fees.

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.