By Sera

Marketing

3 Best Ways To Overlap Loan Effectively

It cannot be denied that taking up loan is risky especially if the borrower has a bad repayment pattern and lack of money management skill. Dealing with high loan instalment, borrower tend to forget and miss their payment which resulting to the penalty charge for late payment to start piling up into bad debt. This payment habit will surely affect your CCRIS & CTOS record and you might face bankcruptcy.

If you are experiencing financial difficulties such as this, one of the ways to relieve yourself from your monthly commitment is by overlapping. Overlap collects various debts into one account (personal loan) that is new with the same financial institution. Overlapping personal loan offers a new financing with lower interest rate or a longer tenure compared to the existing loan. Despite that, there are a few pros and cons that you should consider before applying for overlap persoanl loan. Read this article until the end to find out more.

Personal loan is deemed interesting to borrowers due to its flexibility. One of the uniqueness of a personal loan is that you only need to pay the same installment amount monthly (fixed interest rate) and it does not need a collateral (asset) from the borrower. With such flexibility, many borrowers prefer to use personal loan as a quick fix to their financial problems, such as applying for overlap loan.

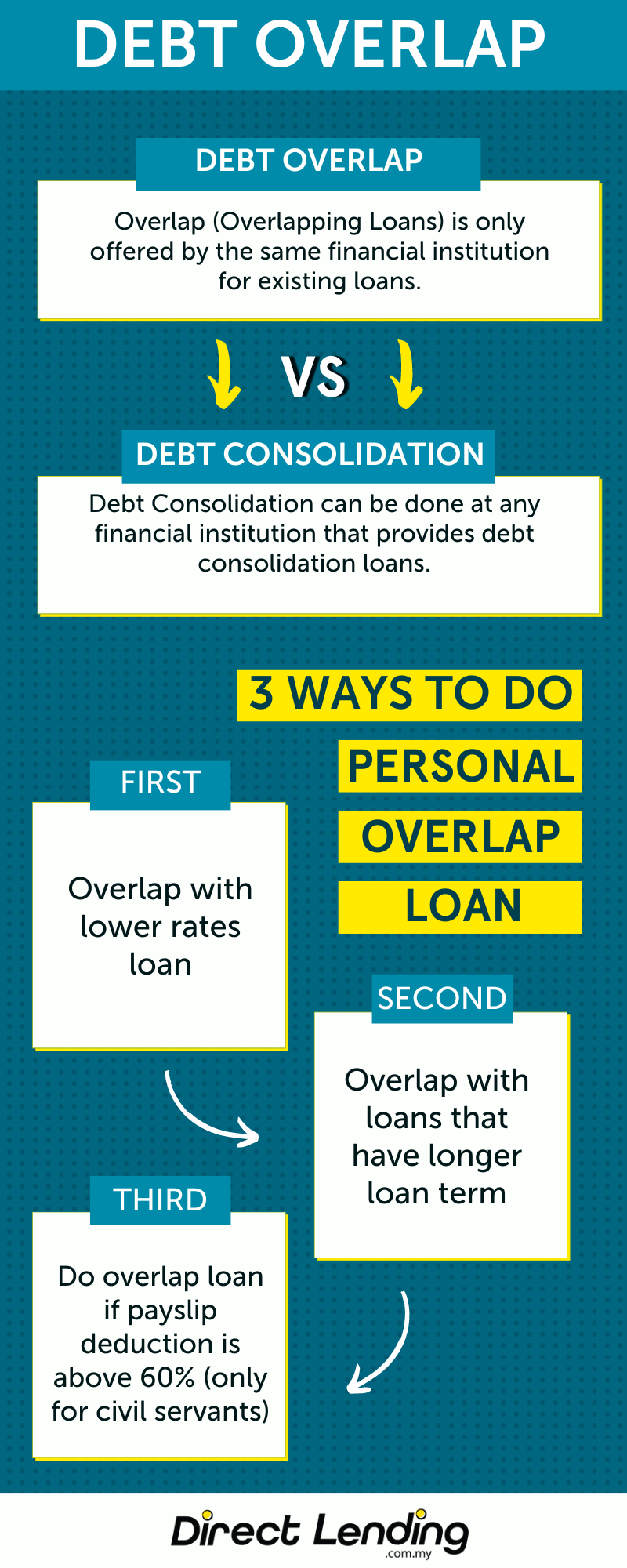

What is the difference between Overlap Loan and Debt Consolidation?

You might be wondering “is overlap the same as debt consolidation?”

Overlap is only offered through the same financial institution. As an example, you have a personal loan and credit card (active loan) at Bank X. You can apply for Overlapping Facilities only at the same bank.

It is a bit different with Debt Consolidation where it can be done at any financial institution that offers the facility.

That being said, there are a few financial institution that offers overlap, and at the same time are able to do debt consolidation using the overlap loan. For example, bank and koperasi loan accept request for overlap personal loan with affordable and much lower interest rate.

3 Ways to Overlap Loan

1. Overlap Loan with Lower Interest Rate

Overlap existing loans with a personal loan that offers a lower interest rate and less monthly installment.

2. Overlap Loan with a Longer Tenure

The monthly installment will be lesser when you overlap an old loan with a loan that has a longer tenure. Example: When you overlap a loan with a balance of 5 years with a new loan with 10 years tenure.

3. Overlap If Deduction in Salary Slip Exceeds 60% (for civil servants)

When the deduction in a salary slip has exceeded 60%, you can opt to do an overlap. If the monthly installment is lower, the deduction will also be less than 60% and this will help to repair your salary slip.

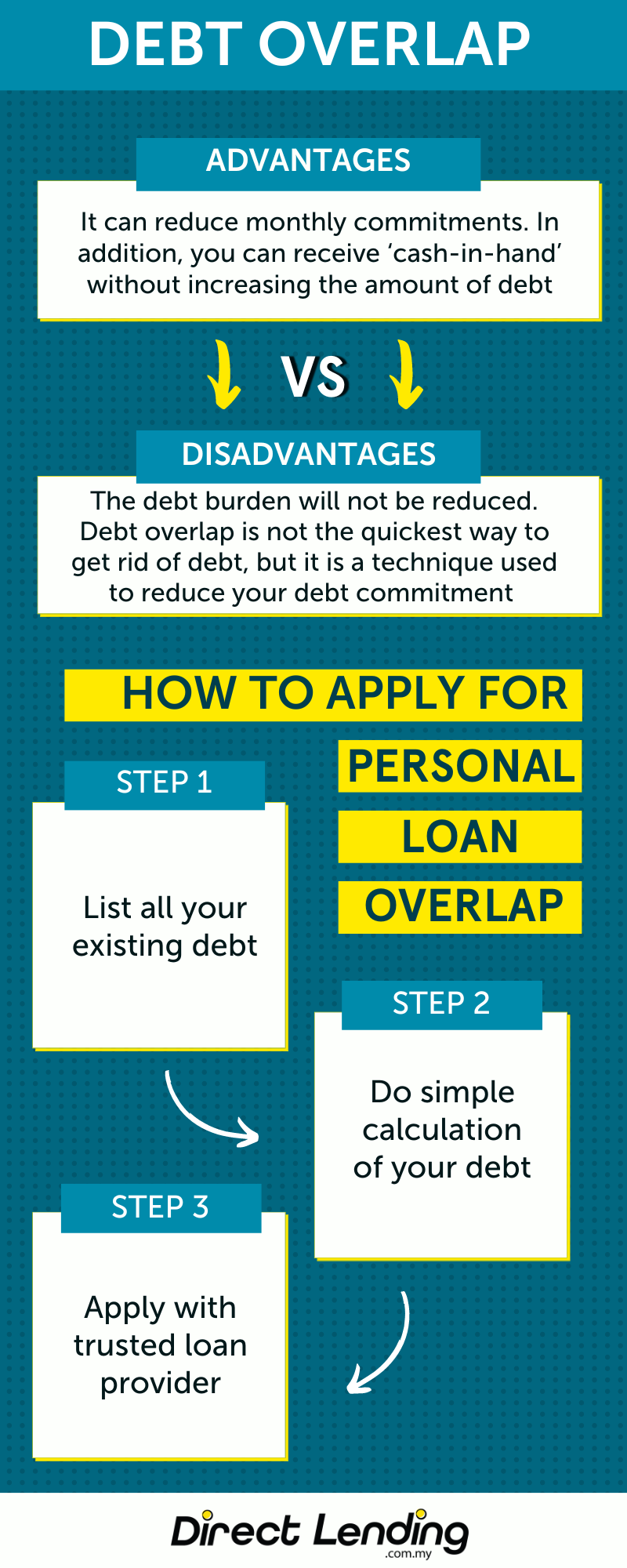

The Pros and Cons of Overlap Loan

What are the pros?

- Lessen monthly commitment

- A new loan offers a lower interest rate to close the old loan with a higher interest rate.

- The monthly installment will be lower (if you close an old loan with a shorter balance of tenure with a new loan with longer tenure)

- Receive cash in hand without adding to existing debt.

What are the cons?

- The debt burden will not lessen. Overlapping a personal loan is one of the techniques to lessen commitment but the debt is still there and will potentially increase if the borrower is not disciplined in paying back the debt.

Steps to Overlap Loan

1. List down all of your existing debt

List down all of your existing debt. Choose the debts that you want to overlap. Review back the interest rate, remaining tenure and the outstanding balance. Refer with the financier if you are unsure on how to obtain those information.

For civil servants who have loans with angkasa deduction, they can refer back to angkasa.

2. Do a simple calculation

Lets say you have two personal loans that are still active from bank X & Y. The personal loan from bank X amounts to RM10,000 with interest rate of 8% and tenure of 3 years; personal loan from bank Y amounts to RM20,000 with interest rate of 9% and tenure of 5 years. You plan to apply for a house loan but with the current amount of commitment that you own, the house loan application might be rejected by the bank. Based on this situation, you can apply for overlapping facilities for personal loan at any financial institution that is ready to help ease your debt burdens.

This is an example for overlapping personal loan from Bank X & Y.

Based on this situation, you have to find a personal loan that offers a lower interest rate than the average 8.5%, which is (8% + 9%) / 2 so it can lowers the interest rate that you would have to pay to the bank. This will also make you save more on the monthly installment of the current loan.

Calculation 1: Overlap debt with Bank Rakyat Personal Financing-i Debt Consolidation amounting to RM35,000 for 10 years

Based on the calculation above, you can save around RM383 a month (RM329 + RM426) – RM372 and save RM4,596 for one year. If you are a civil servant, you are qualified to apply for Bank Rakyat Personal Financing-i Debt Consolidation that offers a promotion for fixed interest rate at 2.76% for financing of 4 years and above.

| Personal Loan from Bank X | Personal Loan from Bank Y | Personal Loan (overlap) | |

| Amount | RM10,000 | RM20,000 | RM35,000 |

| Interest Rate | 8% per year | 9% per year | 2.76% per year |

| Tenure | 3 years | 5 years | 10 years |

| Monthly Installment | RM329 | RM426 | RM372 |

Calculation 2: Overlap debt with Bank Rakyat Personal Financing-i Debt Consolidation amounting to RM35,000 for 3 years

Not everyone prefers to be in debt for a long time. If 10 years sounds too long, you can opt to choose a shorter tenure for 3 years for the repayment of the loan. Calculation 2 is for borrowers who wishes to pay off debts as fast as possible with a monthly installment that is lower and saves more compared to the current monthly installment for the existing debt. Eventhough the monthly instalment is a bit expensive but you still can save RM297 per month. (RM1,052-RM426-RM329) and RM3,564 for one year.

| Personal Loan from Bank X | Personal Loan from Bank Y | Personal Loan (overlap) | |

| Amount | RM10,000 | RM20,000 | RM35,000 |

| Interest Rate | 8% per year | 9% per year | 2.76% per year |

| Tenure | 3 years | 5 years | 3 years |

| Monthly Installment | RM329 | RM426 | RM1,052 |

Overlap Debt With Interest Rate As Low As 2.95%

3. Apply with trusted financier

If you are interested to use personal loan to relieve and lessen your debt commitments, you can contact the bank or financial institutions that offers such facilities.

Before applying for a personal loan, these are 3 tips you have to know:

- Determine the amount of loan that is enough and comfortable for you to make repayment.

- Know the terms for your loan such as the tenure, repayment flexibility as well as the duration of approval and disbursement

- Survey if the financier is legit to prevent yourself from being a victim of a scam case

Special for customers of Direct Lending we also provide services for Overlap Facilities for civil servants and selected GLC employees. You will be able to enjoy personal loan from Bank & Koperasi with Syariah compliance with interest rate as low as 2.95% as well as licensed moneylenders personal loan. This funding is also one of the best ways to pay off car loan faster because you get to merge all your loan into one loan only.

Our smart eligibility checking system is able to suggest the best personal loan from Bank and Cooperatives for you. We will aid in helping you to find, make comparison and apply for personal loan that is cheap and most suitable for you to overlap your old loans and lower your monthly commitment.

Our service is 100% free, no upfront charges or processing fee.

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.