By Yik Seong

Director

Should I Apply An Early Settlement for My Loan?

Early settlement of a personal loan involves making full payments towards the outstanding loan amount before its due time.

For example, if you have a home loan for a period of 35 years but you settle it early in the 25th year, you become debt-free with 10 years left.

This is common because most of us adhere to the principle that paying off debts sooner brings peace of mind. For instance, consider credit card debt. When it's paid off, there's no need to worry about the monthly financial strain.

However, you need to understand that the philosophy behind making an early settlement of a personal loan might be slightly different from other types of loans.

This article will share whether it's advisable for you to settle your personal loan early today.

What is a Personal Loan and How Does It Work

A personal loan, or personal loan, is defined as a sum of money borrowed from a financial institution, such as a bank or financial company.

When this loan is made, the borrower must repay the borrowed amount along with the loan interest and agreed-upon fees within a specified period.

For your information, a personal loan is one form of an unsecured loan, unlike housing loans or car loans. In other words, the bank cannot "seize" any assets from you if you fail to repay the loan.

However, remember that if you fail to repay the loan as scheduled, your CCRIS or CTOS records will be negatively affected, potentially leading to bankruptcy.

How to Settle Personal Loan Early

Everyone wishes to be debt-free and achieve financial freedom early. Perhaps you also want to eliminate personal debt faster to reduce high monthly commitments. Based on this financial goal, there are several financial strategies you can use to accelerate the process of paying off your personal loan.

Benefits and Effects of Early Settlement of Personal Loans

So, can we make an early settlement of a personal loan by paying extra every month or a lump sum to quickly clear the debt?

In general, there is no problem if you choose to make an early settlement of a personal loan or any other loan.

However, two important things to note. Here is a detailed explanation.

1. No penalty or lock-in period

First, make sure your loan has no penalties or lock-in periods. This is because every lender, especially banks, has their own terms when you want to make an early settlement of a personal loan.

Some set a 6-month lock-in period, while others only allow early settlement halfway through the loan period.

For example, within a 6-year period, only in the third year can you make an early settlement. Additionally, some impose early settlement fees of 1% to 5% of the loan.

So, make sure you understand all the terms and conditions or get the right explanation from the lender, whether you will be penalized or fined if you violate the loan contract.

2. Raise your credit score

Second, change your mindset. If you have a goal to raise your credit score, it doesn't necessarily mean you need to settle a personal loan quickly. As long as you pay on time and have no overdue payments, it will have a positive impact on your credit score.

Even if you are obligated to pay off the loan within a certain period, it actually benefits you without realizing it. This is because the bank will see your true ability to meet commitments transparently.

So, in the future, when you want to apply for other loans such as credit cards or housing loans, you can receive financing more easily and quickly.

But if you are already bound by many commitments, for example, you have two credit cards, a car loan, and a personal loan, it is highly recommended to quickly settle your personal loan.

3 Benefits of Settling Personal Loans Early

There are 3 benefits that you can obtain if you settle your personal loan early. Among them are as follows:

Reducing the DSR Value (Debt Service Ratio)

The Debt Service Ratio (DSR) is a ratio formula used by banks to calculate whether someone is eligible to apply for a loan.

DSR is used to assess whether you can manage and pay the monthly installments of your loan. If the DSR calculation indicates that you will have difficulty repaying the loan, they will not approve your application.

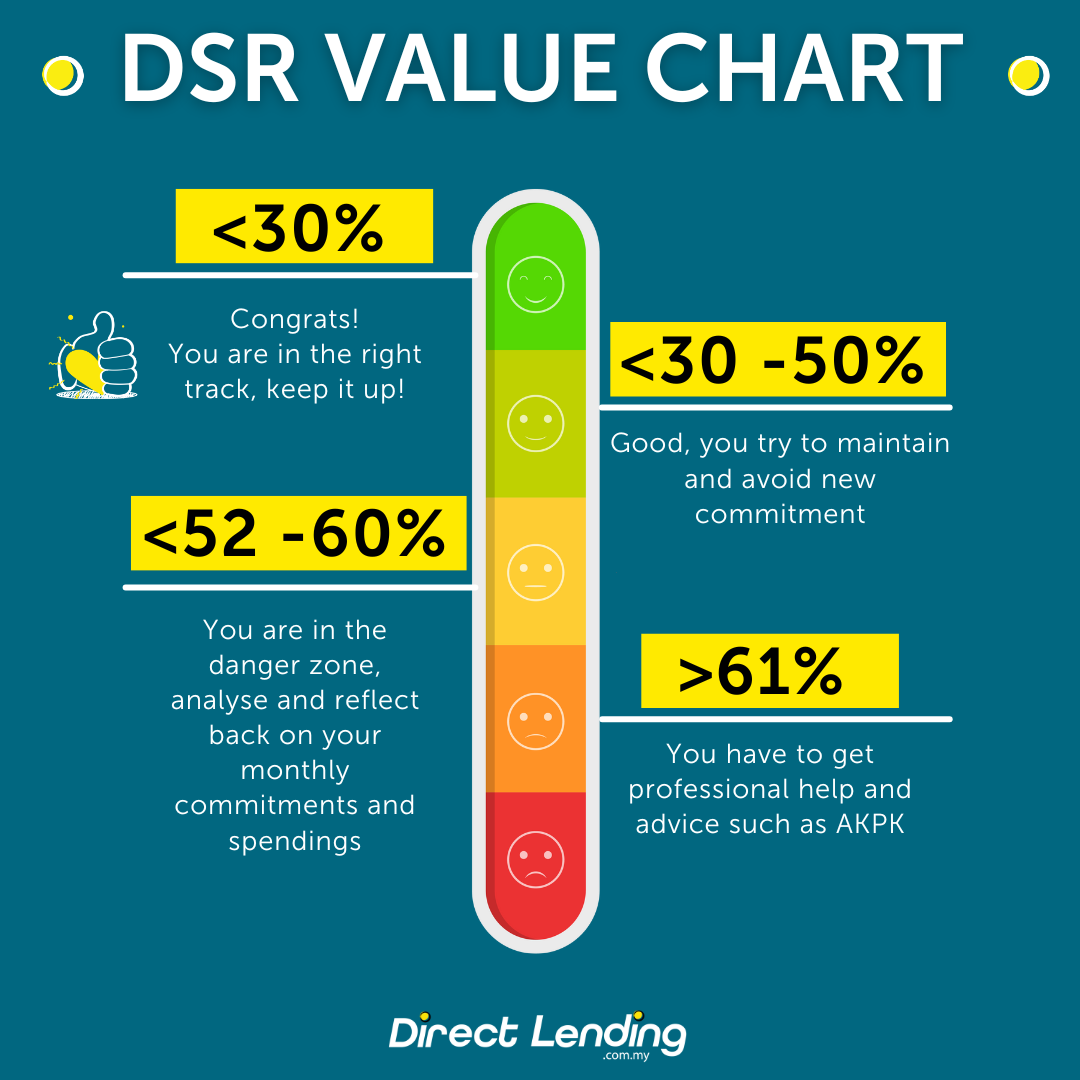

A weak DSR significantly increases the chances of your loan being rejected. In simple terms, the lower your DSR value, the better. The estimated optimal value is around 30% to 40%.

However, each bank has its own DSR threshold. Some banks may accept DSR up to 80%, but others, such as licensed moneylenders, may only accept up to 60%.

If you want to improve a less favorable DSR record, you can start by increasing your net income or reducing debts, such as settling existing loan agreements.

Saving on Interest Payments

In addition to using refinancing methods to reduce interest payments, you can settle your personal loan early for additional savings.

For example, if you have taken a personal loan of RM50,000 for a period of 5 years with an interest rate of 6.5% per annum, you would need to pay a total amount, including interest, of RM67,500.

However, if you settle it in just 3 years, you can save around RM7,000 (without penalty charges), with a total loan amount of RM60,500.

| Personal Loan | RM 50,000 |

| Loan period | 5 years |

| Interest rate | 6.5% |

| Total payment + interest | RM67,500 |

| Early settlement in 3 years | RM60,500 |

| Amount saved | RM7,000 |

Peace of Mind Without Debt

Living debt-free is the aspiration of everyone today. Avoiding debt is a crucial step in maintaining a healthy personal financial situation.

The increasing economic pressures, especially for the sandwich generation, sometimes make it challenging to avoid borrowing.

Nevertheless, with high discipline and good financial awareness, it is possible to manage finances well and avoid falling into excessive debt issues.

So, should you payoff your loans early?

In general, it depends on how you evaluate your financial situation. Ask yourself what do you benefit from debt and compare those benefits with the cost of taking up a loan. Sometimes, not all debts are bad.

Nevertheless, it is always advisable to pay up your loans. Paying off loans early will hurt at first, but it is a good choice if you have money to spare for an extra payment. Keep in mind that your money is not your own as long as you have an outstanding debt. Likewise, accumulating debt more than what you can afford to pay can cripple you financially.

But the most compelling reason to pay off loans early is you are buying peace of mind. Start challenging yourself to be debt-free. Each success means one less debt to worry about.

Video: Should You Settle Your Personal Loan Earlier

This article is prepared by Direct Lending. We are an online personal lending platform that help borrowers to find, apply and receive simple, safe and affordable financing. If you need some financing help, you can apply with us for free. Rates are as low as 2.95% or as fast as 2 working days.

Don’t forget to follow us on our blog and Facebook page for more tips on personal finance!

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.