By Q

Have you ever tried to apply for any loan like applying for personal loan, house loan or car loan through bank but your application was rejected due to your high Debt Service Ratio (DSR). other than that, one of the reason you loan is rejected is due to not fitting the loan eligibility criterias stated.

This is because, every monetary institution, especially in Malaysia have their own respective DSR limit that they set for loan application. Not only that, the bank will also do a background check on your financial report. For example, CCRIS or CTOS report. Maybe you are familiar with these terms, but most people are still not aware of what is DSR.

The big question is, what is DSR? and how does it work? In this article, we will break it down in details everything that you need to know on what is DSR and how to calculate DSR (with detailed calculation reference) to make it easier for you to apply and get accepted in any loan that you apply for like house, car, bank and koperasi and many more, in the near future.

What is Debt Service Ratio (DSR)

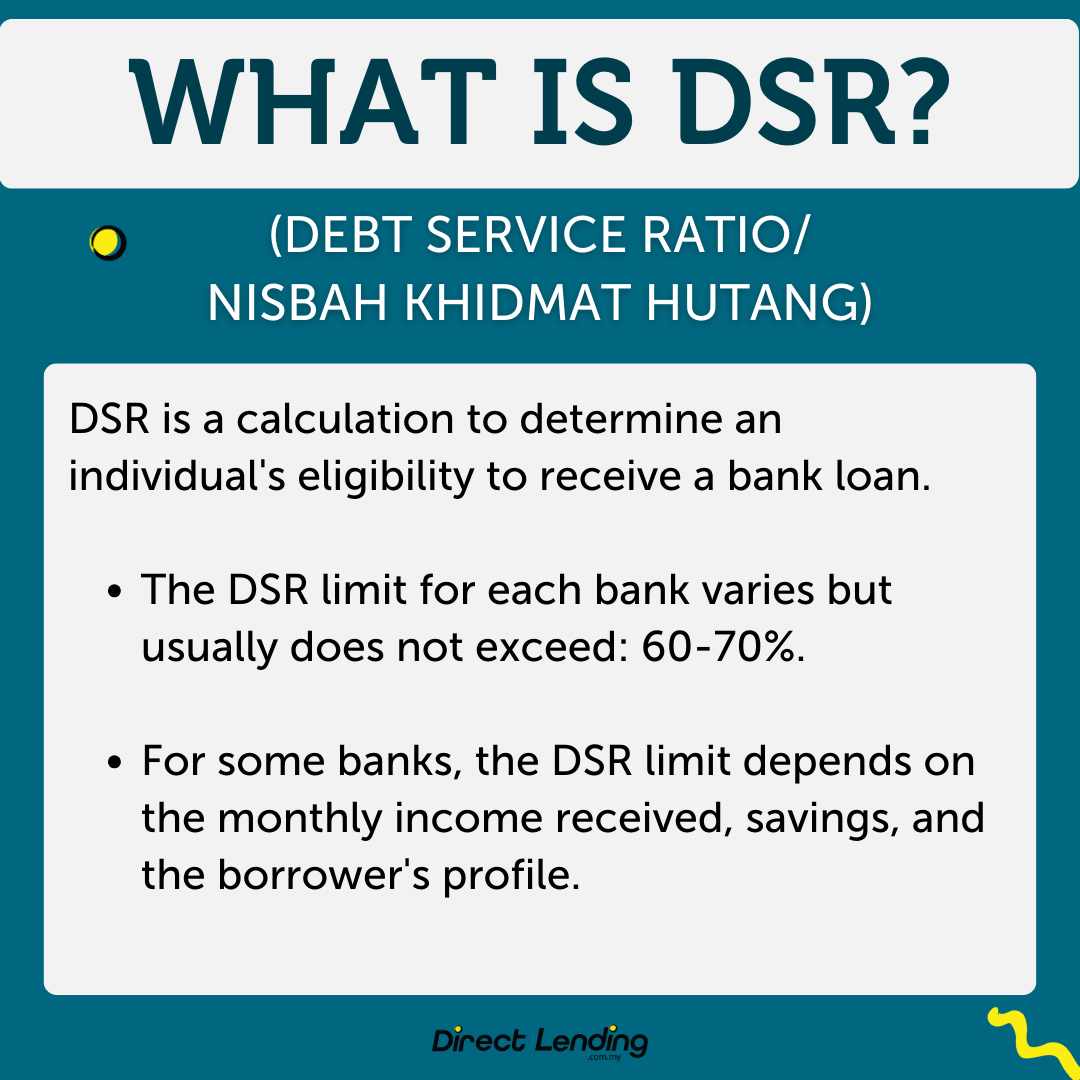

What is DSR? DSR stands for Debt Service Ratio(DSR) which is your debt commitment to your income. Simply put, based on your monthly salary, how much will you use the salary to pay debts and commitments like PTPTN loans, credit card loan, car loan, house loan, ASB loan and others.

Debt Service Ratio(DSR) is also a calculation or formula that is used by the bank for them to identify the applicant elligibility and ability to pay back the amount requested. The basic thing that you need to know is the higher your DSR ratio, the probability of your new loan application being accepted is lower. This is because some of the salary is already devided to pay off the other loan.

On the bank side, if you have a high DSR ratio, they will list you as high risk applicant that might not pay back the money loaned.

The Importance & The Use of DSR

DSR play an important role in loan processing as the value of your dsr can be considered as a benchmark that is used by the bank agency. Here are some of the importance of DSR and why you need to be aware and manage your DSR.

1. The first component that the bank will check

DSR is one of the component that the bank will analyse if you want to apply for any kind of loan. other thing that the bank will check and look at is your Central Credit Reference Information System report or in short, CCRIS.

Through your CCRIS, the bank will be able to check whether you have arrears or any late loan payment. The bank also will be able to see whether you are blacklisted. Read out article on how to clear your CCRIS report to avoid your name from being blacklisted by the bank.

Next, Credit Reporting Agency (CTOS) where the bank agnecy will analyse if there is any company that reported you for not paying loan or bills like Telco company, company that allows installment like buy now pay later and many more.

Other component that the bank will look into before accepting your loan application is your credit score. Credit score is one of the system that gives score to determine your credit health or your financial health. It will evaluate your finacial history so that other monetary institution can determine whether they want to proceed with your application or vice versa.

There is no fixed or standadized method to calculate an individual’s credit score. But based on the calculation done by CTOS, a good credit score is 697 and above while a low credit score is 528 and below.

2. Determine whether the loan application is approved or not

The main function of DSR is to evaluate whether you are elligible or not to apply for loan. Because of that, it is extremely important for you to maintain a good and low DSR value. You can also try how to make personal loan approved faster tips depending on your DSR value.

If the DSR value is more than allowable limit by the bank, than your applicantion will be rejected instantly and that action will be recorded in your financial record, which is your CCRIS report. So, it is extremely important for you to calculate first before you apply for loan in any bank agency.

3. Know your financial ability

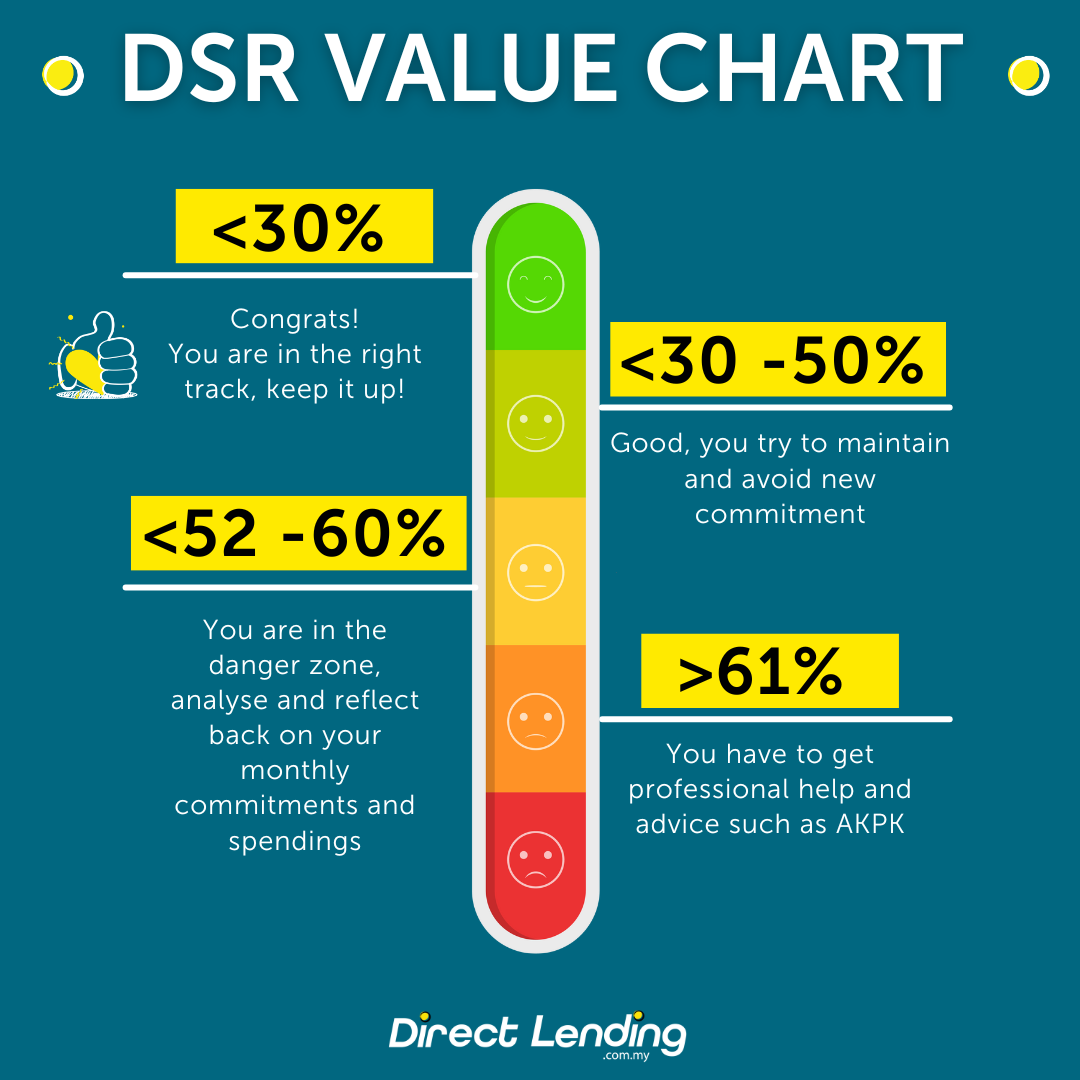

Through calculating your DSR will get get to know if your financial ability is in a good or a bad condition. You are encouraged to maintain your DSR value not more than 60%, where the value can be considered as “safe value” or the maximum limit for most of the bank institute in Malaysia

Despite what have been said, each bank institution in Malaysia have variety of DSR rate depending on the type of the loan that you are applying for. If your DSR value is high, that means that you have lesser ability to take u a new loan or to add a new commitment. You can refer the table below to know your current debt commitment ability.

| Debt Service Ratio Value | Brief Explanation |

| Under 30% | Congrats! You are on the right track, keep going! |

| 31-50% | Good, try to maintain the value and avoid taking up new commitment |

| 51-60% | You are in the danger zone! Check and track back your monthly spending and your debt. |

| 61 and above | You need to get professional help. For example, you can refer Agensi Kaunseling & Pengurusan Kredit (AKPK). |

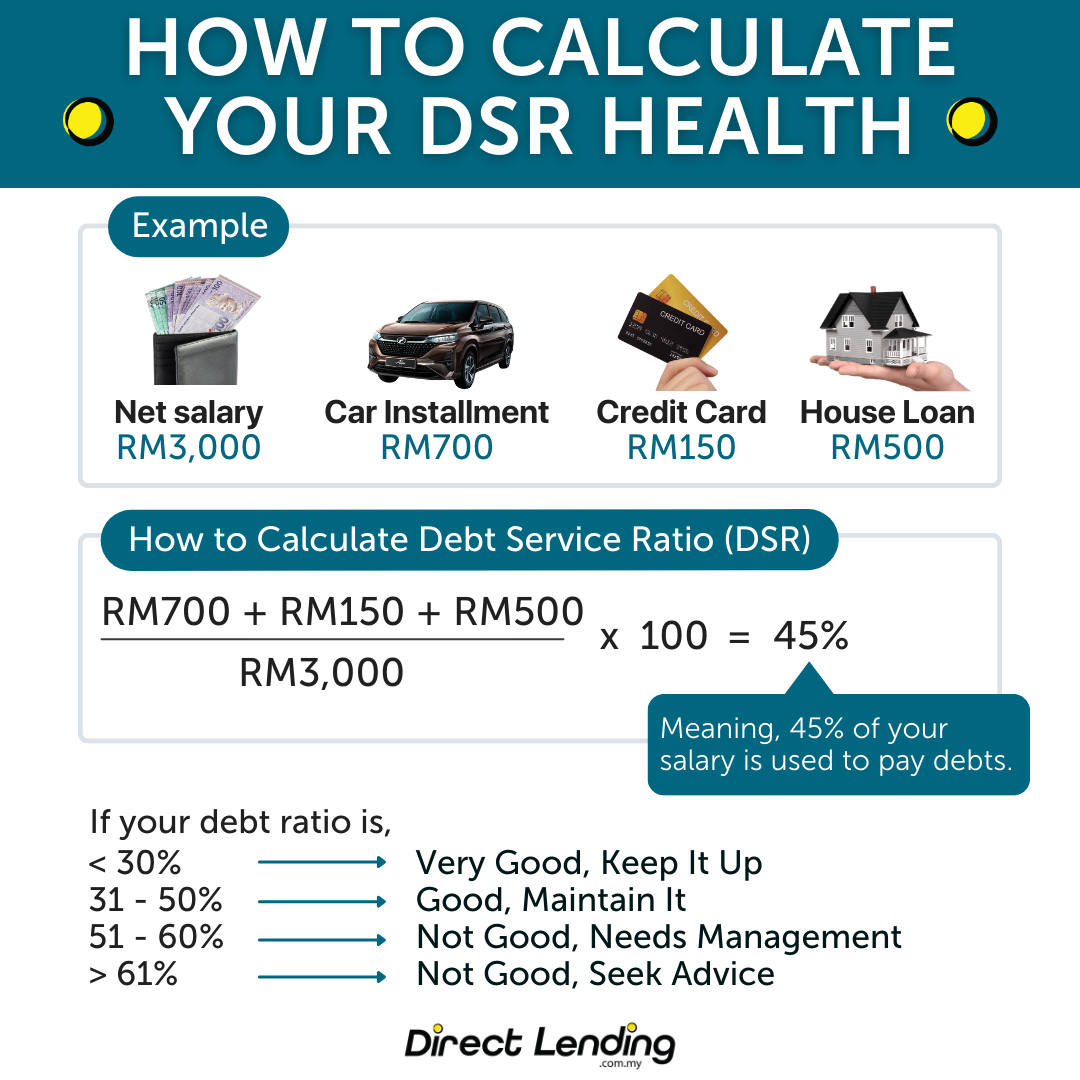

DSR Formula

| Debt Service Ratio Formula |

| Monthly Commitment ÷ Net Income x 100% = DSR |

- Example of monthly commitment = PTPTN loan, Credit Card Loan, Car Loan, House Loan, ASB Loan, Private Loan and more.

| How To Calculate Net Income |

| Salary – Monthly Cut = Net Income |

- Example of monthly cut =EPF, Socso, Income tax and others

How To Calculate DSR

As mentioned before, DSR is comprising interest payments and debt amortisations – as a proportion of income. The calculation of DSR is simple and easy to understand. You only have to make sure that you are not exceeding the maximum DSR value that is set by the bank institution that you want to apply for.

The maximum limit of DSR is different for each bank institution and dependant to the financial profile of the applicant.

Down below, we have included a simple and compact calculation so that it is easier for you to understand on how to calculate DSR.

Example: Calculation A

| Monthly Net Income | RM 3,000 |

| Monthly Commitment:Car Loan = RM500 PTPTN Loan = RM150 Personal Loan = RM200 Credit Card Loan = RM 100 | RM 950 |

| Debt Service Ratio= RM950/ RM3,000 X 100% | 31.16% |

Example: Calculation B

| Monthly Net Income | RM 5,000 |

| Monthly Commitment: Car Loan = RM 650 PTPTN Loan = RM 400 House Loan = RM 1,300 Personal Loan = RM 900 Credit Card Debt = RM 500 | RM 3,750 |

| Debt Service Ratio= RM 3,750/ RM 5,000 X 100% | 75% |

Video: How to Calculate DSR

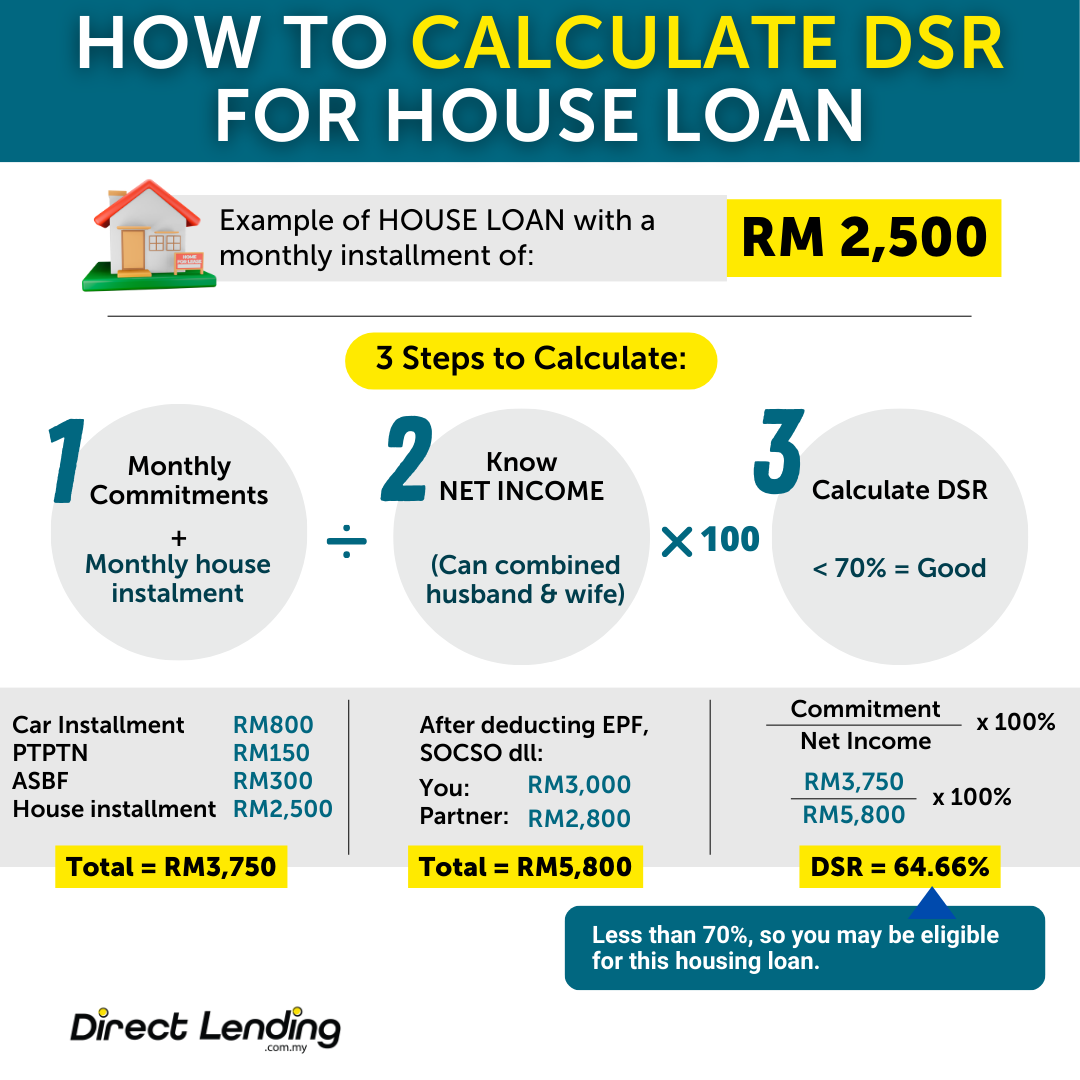

How To Calculate DSR For House Loan

To calculate DSR for house loan, you can directly insert the amount of the monthly instalment for the new loan. For example, you wanted to buy that cost RM 100,000 and the estimated monthly payment of the house is RM 500. So, add RM 500 to your current monthly commitment.

You can use any online calculator like Home Loan Calculator to get the monthly pay back estimation for the house that you desired.

Above is the formula of Debt Service Ratio for Housing loan

| Debt Service Ratio Formula for Housing Loan |

| (Current Monthly Commitment + new monthly housing instalment) ÷ Net Income x 100% |

DSR Value For Malaysian Bank

The table below is the DSR value of each bank in Malaysia. There is two different calculation method depending on the banks. There are some bank that use net salary in DSR calculation while there are banks that uses gross salary in their DSR calculation.

- Net salary = monthly salary that you receive after monthly cut like EPF, Socso/ Perkeso and more.

- Gross salary = Monthly salary that you receive before the monthly cut.

When you want to make any kind of loan with the bank, you are encouraged to pick a bank with the highest DSR limit as that will help your loan application to get approval. Below is the maximum DSR limit for each bank in Malaysia. (based on the year 2019)

| Bank | Net Salary | Maximum DSR | Net Salary | Maximum DSR |

| CIMB Bank | < RM 3,000 | 65% | > RM 3,000 | 75% |

| RHB Bank | < RM 2,204 | 55% | > RM 2,205 | 60% |

| Maybank | < RM 3,499 | 40% | > RM 3,500 | 70% |

| BSN | < RM 2,999 | 60% | > RM 3,000 | 75% |

| HSBC | < RM 2,999 | 60% | > RM 3,000 | 70% |

| Hong Leong Bank | < RM 2,999 | 60% | > RM 3,000 | 80% |

| Bank | Gross Salary | Maximum DSR | Gross Salary | Maximum DSR |

| Affin Bank | < RM 4,999 | 60% | > RM 5,000 | 80% |

| Bank Islam | < RM 2,999 | 50% | > RM 3,000 | 70% |

3 Things That Will Affect DSR Value

There are also things and factors that might affect your Debt Servive Ratio. For best, try to avoid making these mistakes that we are about to list down if you want to maintain a good Debt Service Ratio.

1. Too many monthly commitment or amount of loan

When you own too many commitment, indirectly, your DSR value will also increase. But, if your net salary also increase, it would not be a problem. It is very important to stabilize both aspect which is amount of monthly commitment as well as the amount of your monthly net salary.

2. Employment Status

Employment status is also vital in making sure that your DSR is unfazed. this is because the bank agency will look at your working sector or industry (example: public sector or private sector) and the employment period to make sure that you have a stable job. This is because it might give a bad aftereffect for loan repayment.

3. Credit History

Credit history includes your financial records such as CCRIS & CTOS, credit score. Avoid having your name blacklisted or included in the list of accounts under special observation or 'Special Attention Account.' You also need to steer clear of any existing loans that have been "overdue" for 3 months and above, under your name (even if you are only a co-borrower).

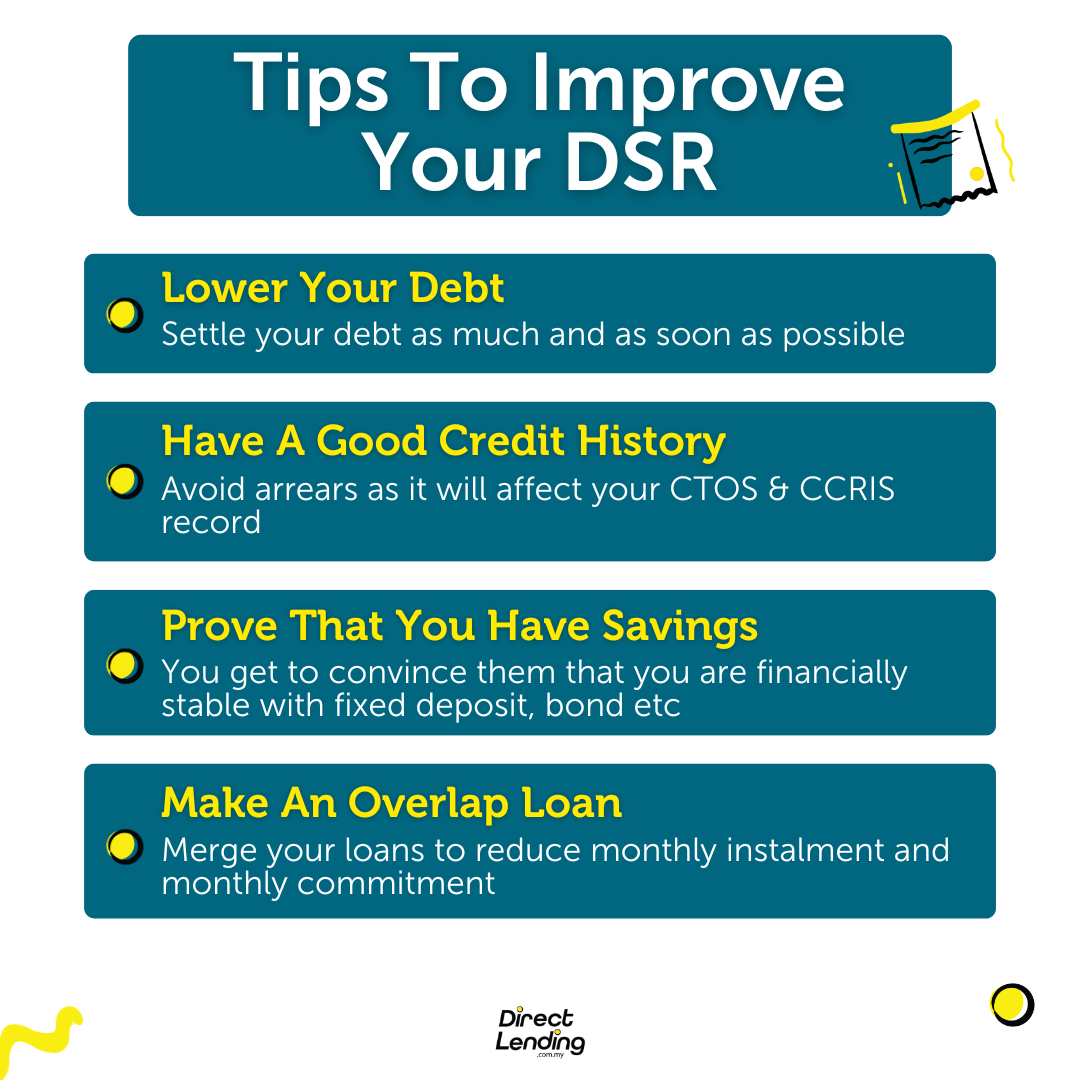

4 Ways to Improve DSR Value

If you already have a high DSR value, that does not mean that you do not have a chance to apply for any loan with the bank. Below, we have included 4 ways on how you can improve your DSR value to make sure that your DSR is better and lower from before.

1. Minimize your loan amount

Having lot of loan will surely affect your DSR value. settle your loan as soon and as much as you can. You can use technique or ways to pay off debt quickly like Snowball method where you focuses on settling debt that is lower in amount before paying off the larger debt.

2. Make sure to have a good Credit history

Avoid late payments as that will affect your CCRIS or CTOS record. If you do not have any credit history, you are recommended to start build your credit score now, as it is important and will help you in the future when you wanted to make housing loan or car loan.

This is because, not having any credit record is not good and can be classified as low credit record. The easiest way for you to build your credit record is by applying for credit card

3. Savings prove

Normally, the bank really like people who have savings. Individual that have savings are considered as low risk as they are able to show that they have a stable financial.

This is included in all kind of fix- deposit, bond, fund and more. Collect all the needed document until the day to present your application. Application can still be rejected if you do not have the complete document that is needed.

4. Make Debt Consolidation

Debt consolidation is not debt cancellation. it is a method where taking out one loan to pay off many others. This method is often used to those who are burdened with expensive monthly instalments and having loan with high interest rate.

That said, the monetary institution will combine all the old loans that you have into one new personal loan and directly, the monthly instalment will become lower. This technique will be instantly reduce your amount of monthly commitment and help fix your DSR. You can refer to our article on how to make consolidation debt for more details.

Conclusion

Eventhough a certain individual have a high salary, it does not guarantee that their application will be accepted instantly by the bank. If you have a high salary but simultaneously have a lot of commitments and loan, that would not make their DSR value any better.

This is why financial management are very important aspect that people need to pay more attention to from the early phase. By managing these commitments and debt your Debt Service Ratio will also be great.

This article is written by Direct Lending – An online personal lending platform that provides bank and koperasi personal loan as well as licensed moneylenders personal loan. For car owner, check out our car repair instalment plan- Repair car now, Pay later. We can help you find, compare and apply personal loan that best suits your financial needs. Check your eligibility for free, no upfront payment or processing fees and get a loan rates from 2.95% p.a. or 2 working days.