By Q

Fast Approval Personal Loan Within 24 Hours

Personal loan has been the primary choice for financial funding especially when you are in need for emergency cash. The flexibility in applying for fast approval personal loan online that does not require compensation or loan guarantor made it general public’s favourite like koperasi loan for public sector worker and licensed moneylender for private worker. This convenience resulted to fast approval personal loan becoming the ‘quick fix’ to help individual that have financial turbulence.

Table of contents

- Why Do People Apply for Fast Approval Personal Loan?

- How Fast Can Your Loan Get Approved?

- Fast Approval Personal Loan For Emergency Cash – 24 Hours Approval

- Fast Approval Personal Loan Online – 2 Days Approval

- Fast Approval Personal Loan For Wedding

- Fast Approval Personal Loan For Medical Cost

- Fast Approval Personal Loan For Education

- Fast Approval Personal Loan For House Renovation

- Fast Approval Personal Loan For Festivities/Vacation

- Fast Approval Personal Loan For Debt Consolidation/Overlap

- Fast Approval Personal Loan To Purchase Car/Motorcycle

- Fast Approval Personal Loan To Clear Bad CCRIS/CTOS Record

- Fast Approval Personal Loan For Business

- Infographic: 10 Fast Approval Loan for Instant Cash

- Video: How to Get Fast Approval Personal Loan Online for Emergency Cash

- Summary

Why Do People Apply for Fast Approval Personal Loan?

There can be various reason as to why people apply for a personal loan like emergency cost for medical purpose or car repair so that they can get instant cash. There are also other reason like to avoid the hussle of complicated process like business loan, car loan and more. All of these reason aside, it safe to say that these people apply for fast approval personal loan so that they can can an extra funding to help them support themselves better.

How Fast Can Your Loan Get Approved?

How fast the loan approval time needed is all depending on the type of the loan as well as the loan provider itself. There are loan that takes a few weeks to process but there are also loan application that takes only a few days. There are loan application that can be approved as fast as 24 hours and the application can be made online. All of this listed online fast approval personal loan is free (no upfront payment of processing fee).

Fast Approval Personal Loan For Emergency Cash – 24 Hours Approval

Obviously everyone is looking for a fast approval personal loan especially when you are in a tight spot and very much need the emergency cash as soon as possible. If you are lucky enough to make it through instant cash loan from bank.

However, if you did not make it through the requirement needed for a bank loan, you can try other alternative of fast approval personal loan online that is as fast as 24 hours at Direct Lending. No upfront payment and your ATM card will not be taken. Low salary is also eligible for fast approval personal loan.

Recommended Financing: Licensed Moneylender

- Loan amount from RM1,000 to RM20,000 (final approved amount based on your affordability)

- Flexible loan tenor from minimum 1 year to 4 year

- Interest rate is 1.5% per month or 18% per annum

- Have a permanent job with at least 3 months of service

- Minimum gross monthly fixed income (basic & allowances) of RM1,500 for Peninsular Malaysia and RM1,200 for Sabah & Sarawak

Apply For Licensed Moneylender

Fast Approval Personal Loan Online – 2 Days Approval

If you have a bad CTOS, CCRIS and listed in Special Attention Account(SAA) or AKPK. You are also eligible for secured fast approval personal loan with some of the licensed moneylenders. If you are a public sector worker, you have another option than credit community which is koperasi loan. Koperasi loan is more affordable and worth it as the interest rate are lower and also Syariah compliance.

Recommended Financing: Koperasi Loan

Yayasan Ihsan Rakyat (YIR) & Yayasan Dewan Perniagaan Melayu Perlis (YYP)

- Interest rate from 6.65% p.a

- Funding amount up to RM300,000

- No fees, no upfront payment. Application is 100% free.

- Eligible for government servant (except for Army)

- Permanent job and started service for minimum of 6 months

- Monthly salary minimum of RM1,500 including fixed allowance.

- High outside commitment, CCRIS/CTOS and AKPK is also eligible for loan

Fast Approval Personal Loan For Wedding

With the current living cost that is rapidly increasing, which translated itself with a high cost for a wedding. Some couple do not mind having a small and private wedding as long as they are content. Nonetheless, there are many people who dream of the dream wedding that is big and merry.

Before making the final decision to apply for personal loan to support a wedding, make sure that you and your partner have had a heart to heart conversation and they have consented. Make it loud and clear of the long term effect that the both of you will have to face together if you really wanted to apply for fast approval personal loan for marriage to upgrade your wedding budget.

If both have consented, you can apply for a small amount first or apply for loan with a low interest rate to help you and your partner make your dream wedding a reality.

Recommended Financing

- Apply for Licensed Moneylender Here

- Personal Loan from MBSB Bank

- Interest rate as low as 2.82%

- Funding amount up to RM400,000

- Tenure period minimum of 2 years to 10 years

- Payout to 98%

- Funding is secured by Takaful

Apply For MBSB Bank Personal Loan

Fast Approval Personal Loan For Medical Cost

If you have Takaful and a lot of savings, you do not have to worry about emergency medical cost as it will surely help in getting instant emergency cash. However, there are some emergency situation where your Takaful coverage cannot afford the medical cost like medical equipment and machine.

If you still need extra fund to support the emergency medical cost, you can consider applying for fast approval personal loan. Before applying for personal loan, we recommend you to apply with low interest rate so that you will not be burdened by the monthly commitment. Other alternative is applying loan with high payout which is the funding amount that you can receive up to 98%.

Recommended Financing

Apply For Licensed Moneylender Here

Personal Loan Bank & Koperasi

1. MBSB Bank

- Fixed rate as low as 2.82%

- Payout up to 98%

2. Ambank Islamic

- Fixed rate as low as 3.99%

- Payout up to 98%

3. Public Islamic Bank

- Fixed rate as low as 3.88%

- Payout up to 98%

Apply For Personal Loan Bank & Koperasi

Fast Approval Personal Loan For Education

If you want to improve your skill and equip yourself with the right skills and knowledge by signing up to professional training workshop, try looking for free online training and workshop or find a cheaper one. However, if you are interested to pursue your study, you can apply for personal loan to support the educational cost and fees.

For example, fee per semester for a Master in UiTM more or less RM3K-RM4K, the period for a master can take up to 1 to 2 years of completion. There are applicants that use personal loan to fully support their study while there are some that only need half the amount of loan and pay the rest with their money depending on their financial ability.

You can choose fast approval personal loan with low interest rate depending on your eligibility.

Recommended Financing

Apply For Licensed Moneylender Here

Personal Loan Bank & Koperasi

- Malaysian Citizen aged from 20 – 58 years old

- Public sector (AG), statutory body and selected Government Linked company (GLC)

- Amount loaned up to RM400,000

- Syariah compliance payment system

- Rate as low as 2.82%

- Approval as fast as 2 working days

Apply For Personal Loan Bank & Koperasi

Fast Approval Personal Loan For House Renovation

House renovating project can cost you a large sum and the living cost is at peak. There is a house renovation loan program but if you chose to apply for personal loan to have a house renovation, it is still counted as a good debt as making a few upgrading process like upsizing the kitchen, re-enforce the house structure and upgrading the living area will increase the house value. If the renovation cost is high, financing like MBSB Bank Personal Loan is a reasonable choice.

This funding advantages are big loan, low interest rate, longer tenure period and affordable monthly payment. This funding also does not require compensation and offers a Syariah compliance loan which is the right fit to upgrade your house renovation funds.

MBSB Bank Personal Loan

- Funding amount up to RM400K

- Floating rate as low as 2.82% p.a

- Tenure period up to 2 - 10 years

- Pay out up to 98%

- No guarantor needed

- Fast processing time- 3-4 working days

Apply For House Renovation Financing

Fast Approval Personal Loan For Festivities/Vacation

If you are having a holiday like a ‘staycation’ in a hotel or Airbnb nearby maybe you will not need the money from personal loan. However, if you are planning for a honeymoon at an exclusive place or going on a vacation with your while family members to celebrate special days like anniversary, convocation or festivities like Eid and so on, personal loan will surely help you achieve your dream vacation.

Despite that, you have to remember that as soon as the vacation ends, you have to pay back the loan right on time to avoid piling loan. This personal loan is suitable if you are to go to an overseas vacation or with your big family members and need some extra fund to support the vacation cost.

Recommended Financing

Apply For Licensed Moneylender Here

Personal Loan Bank & Koperasi

1. Yayasan Ihsan Rakyat (YIR) & Yayasan Dewan Perniagaan Melayu Perlis (YYP)

- Rate from 6.65% p.a

- Funding amount to RM200,000

- Applicant is a public sector worker (except for Army)

- Fixed salary minimum of RM1,500

2. Public Islamic Bank Personal Loan

- Rate as low as 3.88%

- Funding amount up to RM350,000

- Applicant is a public sector worker (except for Army)

- Fixed salary minimum of RM1,500 including fixed allowance

Apply For Personal Loan Bank & Koperasi

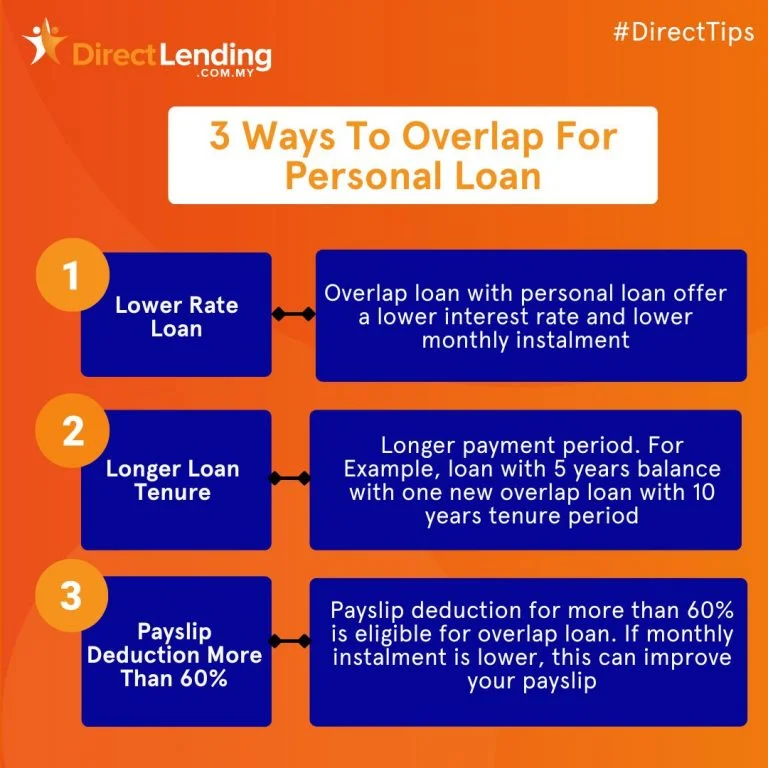

Fast Approval Personal Loan For Debt Consolidation/Overlap

Loan overlap is one of the reason why people apply for personal loan. When you are applying for overlap loan, you will get to settle your piling up loans like credit card loan, hire purchase debt and more because the lender will collect all your debts into one account (new personal loan).

You will have debt balance and different monthly payment from the old debts. Usually, the new instalment are lower than the previous debt. To ensure the monthly payment is in your financial ability range, the interest rate of the overlap loan must at least be lower than the average rate that you had.

This is one of the reason why overlap loan is one of the best option for people who have many old debt and burdening monthly commitment.

Recommended Financing: Personal Loan Bank & Koperasi

1. Yayasan Ihsan Rakyat (YIR) & Yayasan Dewan Perniagaan Melayu Perlis (YYP)

- Processing period: 2 working days

- Rate from 6.65% p.a

- Financing amount to RM200,000

2. Koperasi Bersatu Tenaga Malaysia Berhad (KOBETA)

- Processing period: 2 weeks

- Interest rate: 5.99%(Fixed)

- Financing amount up to RM250,000

3. Koperasi Putri Terbilang Malaysia Berhad (KOPUTRI)

- Processing period: 6-8 working days

- Interest rate: 5.90%(Fixed)

- Financing amount up to RM100,000

4. Koperasi UKHWAH

- Processing period: 2-3 weeks

- Interest rate: 4.99%(Fixed)

- Financing amount up to RM200,000

5. MBSB Bank

- Processing period: 3-4 working days

- Interest rate: start at 2.82%(Floating)

- Financing amount up to RM400,000

6. Kuwait Finance House (KFH)

- Processing period: 1-2 weeks

- Interest rate: start at 4.50%(Fixed)

- Financing amount up to RM250,000

Apply For Personal Loan Bank & Koperasi

Fast Approval Personal Loan To Purchase Car/Motorcycle

Personal loan is one of the way you can support emergency cost if your car or motorcycle is broken. It is also one of the alternative for you to purchase a car if you do not wish to use hire purchase (car loan) from the bank.

When you apply car loan from the bank, you are actually using hire purchase where the bank act as the legal car owner while you are the user. So, as long as the payment is not settled, the car ownership belongs to the bank until you are done with the loan payment. Unless, you apply for personal loan to buy a car or motorcycle, you can purchase the vehicle with cash loaned and own the vehicle instantly.

However, hire purchase are not applicable for car that is more than 10 years old. If you can afford to buy using cash, it is a better option as it will not add up to your monthly commitment. But if you needed extra fund to buy a car, it is not wrong to apply for personal loan with a low rate that does not need a loan guarantor.

Apply For Personal Loan Bank & Koperasi

Fast Approval Personal Loan To Clear Bad CCRIS/CTOS Record

If you have a bad CCRIS/CTOS record or blacklisted for both report, most of the financial institutions will not allow the individual from applying for loan. However, personal loan plan to clear negative CCRIS and CTOS is the only exception. You can still try to apply even though having a bad credit score or credit history.

Recommended Funding: Personal Loan Bank & Koperasi

1. Ambank Islamic

- Processing period: 2 weeks

- Flat rate as low as 4.25%

- Financing amount up to RM250,000

- PTPTN arrears is acceptable

2. Yayasan Ihsan Rakyat (YIR) & Yayasan Dewan Perniagaan Melayu Perlis (YYP)

- Processing period: 2 working days

- Rate from 6.65% p.a

- Financing amount to RM200,000

- CTOS lower than < RM30,000 is accepted

3. Koperasi Bersatu Tenaga Malaysia Berhad (KOBETA)

- Processing period: 2 weeks

- Interest rate: 5.99%(Fixed)

- Financing amount up to RM250,000

- CTOS lower than < RM20,000 is accepted

4. Koperasi Putri Terbilang Malaysia Berhad (KOPUTRI)

- Processing period: 6-8 working days

- Interest rate: 5.90%(Fixed)

- Financing amount up to RM100,000

- CTOS lower than < RM5,000 is accepted

5. Koperasi UKHWAH

- Processing period: 2-3 weeks

- Interest rate: 4.99%(Fixed)

- Financing amount up to RM200,000

- CCRIS/CTOS negative records accepted. Case-to-case basis, subject to koperasi UKHWAH’s approval

6.Kuwait Finance House (KFH)

- Processing period: 1-2 weeks

- Interest rate: start at 4.50%(Fixed)

- Financing amount up to RM250,000

- CCRIS outstanding debt within 2 months and CTOS under RM3,000 is still eligible to apply

Apply For Personal Loan Bank & Koperasi

Fast Approval Personal Loan For Business

If you just started up a business or need funding to upgrade your business, there are a few funding scheme or business loan that you can apply. Many business owner apply for business loan as it offers a lower rate and affordable monthly instalment. This greatly help especially if you loan a huge amount. However, there are a few business owner that pick personal loan for business:

- Started up business

- Small amount of loan

- Need instant cash

- Do not want to go through the hassle of preparing business documents required

In account of that, we suggest a few options of personal loan for you:

Apply For Licensed Moneylender Here

Apply For Personal Loan Bank & Koperasi:

- Rate as low as 2.82%

- Loan amount up to RM400,000

- Syariah compliance payment system

- Loan approval as fast as 3 - 4 days

Apply For Personal Loan Bank & Koperasi

Infographic: 10 Fast Approval Loan for Instant Cash

Video: How to Get Fast Approval Personal Loan Online for Emergency Cash

Summary

All the suggested loans are based on the specifics need that you might have for applying for a personal loan or fast approval personal loan. However, that does not mean that you cannot get a personal loan or fast approval personal loan from a different loan provider than the one that we recommended because every loan provider have their own approval criteria.

Other than checking eligibility from each applicant, every lender will also look at your credit score and payment history of your other debts. There are a few lenders that is more flexible in approving their loan, while there are some that requires supporting documents to convince them to approve your loan application.

Due to that, Direct Lending will make thing easier for loan applicants and will recommend the best loan provider with fast approval personal loan for you. Our 5 stars service is fast, easy, safe and FREE. No upfront payment or any hidden cost will be charged. Check your eligibility online through our platform Direct Lending and our friendly loan consultant will help you to choose the best loan that suits you.

This article is written by Direct Lending – An online personal lending platform that provides bank and koperasi personal loan as well as licensed moneylenders personal loan. For car owner, check out our car repair instalment plan- Repair car now, Pay later. We can help you find, compare and apply personal loan that best suits your financial needs. Check your eligibility for free, no upfront payment or processing fees and get a loan rates from 2.82% p.a. or 2 working days.