By Sera

Marketing

What Is a Personal Loan & The 5 Things You Should Know Before Applying

Personal loans are popular among individuals in Malaysia due to their wide availability. Usually, applicants do not need to provide collaterals or assign loan guarantors, all you need are a good credit score and proof of steady income to ensure that you can afford the monthly instalments.

Regardless of that, we have prepared a comprehensive guide within this article to assist you in further understanding what a personal loan is, what to consider before applying, things you need to know before signing a contract and many more, including the mistakes to be avoided while applying for a personal loan.

What is a personal loan?

A personal loan is money that an individual borrows from a particular financial institution with an agreed upon interest rate and duration for loan repayment.

A personal loan provides the borrower with a flexibility in using the borrowed fund according to their individual needs which range from clearing personal debt to funding education.

Types of Personal Loans

There are two types of personal loans, secured and unsecured personal loans, and how do they differ from each other?

Secured personal loan

This loan requires a guarantor or a collateral in the form of property. If the borrower defaults on the loan, the institution acting as his/her creditor has the power to seize the collateral, more formally known as collateral repossession, or they can also transfer the responsibility of repayment to the guarantor.

This type of loan is usually taken by borrowers with weak credit records, but it is also favoured by some due to it having a lower interest rate as compared to others.

Unsecured personal loans

This type of loan does not require any guarantor nor collateral, and in addition, it also gets approved quicker and easier if the applicant meets the minimum requirements set.

However, it also comes with a higher interest rate as compared to others.

5 Things to Consider Before Applying for A Personal Loan

Source: Freepik

Source: Freepik

1. Do you really have to apply?

Before applying a loan, you need to have a good reason for a personal loan, be it for house renovations, vehicle purchase, starting or expanding businesses, education, healthcare, getting married, etc.

Before deciding to borrow, think again if your needs could be met through saving. With a decent amount of savings, the loan amount can be reduced and the borrowed funds can be used merely to top-up the insufficient amounts.

You must also consider whether the loan taken will be a form of investment or burden to you. Will the the loan be bringing you long-term returns? You must know that taking up a personal loan can be a big responsibility and you must weigh up its costs and benefits to you before making a final decision.

Unexpected circumstances may force you to take up a loan. You may be left with no option other than funding medical emergencies and surgeries with a personal loan, and it can come in handy for when times are really tough. The most important thing to consider is that you can afford monthly repayments comfortably with your monthly income.

2. Will you be better off financially?

Some of us might have experienced feeling ‘trapped’ in debt, and there is no denying that financial constraints may feel very difficult to overcome. Although it may sound counterintuitive, taking up a personal loan can actually help one to improve their financial position by improving their cash flows.

Debt consolidation is a technique where an individual takes up a personal loan for paying off debts, usually credit card debts. A credit card, which is essentially a piece of plastic, may give the impression of great consumer buying power but this can also destroy one’s financial position if not used wisely. Usually with an annual interest rate of 18%, a credit card debt may very quickly grow especially with uncontrolled usage, but this can be corrected through debt consolidation. You can also use this same technique for paying off your other commitments and may be able to save on interest rates.

3. Determine the amount you need and the amount you can afford

Once you have determined a reason to borrow, you will now have to check whether you qualify to apply. A part of this step is to calculate the monthly repayment amount that you can afford based on your income, and this is essential in ensuring that you do not end up borrowing more than you can manage.

As a general guide, your monthly commitment should not amount to more than 60% of your monthly income. This information can be used for you to determine the loan amount that you can afford as well as the repayment duration.

Other than that, retaining 40% of your monthly income will leave you with enough for your essential needs and other regular expenses. A smart borrower will not borrow more than he/she can afford or take up loans that will put a strain on their financial position.

4. Find the right creditor

The loan that you make needs to be safe and worthy. Find a creditor that can help you get a loan approval and not merely offering processing services. Make comparisons of interest rates and repayment conditions across several loan providers; this is to ensure that you feel confident about the loan and not make mistakes. Discuss your options for repayment thoroughly with every potential creditor, especially on matters such as the type of base rate, whether they are fixed or variable, flat rate, as well as if there is any early settlement penalty.

5. Only deal with trusted creditors and consultants/agents

A trusted creditor will not take advantage of the trust given by their borrowers. No certified creditors will ask for deposits, all fees will only be deducted from the loan once it has been approved, and the fees involved should be stated clearly.

The same is for certified agents, where they too will not take any deposit. Their commission will only be received from the creditor institution when the loan has been approved. Beware of agents asking for processing fees as this is one of the signs of a personal loan scam.

8 Things You Should Check Before Signing a Personal Loan Contract

Watch this video for more explanation on personal loan contracts.

What is a contract?

A contract is a spoken or written agreement between two parties on a particular matter. Other common terms that are used interchangeably are agreement and act. We may not notice it but we are exposed to contracts nearly all the time in our daily lives, for instance, ticking on an ‘I Agree’ checkbox under a website’s terms and conditions is a form of contract. For more information on contracts, you can refer to the Contracts Act 1950.

Interest rate

Most personal loans in Malaysia offer fixed interest rates where the interest rate does not change over the duration of the loan. Next, look at the amount of interest rate. This is what you need to be able to calculate your monthly instalments.

For example, you are applying for a cooperative bank loan of RM10,000 from Co-Opbank Pertama with an annual interest rate of 2.95% and a loan term of 10 years. Your monthly instalment will therefore be about RM96.

Next, you need to consider if the interest rate being offered suits your financial position. A higher interest rate means that you have to pay a higher monthly instalment.

Repayment method

Check with your creditor for any preferred repayment methods. Usually, banks are flexible with accepting payments, from cash deposits, cheques, bank transfers, etc. On the other hand, koperasi loan require borrowers to set up automatic salary deductions through ANGKASA.

Loan term

A loan term refers to the duration given to a borrower to repay the overall amount of a loan. The minimum loan term for a personal loan in Malaysia is 1 year (12 months) and the maximum is 10 years (120 months).

The maximum age to apply for a personal loan is under the age of 60. This means that if you apply for a loan at the age of 54, your loan term will be 6 years. However, some financial institutions have set the age limit to 50 or 55.

Late fee

A late fee will be charged when a borrower fails to pay their monthly instalment after the given due date. Again, this depends on the respective institution acting as the lender. The fee imposed is calculated as a percentage of the overall outstanding loan amount.

Nevertheless, for an Islamic personal loan, there is no compounding interest rate on late fees. A borrower will be charged based on remaining instalments to be made. This means that an Islamic personal loan charges a lower late fee as compared to a conventional loan.

In general, you are advised to make monthly repayments on time to avoid being charged late fees besides leading to a better credit record.

Rebate

Some financial institutions offer rebates for borrowers if they manage to repay the loan amount fully before the end of the agreed loan term. Generally, many conventional banks in Malaysia calculate rebates based on the ‘Rule of 78’, whereas Islamic loan rebates are calculated using the ‘Ibra’ formula. To get a better understanding of personal loan rebates, we will demonstrate using the calculations below.

Suppose a scenario of a personal loan of RM20,000 with a loan term of 60 months (5 years). The interest rate or return rate is 6%. The borrower has chosen to repay the entire loan amount within 20 months.

| Conventional personal loan | Islamic personal loan |

| [(n-3) x (n-2) / N(N+1)] x l | [N(N+1) / N(N=1)] x PM |

|

n = remaining monthly instalments N = loan term l = interest to be paid n = 60 – 20 = 40 N = 60 l = RM20,000 x 6% x 5 = RM6,000 |

n = remaining monthly instalments N = loan term PM = profit margin n = 60 – 20 = 40 N = 60 PM = RM20,000 x 6% x 5 = RM6,000 |

| [(40-3)(40-2) / 60(60+1)] / x 6000 | [40(40+1) / 60(60+1)] x 6000 |

|

Total rebate = RM2,304.92 |

Total rebate = RM2,688.52 |

The example given above is only a guide for calculating rebates. Check with your respective creditors for your exact rebate amount and explanations.

Early settlement & “lock-in period”

Early repayment or resettlement is when a borrower decides to pay off the loan before the end of the loan term. This may cause an early repayment charge to be imposed, although this may differ from one institution to another. For example, some banks may charge a certain percentage on the outstanding balance or charge a fixed rate, while some banks may not charge early repayment fees at all. Therefore, bear in mind to also check this with your creditor.

In some cases, a personal loan contract may also include a lock-in period. This is when borrowers are not allowed to pay in full earlier than what is scheduled as the loan term or they may face early repayment penalties.

Handling fee, processing fee & stamp duty

Check with the financial institution that you are dealing with for any handling fee they may charge you with. Some institutions do not impose any handling nor processing fee. On the other hand, stamp duty fee is about 0.5% on the loan or in simpler terms, a charge of RM5 is imposed on every RM1,000 of the loan. So, if your loan amount is RM10,000, the stamp duty will be RM50.

Normally, any charges or fees will be automatically deducted from the loan itself. If you are asked by the creditor to pay a deposit as processing fee, this might be a red flag for a scam. You should always remember that certified loan providers will not ask you for any payment before you accept a loan.

Certain government loans may also charge a membership fee of around RM25 – RM30 per month. This amount will be deducted from your salary and simultaneously your monthly instalment.

Insurance

Usually, a borrower will receive an insurance coverage to protect from potential loan defaulting as a result of accidents that may cause total permanent disabilities (TPD) or death. This is a way of protecting both the borrower and the lender.

The insurance premium is calculated based on the amount of loan. Normally, this insurance will be taken from whichever insurer that the creditor institution works with, but sometimes flexibility is given for borrowers to choose their own insurers. Meanwhile, some lenders do not require their borrowers to get any insurance protection at all especially for short-term loans with loan terms less than 3 years.

5 Personal Loan Myths

Myth 1: Personal loan is a bad debt

The truth is, a personal loan only becomes a bad debt if the individual borrower fails to manage their own finances accordingly. A lot of personal loans get misused by borrowers themselves due to poor management or lack of knowledge, also causing them to fail to repay the monthly instalments well.

To overcome this, seek money management advice from certified parties to get help in checking your eligibility before applying for a loan. This is essential in knowing the amount of monthly instalments that you can afford to repay.

Myth 2: Personal loans carry high interest rates

Every loan, regardless of purpose, has their own interest rate that is determined by the institution that provides it. Interest is usually set at acceptable rates, but lateness of borrowers in making repayments can cause them to be charged with penalties and fees as have been agreed in the loan contracts.

When this happens, the amount to be paid grows due to outstanding balances and penalties, causing borrowers to mistake them for high interest rates. To avoid confusion on the amount of interest rate charged, confirm with the officers responsible on this matter and other matters like penalties imposed (if any).

Myth 3: Personal loans badly affect your credit score

Yes, this can happen, but only if you cause it yourself through late repayments. Your credit scores can worsen if you make late repayments or do not pay any types of instalment (including your phone bills), not only limited to personal loans. It is always useful to learn about CTOS and CCRIS, how they are calculated, the factors that affect them and ways to clear your CCRIS.

Myth 4: My personal loan application will only get approved if I am a civil servant

In the process of getting a loan application approved, your eligibility is assessed based on your income and commitment in repaying the monthly instalments, and not limited to your job sector solely. If you meet the requirements and maintain a good credit record, you have the same probability of getting approved for the loan regardless of your job sector.

To ease the process of approval, it is important to present all the required documents accordingly. Therefore, make sure that you have all the documents needed to proof your repayment ability (e.g. salary slip, latest EPF statement or Income tax statement) to present to the lender during your application.

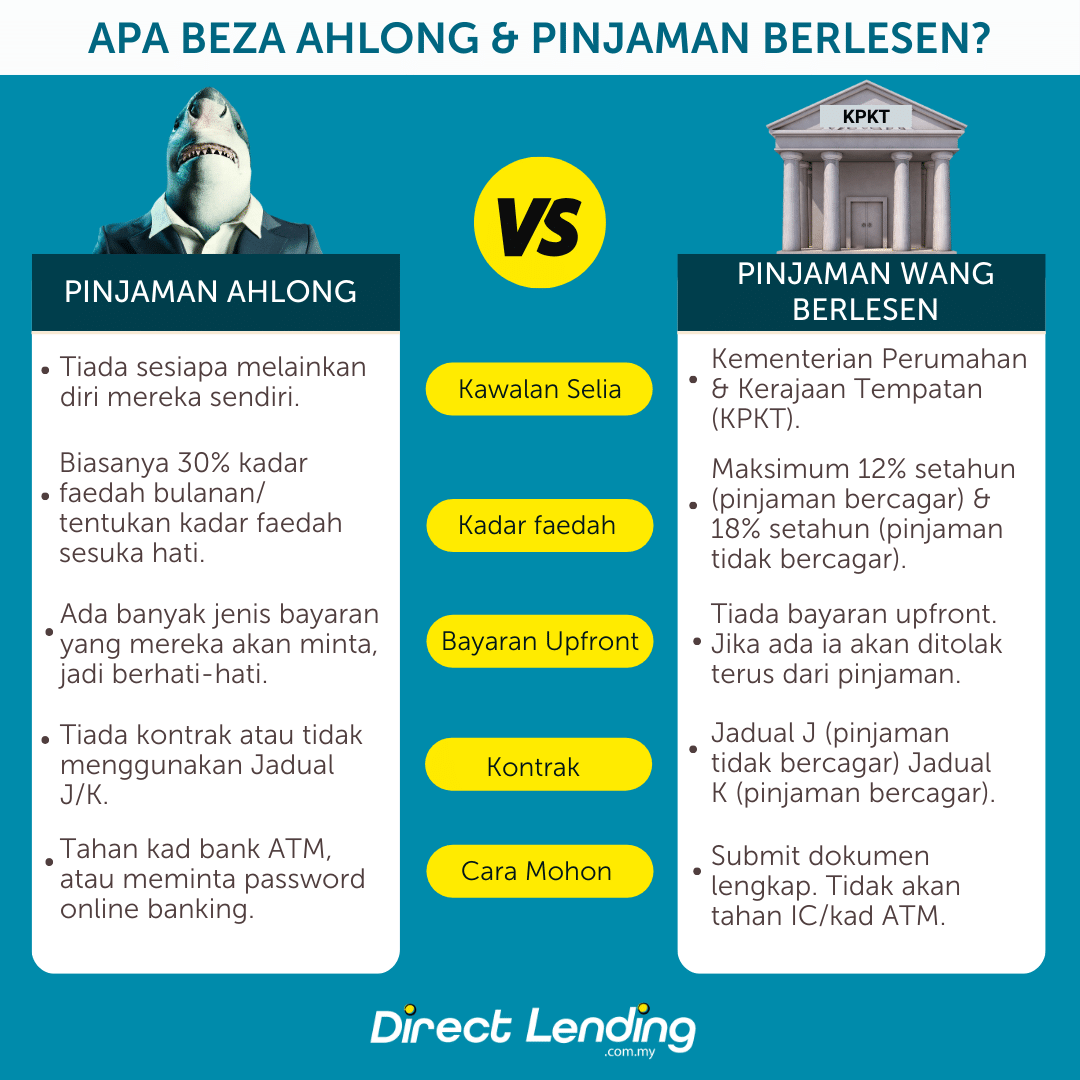

Myth 5: You can only get personal loans through “Ah-Long” or will need to pay a deposit for getting a personal loan, if you have been rejected by banks

Before you borrow, do background checks on the agency that is offering the loan. There have been countless news reports on people getting scammed after borrowing from the wrong agencies. Many are tempted by the agencies that promise very quick loan approvals, sometimes as quick as within an hour!

As a borrower, you have to always be cautious of services provided by certain parties by making careful background checks. At the very least you should know that a certified lender will not charge you anything before you accept a loan.

Avoid These 6 Mistakes Before Applying For A Personal Loan

Perhaps you are eligible for a higher amount of loan, but this does not mean that you should take it. Bear in mind that a higher loan amount will require you to pay more interest over a longer time.

2. Disregard your credit score

Banks will process your application by evaluating your credit score. This piece of information is important as it reflects your attitude in debt repayments, whether you are consistently on time or otherwise.

If you have outstanding debt like credit card debts, you should settle those first before applying for a personal loan. Your credit scores will determine the approval of your loan, the loan amount and the interest rate that will be charged on you.

There are also alternative sources of personal financing such as licensed money lenders or cooperative loan (koperasi) where they can offer loans to applicants with lower credit scores. Licensed money holders usually charge higher interest rates than bank and koperasi loans. This is because cooperative loan repayments are made through salary deductions, whereas licensed money holders still assess your ability to repay using your credit score.

3. Borrowing from unlicensed money lenders or ‘ah long’

In desperate times, one is inclined to making decisions that may be unwise just so that they can find solutions to their problems. Therefore, one may resort to applying from ‘ah long’ because these agencies are able to offer cash quickly. However, it is always advised to do background checks on your creditors, even when you are desperate. If the offer is ‘too good to be true’, the creditor is likely to be an ‘ah long’, or loan shark, and they are unregulated creditors that may end up exploiting and even harming your overall safety.

4. Offering to use your name for someone else’s loans

There are instances where individuals offer others to use their names for someone else to apply for loans, such as friends and family members. This is a very risky move as the person who is the actual borrower may be prone to default on the loan, but the one that has to bear the brunt of this situation is the one whose name is registered on the loan. You may even go as far as being declared bankcruptcy for a loan that is not even yours to begin with.

5. Serve as guarantor without making thorough assessments

Some banks require borrowers to appoint a guarantor for their loans to be approved, and you may be asked by friends or family members to act as their guarantor. This is not the wrong thing to do, but you need to make sure that you are aware of the person’s financial situations and their attitudes towards loan repayments. This is so that you do not get caught should the borrower ends up defaulting. Before becoming a guarantor, make sure that you and the borrower have a mutual trust so that you do not end up getting caught up in legal proceedings and other repercussions.

6. Ignore the contracts and documents involved

The loan contract documents and the loan application process undoubtedly may seem complex and intimidating, so it is easy for one to look past the details altogether. However, it is vital for you to properly know and understand the intricacies involved with your loan so that you do not end up regretting what could have been avoided. Imagine not knowing beforehand that you will be faced with a very high interest rate over the next 10 years of your loan term! So, be attentive towards the details when you apply for a loan. Make careful comparisons and go for the best option, and also think of the long term.

Conclusion

Finally, get a loan provider that can offer you a financial product that also comes with conditions suitable with your financial position. As a gentle reminder, a creditor with low interest rates may end up charging hidden fees. We hope that this comprehensive guide will help you in making better choices and make smart financial decisions.

This article is prepared by Direct Lending, an online loan platform that offers bank & koperasi personal loan, especially for the civil servant. We can help you to find, compare and apply financing that best suits your financial needs

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.