By Yik Seong

Director

9 Common Reasons for Applying for a Personal Loan

Why might an individual choose to apply for a personal loan? One of the reasons for personal loan for this is that they need some extra cash on hand.

That being said, there are also those whom already have enough for regular expenses but still opt for making personal bank loans or koperasi loans.

This could be because in order to gain some extra money to fund less regular expenses, borrowed personal loan from licence money lender or koperasi are often more affordable (measured in terms of interest rate) and easier to obtain as they usually do not require any asset collaterals. You must still be vigilant in choosing the correct agency to borrow from and avoid ‘Ah Long‘ or loan sharks at all costs.

So how does a personal loan work?

There are several type of base rate in Malaysia, and most personal financing in Malaysia offer fixed rate, meaning that the amount paid as monthly instalments is equal for each month.

As mentioned before, most personal loans also do not require any collaterals. This means that borrowers do not have to risk their assets nor appoint loan guarantor for their application to be approved. This flexibility is preferred because many would want their financial needs to be fulfilled with a simple ‘quick fix’, especially in times of emergencies.

Video: How to Apply Personal Loan 2024, Fast Approval!

Most personal loan applications get processed as quick as 24 hours after you have your eligibility checked, and once you get your loan approval, it can take from 24 hours up to a few weeks for the money to be credited to your account depending on each respective financial institution. It is after all these other steps that you will begin to repay the loan through monthly instalments.

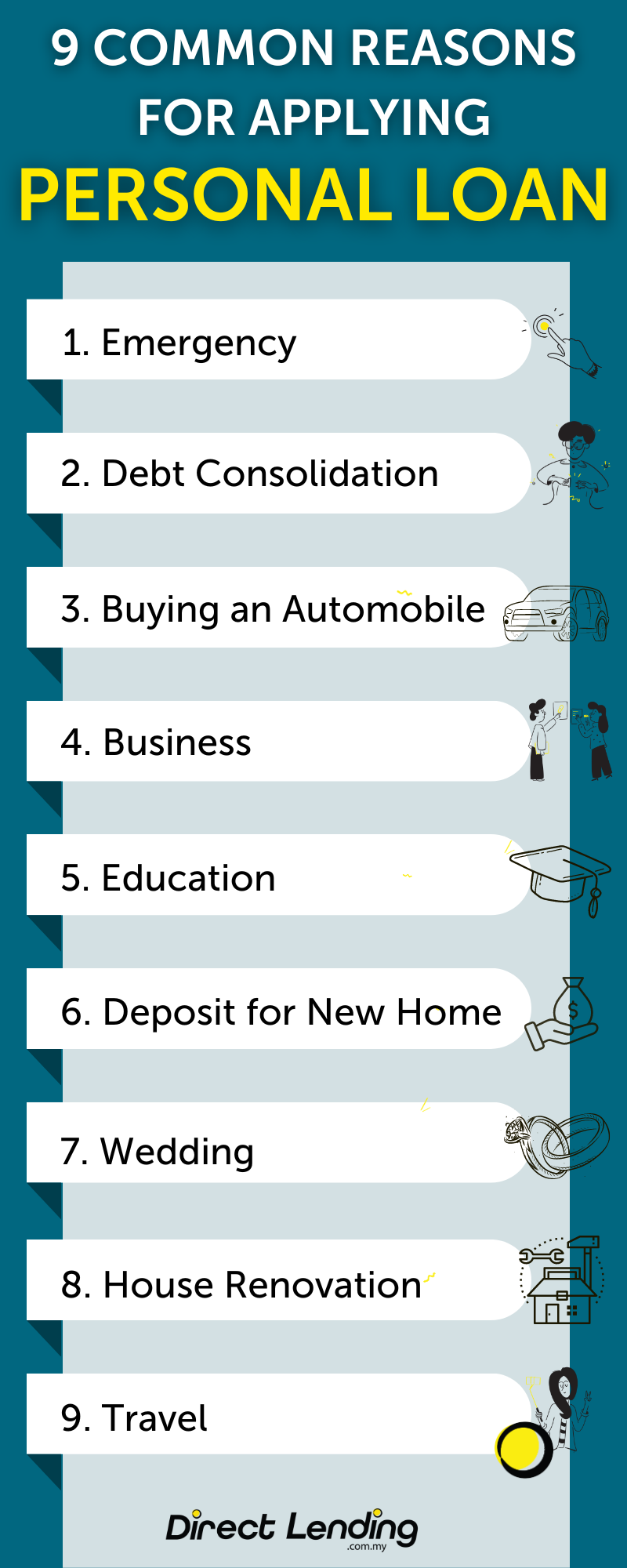

These are the common reasons for applying for a personal loan:

1. Emergency

Source: Cied Peru

Source: Cied Peru

Sometimes life finds a way to present you with a circumstance you least expect to happen, and these can tend to put you in dire situations. You may suddenly be faced with a large and urgent healthcare bill to bear, or your car might need repairing. At times like these, a personal loan may be a big help to alleviate your worries.

Another scenario may be that you unexpectedly lose your job or your main source of income, and taking a personal loan might be your best temporary solution to make ends meet while finding a new job.

Alternatively, a civil servant can also obtain personal financing through cooperative loans. This is an affordable type of loan offered by several cooperatives in Malaysia and is also an option for civil servants with poor CCRIS and CTOS records, or are listed in AKPK or SAA.

Certain cooperatives would still approve loans for civil servants with poor credit records and this is due to their preferred loan repayment method, which is through automatic salary deductions on ANGKASA. Nevertheless, this does not mean that an individual’s credit record is disregarded altogether in determining the approval of his or her loan application.

2. Debt Consolidation

The next reason for applying for personal loans is for debt consolidation.

The next reason for applying for personal loans is for debt consolidation.

This is a method in which separate debts with respective interest charges are conjoined into one single personal loan with one (usually lower) interest rate. This will also consolidate all the debts into a new personal loan account.

For those with high commitments such as having several credit card debts, this helps in improving their cash flow and cutting down the burden of interest charges.

For example, if you have an outstanding credit card debt with annual interest rate of 18%, by debt consolidation, you will be able to repay the loan at possibly a much lower interest rate.

This process allows the borrower to focus on repaying their debt to one single party and thus lowering the chance of missing payments, late fees and resulting ballooning debt.

A personal loan may be an individual’s way of clearing outstanding debt and improving their CCRIS and CTOS credit records.

3. Buying an Automobile

In instances where a buyer is interested in buying an old/classic car, they may only be able to afford it through personal loans. This is because conventional hire purchase loans are not available for cars beyond a certain age limit (10 years and above), and the best way to buy a car is to just pay in cash.

Besides vintage automobiles, motorcycles are also often bought in cash funded through a personal loan. There are times when this option is better than a conventional hire purchase loan in terms of being more affordable and bears lower interest charges. Some of the benefits of funding a new motorcycle through a personal loan are:

- Full ownership of the motorcycle by paying in cash to the dealer

- Longer duration for monthly instalments i.e. up to 120 months

- Monthly instalments may be lower (due to increased loan term)

It should be noted that personal loan approvals are dependent on each applicant’s respective credit record and and if they meet the eligibility criteria, this can still be a time consuming process.

4. Business

Entrepreneurs of small and medium enterprises (SMEs) are more likely to face financial difficulties in sustaining their businesses, especially at startup.

Be it for starting up or expansion of their businesses, business owners have 2 financing options; loans and personal loans, and these products are not similar.

Business loans are for those who would like to start a new business or are looking for expansion. They are offered by institutions like TEKUN and MARA that usually provide business loans for SMEs.

As compared to personal loans, business loans are charged with lower interest rates ranging from 5 to 10%. It is however quite restricted to only businesses of certain kinds; if your business is related to the investment and property sectors, your loan application might be rejected.

If you are a business owner that do not qualify for business loans, you may opt for personal loans as a way of financing. Do not get put off by interest rates just yet as some loans, such as those offered through Direct Lending offer as low as 2.95% interest, although they are only open to civil servants.

5. Education

As the investment mogul Warren Buffett has put it, “the best investment you can make, is an investment in yourself…”, and this may be the reason that more and more people are pursuing education, whether by enrolling in universities or through online courses.

If you are seeking formal education in colleges or universities, you will know that the tuition fees are usually not cheap, but you can fund this pursuit through a personal loan.

To quote an example, a Master’s programme in UiTM would cost around RM3K to RM4K per semester, and the duration of study is around 1 to 2 years. One can choose to cover this cost fully through a personal loan, or only partially with the rest funded by their own savings.

6. Deposit for New Home

Owning a property has long been a status symbol and also a source of a comfortable life, but many are still not able to afford the large costs that is required to own a house.

This is because a downpayment or deposit is needed to secure a house purchase, and although several developers do offer zero downpayments, they may come with other drawbacks such as higher interest rates and lower loan margins which make this less of an attractive offer.

Therefore, one can choose to fund their housing deposits through personal or cooperative loans.

7. Wedding

Do you really need to borrow in order to get married? The answer lies in the preference of the couple themselves. Some would prefer a regular wedding catering to only the closest friends and family in order to save costs, while some may insist on going big and bold. At the end of the day, the couples must be fully aware of the long term implications of their decisions.

A couple should make it a point to come to a mutual agreement before applying for a personal loan that is intended to fund the wedding ceremony. Yes, rising living costs have made a wedding ceremony expensive regardless, but a proper budgeting and careful planning can help a family to execute a decent ceremony without burning a hole in their pockets.

If the couples insist on borrowing, perhaps they can choose a smaller amount of loan that will help them achieve their desires without leaving them with huge burdens of debt trailing behind.

8. Home Renovation

The key to retaining the quality of a house and its value lies in its maintenance, but house renovation costs can be overwhelming, and very thorough planning is needed before modifying a house in order to cut down on wastage.

It is understandable that certain homeowners get derailed from their original modifying budget due to unplanned raw material costs.

This is why they can choose to fund their renovation costs through personal or cooperative loans.

9. Travel

Last but not least, most of us have prepared bucket-lists of ‘countries to have visited by the age of 30’ or something similar, but this is quite an expensive dream to have.

Perhaps you have saved for that dream trip of yours but still lack a certain amount, and this can be solved through taking a personal loan. All you need to make sure is that you are able to repay the monthly instalments without it being a great difficulty to you.

Infographic: 9 Common Reasons For Applying Personal Loan

Reminders Before You Take Up A Loan

These are the few important reminders before you apply for a personal loan

- Determine the amount of loan that is enough and comfortable for you to make repayments.

- Understand the terms and conditions of your loan, such as loan term, flexibilities in repayment and time taken for approval and getting the money credited into your account.

- Check if your creditor agency is certified to avoid falling victim to scams.

This article is prepared by Direct Lending. A digital platform that helps you to find, make comparisons and apply for the cheapest and most suitable personal loan for you. Our smart eligibility checking system is able to suggest the best personal loan from Bank and Cooperatives for you. Our service is 100% free, no upfront fees or processing charges.

(This article was originally published on the 12th of August 2017 and has been updated on the 20th of March 2024).

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.