Malaysia’s Loan Specialist

130,000+

successful loan eligibility checks

RM 300m

safe financing disbursed

2,000+

5-star reviews from our customers

How Direct Lending works?

Check Your Rate

Submit Documents

Verify Details & Accept Offer

Get Your Money

What our Happy Customers Say

You could be next

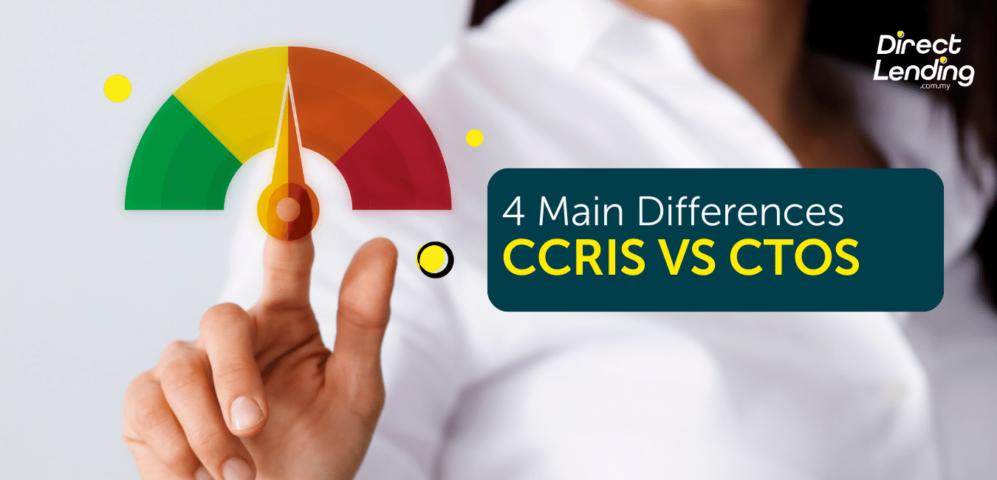

What’s new at Direct Lending

We are always eager to help improve your personal finance affairs.

Direct Lending Partners with Tan Chong Motor to Introduce a Shariah-compliant Auto Service Financing

Direct Lending Partners with Tan Chong Motor to Introduce a Shariah-compliant Auto Service Financing

Frequently Asked Questions

Direct Lending started as a digital personal loan platform, enabling borrowers to find, apply and receive personal financing that best suits them in a safe and affordable manner. There are currently over 30 financing providers on its platform, from co-operatives, Bursa Malaysia listed companies, licensed moneylenders and credit communities.

With the vision to provide a seamless financing experience for every hardworking adult, Direct Lending launched its first point of sales financing solution in late March 2022, a Syariah compliant auto service financing which enables car owners to obtain financing at workshops to pay for their essential car repairs instantly. In December 2022, Direct Lending further expand the business by offering financing to micro SME businesses

Direct Lending is recognised as the Top Rising Star of The Year by Fintech Frontiers Award 2023. Direct Lending is a recipient of Cradle CIP300 funding in 2019.

Direct Lending only collaborates with licensed and legitimate koperasi, licensed moneylenders and credit communities. The application process is 100% free for our borrowers. Since incorporation in 2016, we have received over 2,700 5-stars review from our customers in our Google Business Page and Facebook.

For civil servant personal loan, you are eligible to borrow if you are currently:

- A Malaysian citizen aged between 20 and 58 years old

- Have a permanent job in the civil sector and with at least 6 months of service

- Minimum gross monthly income of RM1,500

For private sector personal loan, you are eligible to borrow if you are currently:

- A Malaysian citizen aged between 18 and 60 years old

- Minimum gross monthly income of RM1,500 for Peninsular Malaysia and RM1,200 for Sabah & Sarawak

- Have a permanent job with at least 3 months of service

For auto service financing, you are eligible to borrower if you are currently:

- A Malaysian citizen aged 18 and above

- Have sufficient income to meet the monthly repayment

You can:

- Email us at support@directlending.com.my;

- call us at +603 9212 4200 between 9.00am-6.00pm from Monday to Friday

- chat with us through Direct Lending website

- visit us at our office at Unit 22-3A, Oval Tower Damansara, 685 Jalan Damansara, 60000 Kuala Lumpur

We’d love to hear from you!