Featured Blog

February 12, 2026

We have received many inquiries from our customers on how to improve their CCRIS report (Central Credit Reference Information System) records.

Latest Blogs

February 12, 2026

We have received many inquiries from our customers on how to improve their CCRIS report (Central Credit Reference Information System) records.

February 11, 2026

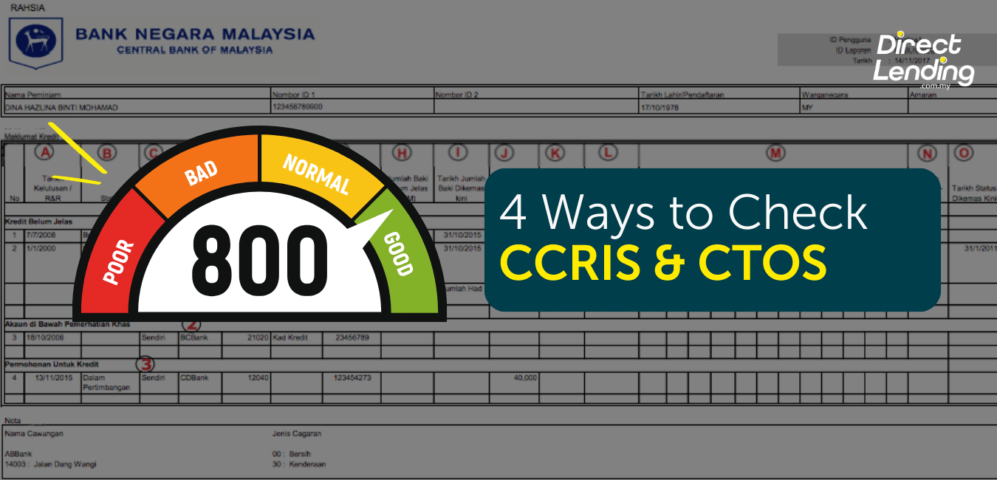

“Your loan is rejected because you have a bad CCRIS or CTOS record”. Have you been told this before by a bank officer? And you are wondering, “What is CCRIS and CTOS?”.

January 12, 2026

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

December 10, 2025

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

November 12, 2025

The recent case of loan sharks charging RM500 for every 30 minutes delay in repayment is not an exaggeration. This case happened to an insurance agent who borrowed RM3,000 and paid the full amount.

November 12, 2025

Personal loans are popular among individuals in Malaysia due to their wide availability.

January 12, 2026

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

December 10, 2025

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

November 5, 2025

The term ‘car loan’ is a term that is familiar to most of us and it is very commonly talked as car is a necessary asset to have now. It is the best not to only rely on the public transport for our daily commute.

November 5, 2025

Everyday, people are always out and about, be it for work or for pleasure. People always move and transport from places to places.

November 5, 2025

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

October 30, 2025

“Get money from home refinancing? How does that work?” Perhaps some of us are not aware that the homes we live in can actually bring us some extra cash.

February 12, 2026

We have received many inquiries from our customers on how to improve their CCRIS report (Central Credit Reference Information System) records.

February 11, 2026

“Your loan is rejected because you have a bad CCRIS or CTOS record”. Have you been told this before by a bank officer? And you are wondering, “What is CCRIS and CTOS?”.

November 12, 2025

The recent case of loan sharks charging RM500 for every 30 minutes delay in repayment is not an exaggeration. This case happened to an insurance agent who borrowed RM3,000 and paid the full amount.

November 12, 2025

Personal loans are popular among individuals in Malaysia due to their wide availability.

November 5, 2025

The term ‘car loan’ is a term that is familiar to most of us and it is very commonly talked as car is a necessary asset to have now. It is the best not to only rely on the public transport for our daily commute.

November 4, 2025

A personal loan is a type of credit facility offered by financial institutions to help fulfill your financial needs. In general, many borrowers apply for a personal loan based on various reasons such as settling overdue debts, tackling emergency needs, wedding costs, home renovation, and many more.

June 18, 2024

There is no doubt that there are a handful of people whose salaries are always insufficient and worst, run out before the next one. So the question is, how to save money in Malaysia?

June 4, 2024

Have you ever thought of what you might do if you are suddenly faced with a RM40,000 medical surgery bill?

April 24, 2024

In the more recent years, the state of the economy has been fluctuating in an unprecedented manner that it has become even more important to have a steady amount of savings, especially for your children education fund.

April 23, 2024

Owning a home is definitely one of the things that people would name as a ‘life goal’, and it even serves as a status symbol apart from being a source of comfort.

March 4, 2024

Recent statistics have shown that more than half of Malaysians admit to not having enough savings to survive on for longer than 3 months.

December 29, 2023

There are many individuals who still struggle to save money from salary or earned income. In fact, many could not survive throughout the month and end up borrowing either from banks or family and friends.

February 12, 2026

We have received many inquiries from our customers on how to improve their CCRIS report (Central Credit Reference Information System) records.

February 11, 2026

“Your loan is rejected because you have a bad CCRIS or CTOS record”. Have you been told this before by a bank officer? And you are wondering, “What is CCRIS and CTOS?”.

November 12, 2025

The recent case of loan sharks charging RM500 for every 30 minutes delay in repayment is not an exaggeration. This case happened to an insurance agent who borrowed RM3,000 and paid the full amount.

November 12, 2025

Personal loans are popular among individuals in Malaysia due to their wide availability.

November 4, 2025

A personal loan is a type of credit facility offered by financial institutions to help fulfill your financial needs. In general, many borrowers apply for a personal loan based on various reasons such as settling overdue debts, tackling emergency needs, wedding costs, home renovation, and many more.

October 30, 2025

The biggest cargo people carry these days is debt. Borrowing, including the use of credit cards, is habit-forming. Once you get caught in the habit, you run the risk of spending more than you can really afford.

June 18, 2024

We can all agree that the cost of living in Malaysia has increased significantly. One of our daily necessities that have been increasing is the cost of petrol.

April 23, 2024

Skim Pinjaman Pendidikan, Perbadanan Tabung Pendidikan Tinggi Nasional (PTPTN) is a national student loan scheme that aims to provide financial aid to students undergoing higher education in local higher education institutions or IPTs (Institusi Pengajian Tinggi).

January 5, 2024

The past two years have been extremely challenging to many as we are still combating the spread of the COVID-19 virus.

December 29, 2023

There are many individuals who still struggle to save money from salary or earned income. In fact, many could not survive throughout the month and end up borrowing either from banks or family and friends.

December 29, 2023

Based on The Sun Daily, divorce cases in Malaysia has drastically increase over the last few years since the pendemic. A failed family planning is one of the major trigger for a fight to brake between spouses which leads to miscommunication.

October 10, 2023

If you are a young graduate who just got employed, receiving your first salary can be really exciting.

May 2, 2024

Direct Lending Sdn. Bhd. (Direct Lending), an online personal lending platform has recently received a RM300,000 grant from Cradle Fund Sdn. Bhd., a government agency with a mandate to fund potential and high-calibre tech start-ups through its Cradle Investment Programme (CIP300).

March 11, 2024

Direct Lending, an online personal lending marketplace, is launching #DIRECTBANTU+ to help ease the Rakyat’s financial burden during the recently announced full lockdown (FMCO).

April 26, 2022

PSB Academy, Direct Lending, and Uni Enrol have partnered up to offer financial assistance to help Malaysian students to obtain higher education in Singapore under the Scholar Search PSB programme.

June 3, 2021

Direct Lending, an online personal lending marketplace, is launching #DIRECTBANTU+ to help ease the Rakyat’s financial burden during the recently announced full lockdown (FMCO).

July 15, 2020

SERV and Direct Lending roll out financial relief for workshops under the SERV Retail-iation program, focusing on automotive aftermarket businesses.

September 6, 2019

Direct Lending Sdn. Bhd. (Direct Lending), an online personal lending platform has recently received a RM300,000 grant from Cradle Fund Sdn. Bhd., a government agency with a mandate to fund potential and high-calibre tech start-ups through its Cradle Investment Programme (CIP300).

January 12, 2026

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

December 10, 2025

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

November 5, 2025

Everyday, people are always out and about, be it for work or for pleasure. People always move and transport from places to places.

November 5, 2025

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

October 23, 2025

Did your personal loan get rejected because you have a negative CCRIS and CTOS record or you are currently listed under the AKPK programme?

January 14, 2025

If you are a civil servant, you will most likely have the experience of receiving SMS or cold calls offering you personal loan financing, whether it is from the bank or koperasi.